Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 5 January 2020 Tommy sold a motor vehicle for 9,000. The customer was due to pay Tommys Trailers on 5 April 2020 but had

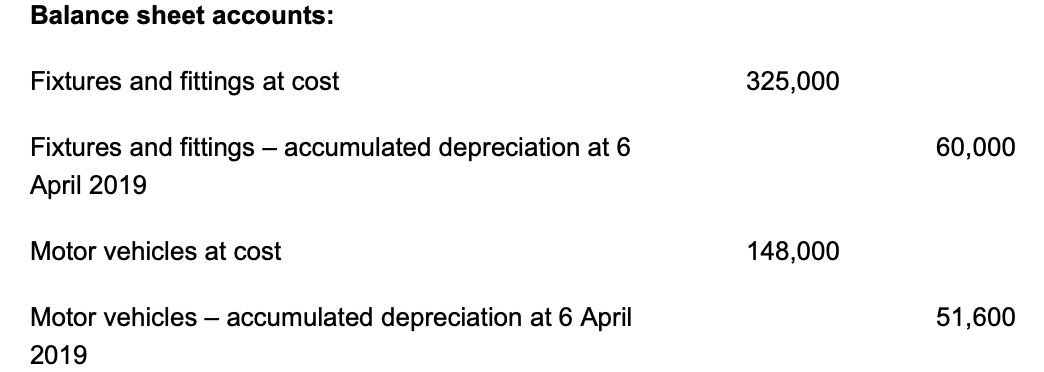

- On 5 January 2020 Tommy sold a motor vehicle for 9,000. The customer was due to pay Tommys Trailers on 5 April 2020 but had not paid at the year-end. Nothing regarding the disposal transaction has been recorded in the accounts. This motor vehicle had been bought on 6 April 2017 for 16,000.

- On 5 October 2019, Tommy bought a new motor vehicle for 22,000 on cash terms. Tommy mistakenly recorded the purchase in the accounts as DR Fixtures & Fittings 22,000 / CR Bank 22,000.

- Depreciation on motor vehicles is provided at 20% per annum using the reducing balance basis on a monthly pro-rata basis. Depreciation on fixtures and fittings is provided at 15% per annum on the straight line basis, assuming no residual value. There were no purchases or disposals of fixtures and fittings during the year.

Ignore Fixtures, only looking at calculating the depreciation for Motor Vehicles part for now.

Ignore Fixtures, only looking at calculating the depreciation for Motor Vehicles part for now.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started