On April 1, 2006, US Ultracom issued 7%, 10-year bonds payable with maturity value of $400,000. The bonds pay interest on March 31 and

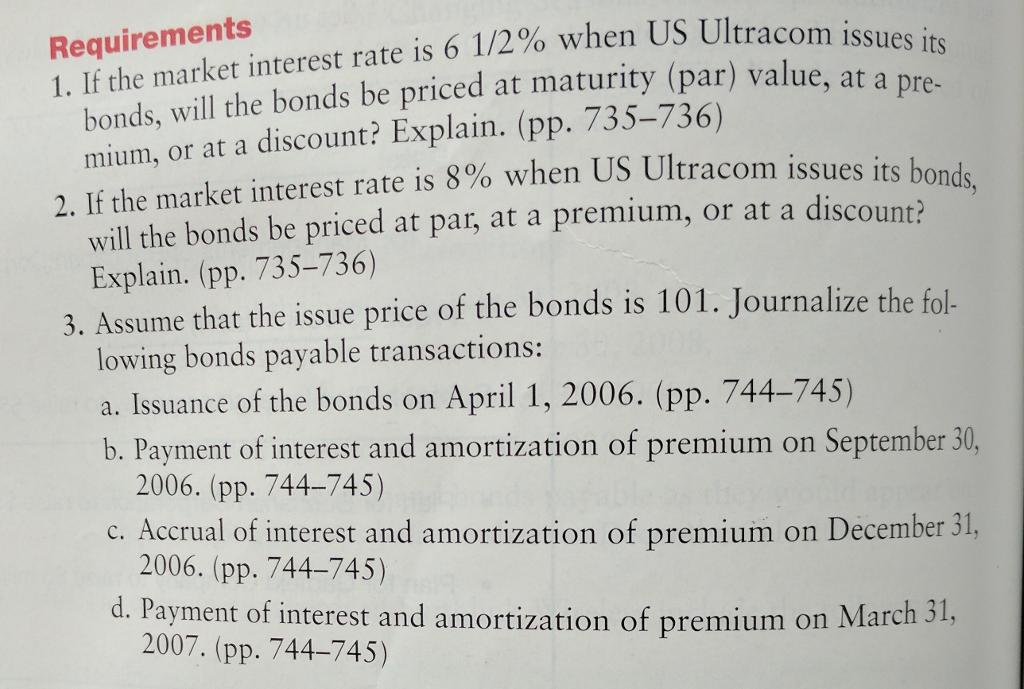

On April 1, 2006, US Ultracom issued 7%, 10-year bonds payable with maturity value of $400,000. The bonds pay interest on March 31 and September 30, and US Ultracom amortizes premium and discount by the straight-line method. continued , .. Long-Term Liabilities 765 Requirements 2. If the market interest rate is 8% when US Ultracom issues its bonds, mium, or at a discount? Explain. (pp. 735-736) will the bonds be priced at par, at a premium, or at a discount? Explain. (pp. 735-736) 3. Assume that the issue price of the bonds is 101. Journalize the fol- lowing bonds payable transactions: a. Issuance of the bonds on April 1, 2006. (pp. 744-745) b. Payment of interest and amortization of premium on September 30, 2006. (pp. 744-745) c. Accrual of interest and amortization of premium on December 31, 2006. (pp. 744745) d. Payment of interest and amortization of premium on March 31, 2007. (pp. 744745)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 As the market interest rate is less than bond interest rate t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started