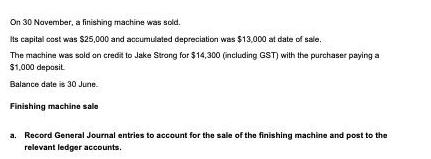

On 30 November, a finishing machine was sold. Its capital cost was $25,000 and accumulated depreciation was $13,000 at date of sale. The machine

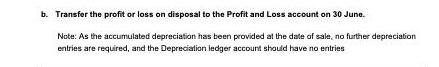

On 30 November, a finishing machine was sold. Its capital cost was $25,000 and accumulated depreciation was $13,000 at date of sale. The machine was sold on credit to Jake Strong for $14,300 (including GST) with the purchaser paying a $1,000 deposit Balance date is 30 June. Finishing machine sale a. Record General Journal entries to account for the sale of the finishing machine and post to the relevant ledger accounts. b. Transfer the profit or loss on disposal to the Profit and Loss account on 30 June. Note: As the accumulated depreciation has been provided at the date of sale, no further depreciation entries are required, and the Depreciation ledger account should have no entries

Step by Step Solution

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a General Journal entries for the sale of the finishing mach...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started