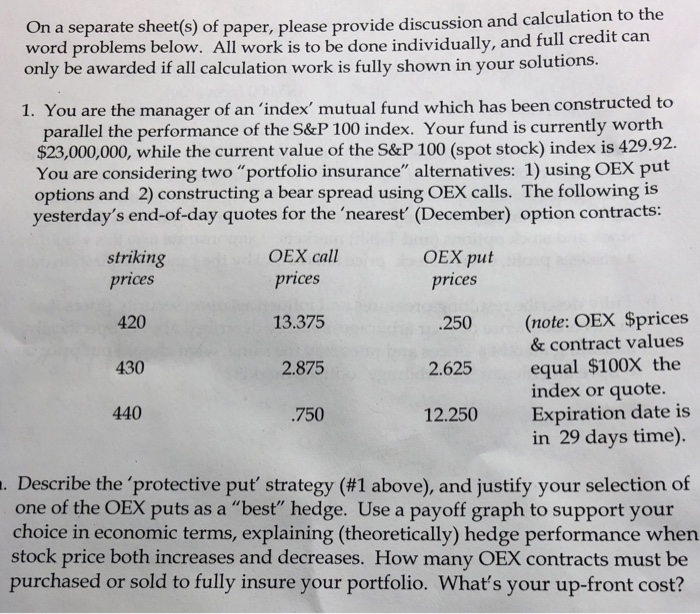

On a separate sheet(s) of paper, please provide discussion and calculation to the word problems below. All work is to be done individually, and full credit can only be awarded if all calculation work is fully shown in your solutions. 1. You are the manager of an 'index' mutual fund which has been constructed to parallel the performance of the S&P 100 index. Your fund is currently worth $23,000,000, while the current value of the S&P 100 spot stock) index is 429.92. You are considering two "portfolio insurance" alternatives: 1) using OEX put options and 2) constructing a bear spread using OEX calls. The following is yesterday's end-of-day quotes for the 'nearest' (December) option contracts: striking OEX call OEX put prices prices 420 430 440 prices 13.375 2.875 750 250 (note: OEX Sprices & contract values 2.625 equal $100X the index or quote Expiration date is in 29 days time). 12.250 Describe the 'protective put' strategy (#1 above), and justify your selection of one of the OEX puts as a "best" hedge. Use a payoff graph to support your choice in economic terms, explaining (theoretically) hedge performance when stock price both increases and decreases. How many OEX contracts must be purchased or sold to fully insure your portfolio. What's your up-front cost? On a separate sheet(s) of paper, please provide discussion and calculation to the word problems below. All work is to be done individually, and full credit can only be awarded if all calculation work is fully shown in your solutions. 1. You are the manager of an 'index' mutual fund which has been constructed to parallel the performance of the S&P 100 index. Your fund is currently worth $23,000,000, while the current value of the S&P 100 spot stock) index is 429.92. You are considering two "portfolio insurance" alternatives: 1) using OEX put options and 2) constructing a bear spread using OEX calls. The following is yesterday's end-of-day quotes for the 'nearest' (December) option contracts: striking OEX call OEX put prices prices 420 430 440 prices 13.375 2.875 750 250 (note: OEX Sprices & contract values 2.625 equal $100X the index or quote Expiration date is in 29 days time). 12.250 Describe the 'protective put' strategy (#1 above), and justify your selection of one of the OEX puts as a "best" hedge. Use a payoff graph to support your choice in economic terms, explaining (theoretically) hedge performance when stock price both increases and decreases. How many OEX contracts must be purchased or sold to fully insure your portfolio. What's your up-front cost