Answered step by step

Verified Expert Solution

Question

1 Approved Answer

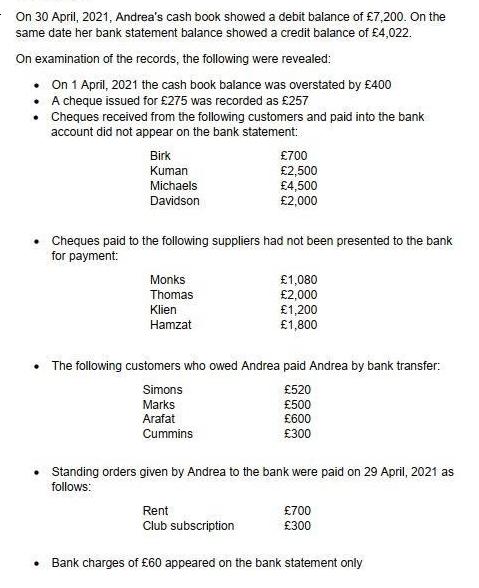

On 30 April, 2021, Andrea's cash book showed a debit balance of 7,200. On the same date her bank statement balance showed a credit

On 30 April, 2021, Andrea's cash book showed a debit balance of 7,200. On the same date her bank statement balance showed a credit balance of 4,022. On examination of the records, the following were revealed: On 1 April, 2021 the cash book balance was overstated by 400 A cheque issued for 275 was recorded as 257 Cheques received from the following customers and paid into the bank account did not appear on the bank statement. Birk 700 2,500 4,500 2,000 Kuman Michaels Davidson Cheques paid to the following suppliers had not been presented to the bank for payment: Monks 1,080 2,000 1,200 1,800 Thomas Klien Hamzat The following customers who owed Andrea paid Andrea by bank transfer: Simons 520 Marks 500 Arafat 600 Cummins 300 Standing orders given by Andrea to the bank were paid on 29 April, 2021 as follows: Rent 700 Club subscription 300 Bank charges of 60 appeared on the bank statement only REQUIRED: a) Prepare an Adjusted Cash Book. (10 marks) b) Prepare a Bank Reconciliation Statement as at 30 April, 2021. (8 marks) c) Explain briefly the principal reasons for preparing a bank reconciliation and discuss the possible reasons why the cash book and bank statement balances may differ. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Bank Reconciliation Statement can be prepared 1 After adjusting the Cash Book balance 2 Before adjus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started