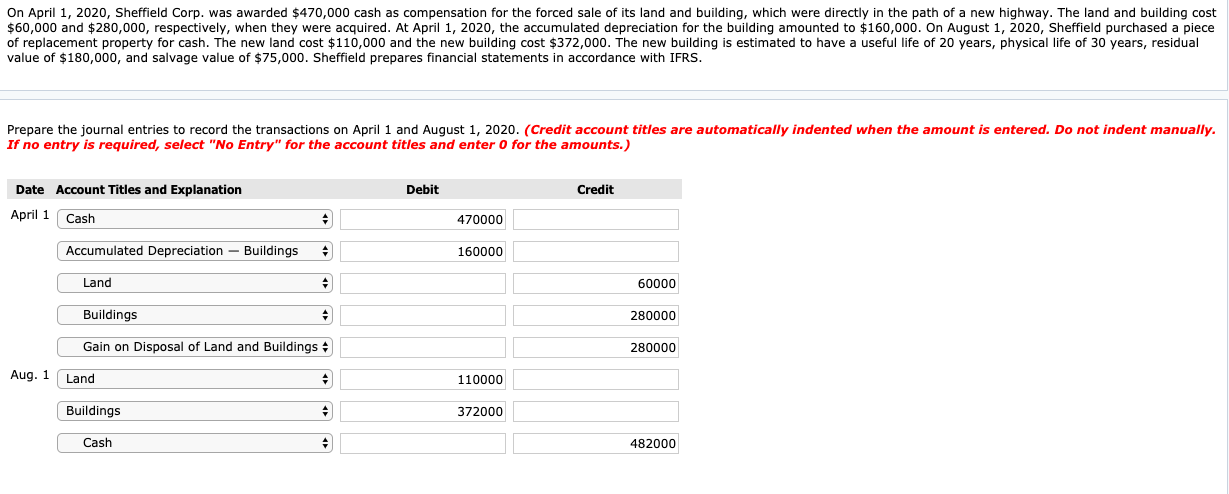

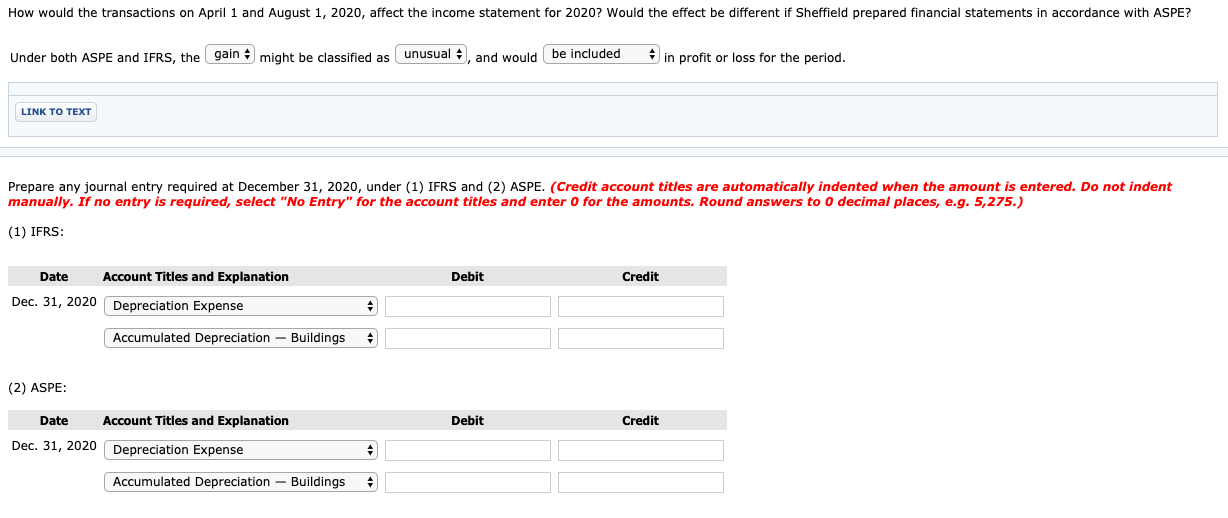

On April 1, 2020, Sheffield Corp. was awarded $470,000 cash as compensation for the forced sale of its land and building, which were directly in the path of a new highway. The land and building cost $60,000 and $280,000, respectively, when they were acquired. At April 1, 2020, the accumulated depreciation for the building amounted to $160,000. On August 1, 2020, Sheffield purchased a piece of replacement property for cash. The new land cost $110,000 and the new building cost $372,000. The new building is estimated to have a useful life of 20 years, physical life of 30 years, residual value of $180,000, and salvage value of $75,000. Sheffield prepares financial statements in accordance with IFRS. Prepare the journal entries to record the transactions on April 1 and August 1, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit April 1 Cash 470000 160000 Accumulated Depreciation - Buildings Land Buildings 60000 280000 Gain on Disposal of Land and Buildings 280000 110000 Aug. 1 Land Buildings 372000 Cash 482000 How would the transactions on April 1 and August 1, 2020, affect the income statement for 2020? Would the effect be different if Sheffield prepared financial statements in accordance with ASPE? Under both ASPE and IFRS, the gain might be classified as unusual, and would be included in profit or loss for the period. LINK TO TEXT Prepare any journal entry required at December 31, 2020, under (1) IFRS and (2) ASPE. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to 0 decimal places, e.g. 5,275.) (1) IFRS: Date Account Titles and Explanation Debit Credit Dec. 31, 2020 Depreciation Expense Accumulated Depreciation - Buildings (2) ASPE: Debit Credit Date Account Titles and Explanation Dec. 31, 2020 Depreciation Expense Accumulated Depreciation - Buildings