Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 31-3-2020, Mahesh's Cash Book Showed a Bank overdraft of 98,700. On comparison he finds the following: (1) Out of the total cheque of

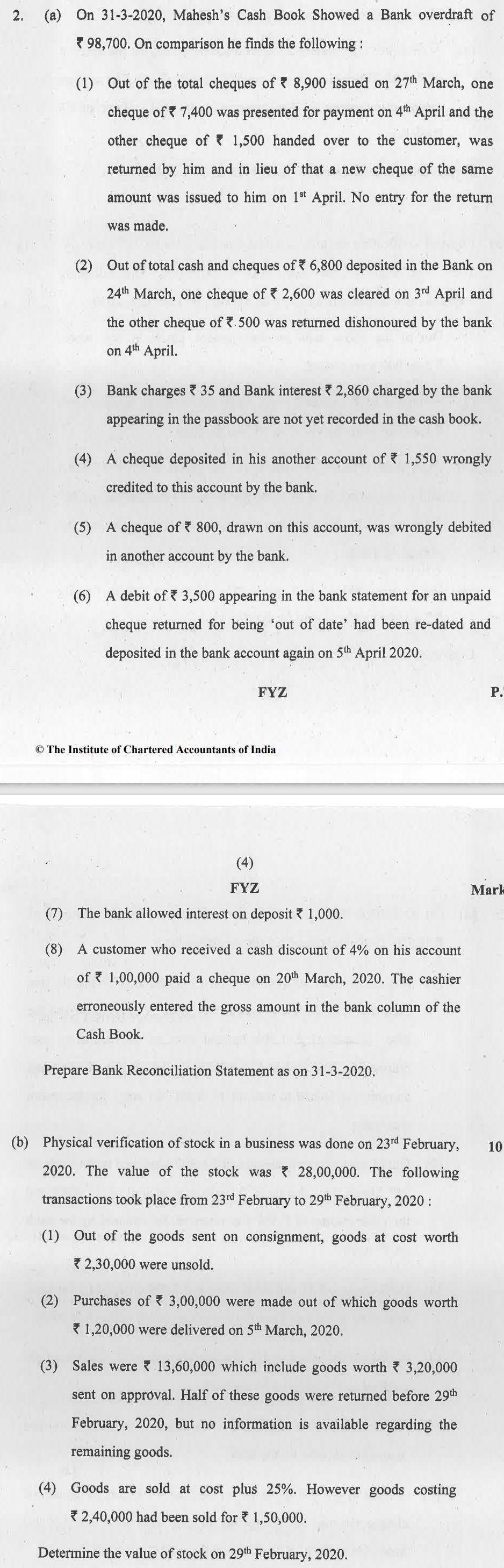

On 31-3-2020, Mahesh's Cash Book Showed a Bank overdraft of 98,700. On comparison he finds the following: (1) Out of the total cheque of 8,900 issued on 27th March, one cheque of 7,400 was presented for payment on 4th April and the other cheque of 1,500 handed over to the customer, was returned by him and in lieu of that a new cheque of the same amount was issued to him on 1st April. No entry for the return was made. (2) Out of total cash and cheques of 6,800 deposited in the Bank on 24th March, one cheque of 2,600 was cleared on 3rd April and the other cheque of 7.500 was returned dishonoured by the bank on 4th April. (3) Bank charges 35 and Bank interest 2,860 charged by the bank appearing in the passbook are not yet recorded in the cash book. (4) A cheque deposited in his another account of 1,550 wrongly credited to this account by the bank. (5) A cheque of 800, drawn on this account, was wrongly debited in another account by the bank. (6) A debit of 3,500 appearing in the bank statement for an unpaid cheque returned for being 'out of date' had been re-dated and deposited in the bank account again on 5th April 2020. FYZ The Institute of Chartered Accountants of India (4) FYZ (7) The bank allo ed interest on deposit 1,000. (8) A customer who received a cash discount of 4% on his account of 1,00,000 paid a cheque on 20th March, 2020. The cashier erroneously entered the gross amount in the bank column of the Cash Book. Prepare Bank Reconciliation Statement as on 31-3-2020. (b) Physical verification of stock in a business was done on 23rd February, 2020. The value of the stock was 28,00,000. The following transactions took place from 23rd February to 29th February, 2020: (1) Out of the goods sent on consignment, goods at cost worth 2,30,000 were unsold. (2) Purchases of 3,00,000 were made out of which goods worth 1,20,000 were delivered on 5th March, 2020. (3) Sales were 13,60,000 which include goods worth 3,20,000 sent on approval. Half of these goods were returned before 29th February, 2020, but no information is available regarding the remaining goods. (4) Goods are sold at cost plus 25%. However goods costing 2,40,000 had been sold for 1,50,000. Determine the value of stock on 29th February, 2020. P. Mark 10

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started