Answered step by step

Verified Expert Solution

Question

1 Approved Answer

D. Fernando began a real estate agency called Fernando Real Estate Agency, and during May of last year, he completed the following transactions: May

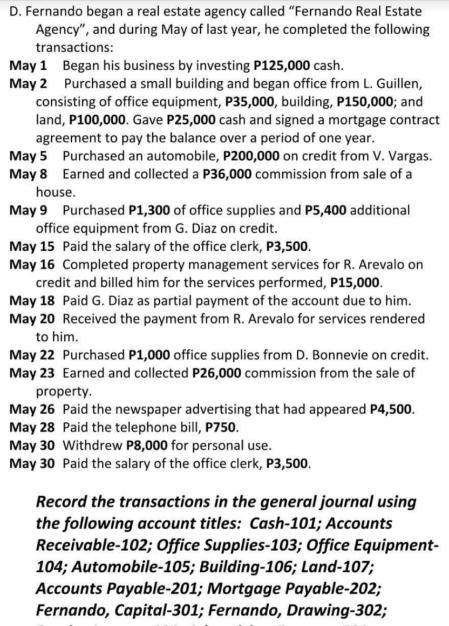

D. Fernando began a real estate agency called "Fernando Real Estate Agency", and during May of last year, he completed the following transactions: May 1 Began his business by investing P125,000 cash. May 2 Purchased a small building and began office from L. Guillen, consisting of office equipment, P35,000, building, P150,000; and land, P100,000. Gave P25,000 cash and signed a mortgage contract agreement to pay the balance over a period of one year. May 5 Purchased an automobile, P200,000 on credit from V. Vargas. May 8 Earned and collected a P36,000 commission from sale of a house. May 9 Purchased P1,300 of office supplies and P5,400 additional office equipment from G. Diaz on credit. May 15 Paid the salary of the office clerk, P3,500. May 16 Completed property management services for R. Arevalo on credit and billed him for the services performed, P15,000. May 18 Paid G. Diaz as partial payment of the account due to him. May 20 Received the payment from R. Arevalo for services rendered to him. May 22 Purchased P1,000 office supplies from D. Bonnevie on credit. May 23 Earned and collected P26,000 commission from the sale of property. May 26 Paid the newspaper advertising that had appeared P4,500. May 28 Paid the telephone bill, P750. May 30 Withdrew P8,000 for personal use. May 30 Paid the salary of the office clerk, P3,500. Record the transactions in the general journal using the following account titles: Cash-101; Accounts Receivable-102; Office Supplies-103; Office Equipment- 104; Automobile-105; Building-106; Land-107; Accounts Payable-201; Mortgage Payable-202; Fernando, Capital-301; Fernando, Drawing-302;

Step by Step Solution

★★★★★

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Lets record the transactions in the general journal using the given account titles May 1 Cash 101 12...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started