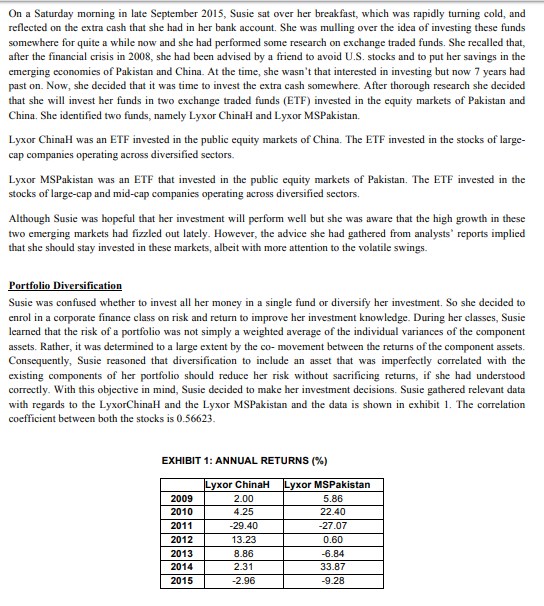

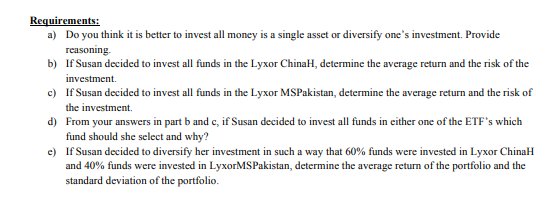

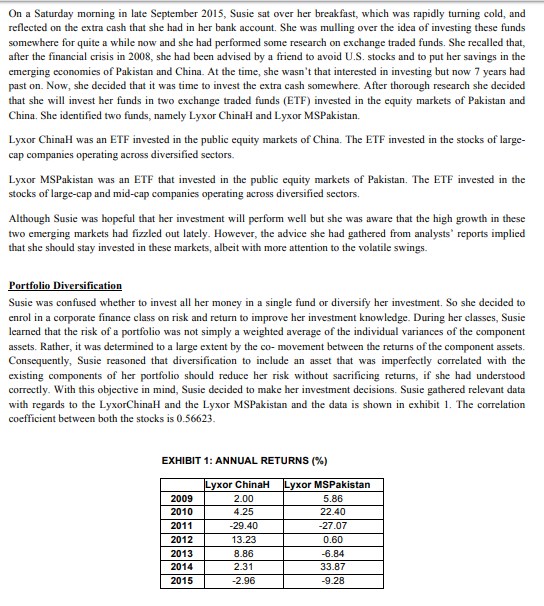

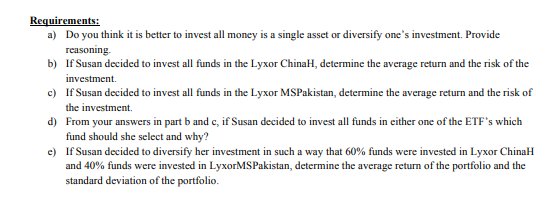

On a Saturday morning in late September 2015, Susie sat over her breakfast, which was rapidly turning cold, and reflected on the extra cash that she had in her bank account. She was mulling over the idea of investing these funds somewhere for quite a while now and she had performed some research on exchange traded funds. She recalled that, after the financial crisis in 2008, she had been advised by a friend to avoid U.S. stocks and to put her savings in the emerging economies of Pakistan and China. At the time, she wasn't that interested in investing but now 7 years had past on. Now, she decided that it was time to invest the extra cash somewhere. After thorough research she decided that she will invest her funds in two exchange traded funds (ETF) invested in the equity markets of Pakistan and China. She identified two funds, namely Lyxor China and Lyxor MSPakistan. Lyxor ChinaH was an ETF invested in the public equity markets of China. The ETF invested in the stocks of large- cap companies operating across diversified sectors. Lyxor MSPakistan was an ETF that invested in the public equity markets of Pakistan. The ETF invested in the stocks of large-cap and mid-cap companies operating across diversified sectors. Although Susie was hopeful that her investment will perform well but she was aware that the high growth in these two emerging markets had fizzled out lately. However, the advice she had gathered from analysts' reports implied that she should stay invested in these markets, albeit with more attention to the volatile swings. Portfolio Diversification Susie was confused whether to invest all her money in a single fund or diversify her investment. So she decided to enrol in a corporate finance class on risk and return to improve her investment knowledge. During her classes, Susie learned that the risk of a portfolio was not simply a weighted average of the individual variances of the component assets. Rather, it was determined to a large extent by the co-movement between the returns of the component assets. Consequently, Susie reasoned that diversification to include an asset that was imperfectly correlated with the existing components of her portfolio should reduce her risk without sacrificing returns, if she had understood correctly. With this objective in mind, Susie decided to make her investment decisions. Susie gathered relevant data with regards to the Lyxor China and the Lyxor MSPakistan and the data is shown in exhibit 1. The correlation coefficient between both the stocks is 0.56623. EXHIBIT 1: ANNUAL RETURNS (%) 2009 2010 2011 2012 2013 2014 2015 Lyxor China 2.00 4.25 -29.40 13.23 8.86 2.31 Lyxor MSPakistan 5.86 22.40 -27.07 0.60 -6.84 33.87 -9.28 -2.96 Requirements: a) Do you think it is better to invest all money is a single asset or diversify one's investment. Provide reasoning b) If Susan decided to invest all funds in the Lyxor ChinaH, determine the average return and the risk of the investment c) If Susan decided to invest all funds in the Lyxor MSPakistan, determine the average return and the risk of the investment d) From your answers in part b and c, if Susan decided to invest all funds in either one of the ETF's which fund should she select and why? c) If Susan decided to diversify her investment in such a way that 60% funds were invested in Lyxor ChinaH and 40% funds were invested in LyxorMSPakistan, determine the average return of the portfolio and the standard deviation of the portfolio