Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On April 1, 2015, ABC Inc. received an advance payment from a tenant in the amount of $408,000 that represented five years of rent.

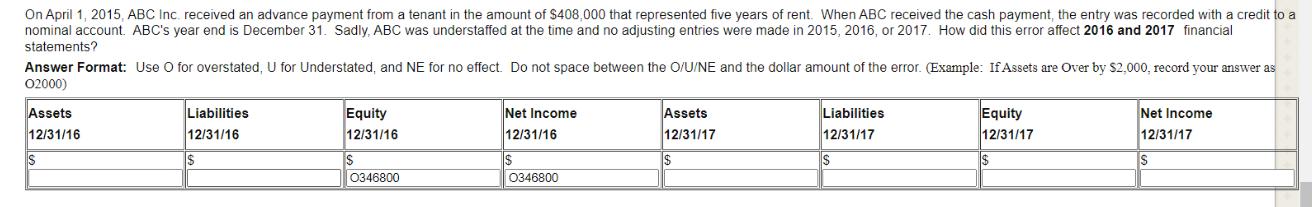

On April 1, 2015, ABC Inc. received an advance payment from a tenant in the amount of $408,000 that represented five years of rent. When ABC received the cash payment, the entry was recorded with a credit to a nominal account. ABC's year end is December 31. Sadly, ABC was understaffed at the time and no adjusting entries were made in 2015, 2016, or 2017. How did this error affect 2016 and 2017 financial statements? Answer Format: Use O for overstated, U for Understated, and NE for no effect. Do not space between the O/U/NE and the dollar amount of the error. (Example: If Assets are Over by $2,000, record your answer as O2000) Assets 12/31/16 Liabilities 12/31/16 IS Equity 12/31/16 S 0346800 Net Income 12/31/16 $ 0346800 Assets 12/31/17 $ Liabilities 12/31/17 S Equity 12/31/17 $ Net Income 12/31/17 S

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Impact of Error on Financial Statements The incorrect recording of the advance payment as a credit t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started