Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 4 / 1 / 2 1 , Big acquired 8 0 % of Little's voting stock for $ 2 0 0 , 0 0

On Big acquired of Little's voting stock for $ The fair value of the NC Interest on that date was $ All of Little's assets and liabilities had fair values equal to book value, so any differential is ascribed to goodwill. Little had the following trial balance on that date:

Cash & Receivables

PPE

Liabilities

Common Stock

Retained earnings

Sales

Cost of goods sold

Other expenses

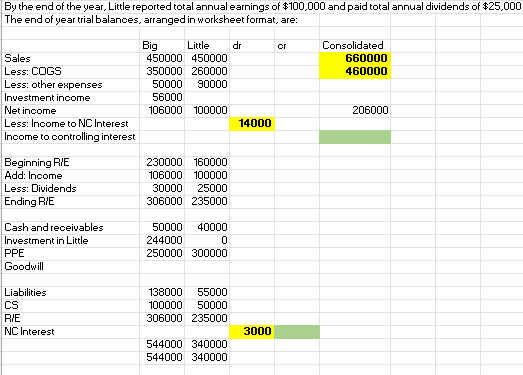

Dividends declared By the end of the year, Little reported total annual earnings of $ and paid total annual dividends of $

The end of year trial balances, arranged in worksheet format, are:

By the end of the year, Little reported total annual earnings of $ and paid total annual dividends of $

The end of year trial balances, arranged in worksheet format, are:

The answers in yellow ARE CORRECT. I ONLY NEED THE ANSWERS IN GREEN. Please know I have checked these answers and know they are right so don't change them. Use them to calculate the two green answers I need. Thanks!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started