Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 31 December 2019, Diamond Ltd paid 1,100,000 to acquire 80% of the ordinary share capital of Gold Ltd. The statements of financial position of

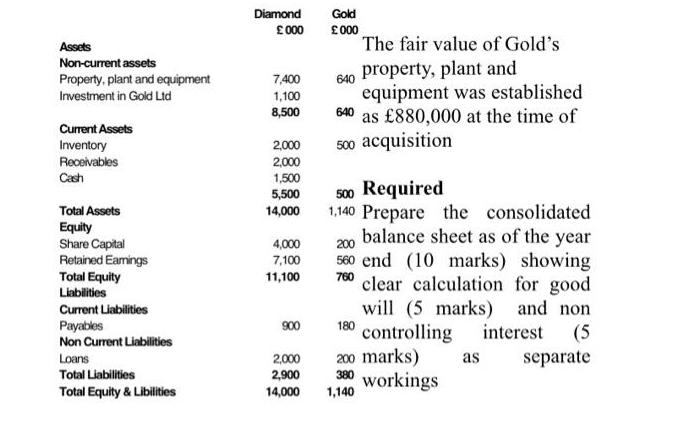

On 31 December 2019, Diamond Ltd paid £1,100,000 to acquire 80% of the ordinary share capital of Gold Ltd. The statements of financial position of the two companies just after this transaction were as follows:

The fair value of Gold’s property, plant and equipment was established as £880,000 at the time of acquisition

Required

Prepare the consolidated balance sheet as of the year end

showing clear calculation for good will

and non controlling interest

as separate workings

Question 03 :

- Define an Intangible Asset as per IAS 38

- Explain the initial recognition and subsequent recognition of an intangible asset

- Discuss the treatment of internally generated intangible assets as per IAS 38

Diamond Gold 00 000 The fair value of Gold's Assets Non-curent assets Property, plant and equipment 640 property, plant and equipment was established 640 as 880,000 at the time of 7,400 Investment in Gold Ltd 1,100 8,500 Current Assets Inventory 500 acquisition 2,000 2,000 1,500 5,500 14,000 Receivables Cash 500 Required 1,140 Prepare the consolidated balance sheet as of the year 560 end (10 marks) showing clear calculation for good will (5 marks) and non controlling 200 marks) workings Total Assets Equity Share Capital Retained Eamings Total Equity 4,000 200 7,100 11,100 760 Liabilities Current Liabilities Payables Non Current Liabilities 900 180 interest (5 Loans 2,000 as separate Total Liabilities 2,900 380 Total Equity & Libilities 14,000 1,140

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a An intangible asset is a nonmonetary item with no physical substan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started