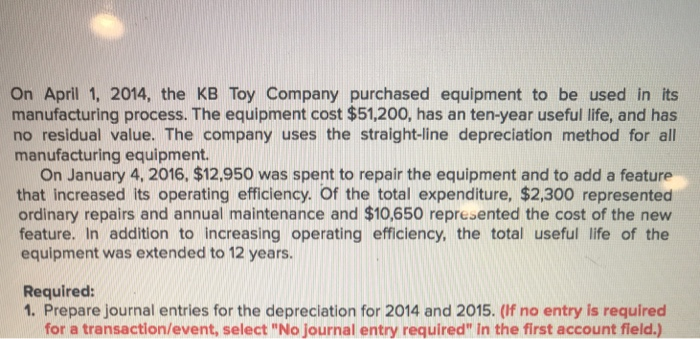

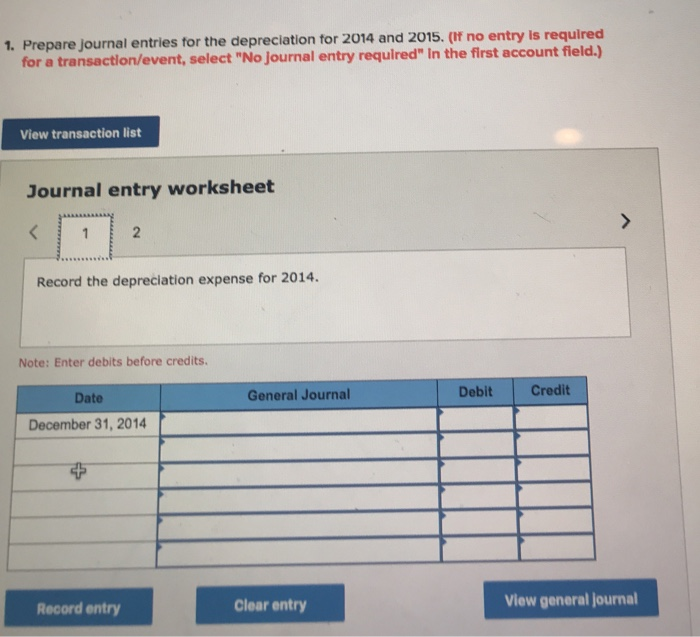

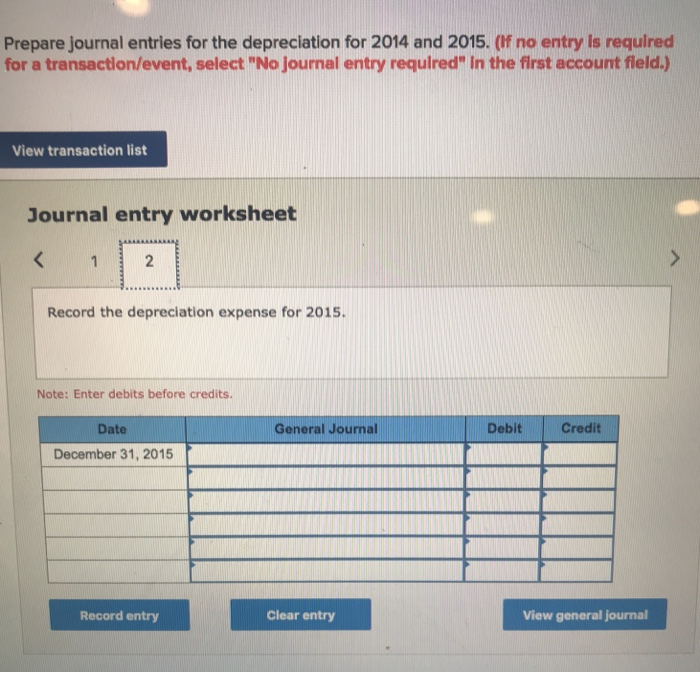

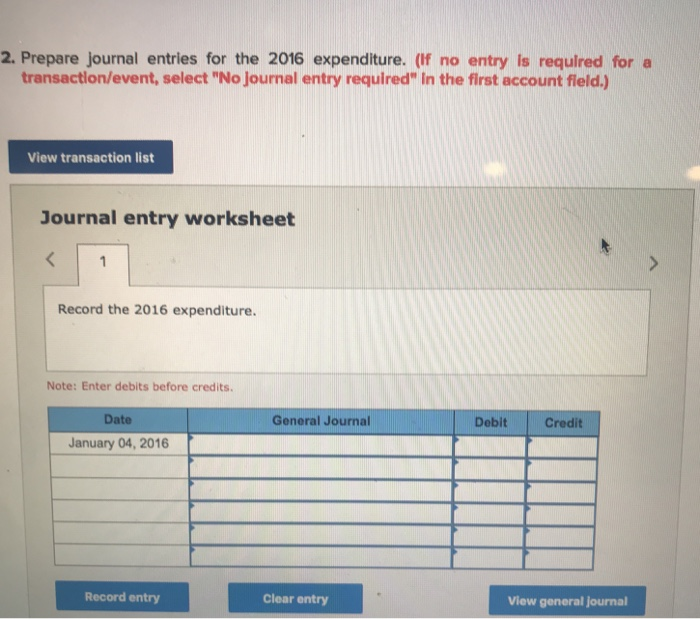

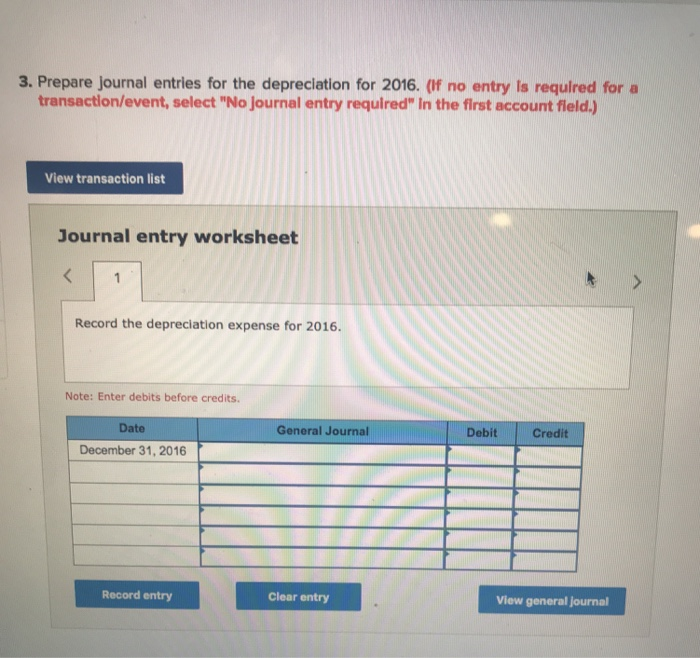

On April 1, 2014, the KB Toy Company purchased equipment to be used in its manufacturing process. The equipment cost $51,200, has an ten-year useful life, and has no residual value. The company uses the straight-line depreciation method for all manufacturing equipment. On January 4, 2016, $12,950 was spent to repair the equipment and to add a feature that increased its operating efficiency. Of the total expenditure, $2,300 represented ordinary repairs and annual maintenance and $10,650 represented the cost of the new feature. In addition to increasing operating efficiency, the total useful life of the equipment was extended to 12 years. Required: 1. Prepare journal entries for the depreciation for 2014 and 2015. (If no entry is required for a transaction/event, select "No journal entry required" In the first account field.) 1. Prepare journal entries for the depreciation for 2014 and 2015. (If no entry is requlred for a transactlon/event, select "No Journal entry required" In the first account field.) View transaction list Journal entry worksheet 2 Record the depreciation expense for 2014. Note: Enter debits before credits. Debit Credit General Journal Date December 31, 2014 View general journal Clear entry Record entry Prepare journal entries for the depreciation for 2014 and 2015. (If no entry is required for a transaction/event, select "No journal entry required" In the first account fleld.) View transaction list Journal entry worksheet 2 Record the depreciation expense for 2015 Note: Enter debits before credits. Debit Credit Date General Journal December 31, 2015 View general journal Clear entry Record entry 2. Prepare journal entries for the 2016 expenditure. (If no entry Is required for a transaction/event, select " No Journal entry required" In the first account field.) View transaction list Journal entry worksheet Record the 2016 expenditure. Note: Enter debits before credits. Date General Journal Debit Credit January 04, 2016 Record entry Clear entry View general journal 3. Prepare journal entries for the depreciation for 2016. (If no entry Is required for a transaction/event, select "No journal entry required" In the first account fleld.) View transaction list Journal entry worksheet Record the depreciation expense for 2016. Note: Enter debits before credits. Date General Journal DebitCredit December 31, 2016 Record entry Clear entry View general journal