Answered step by step

Verified Expert Solution

Question

1 Approved Answer

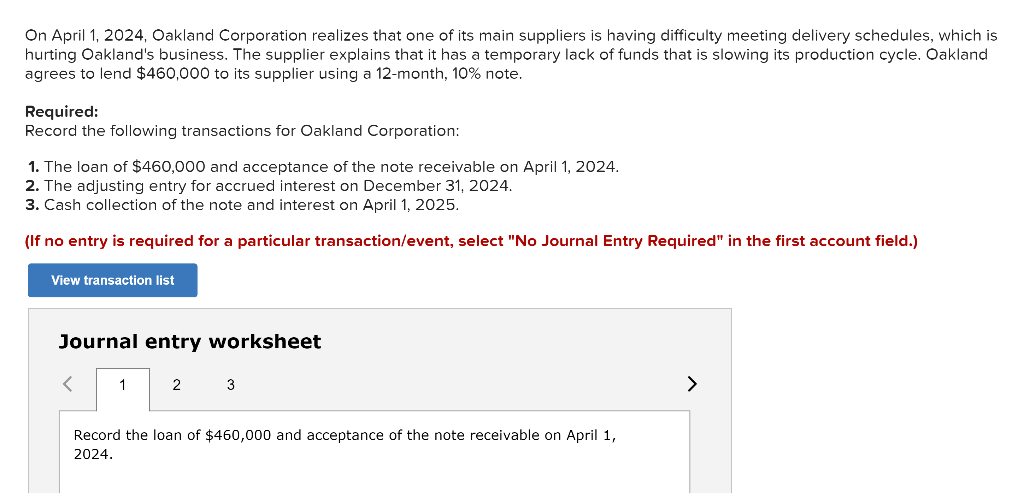

On April 1, 2024, Oakland Corporation realizes that one of its main suppliers is having difficulty meeting delivery schedules, which is hurting Oakland's business.

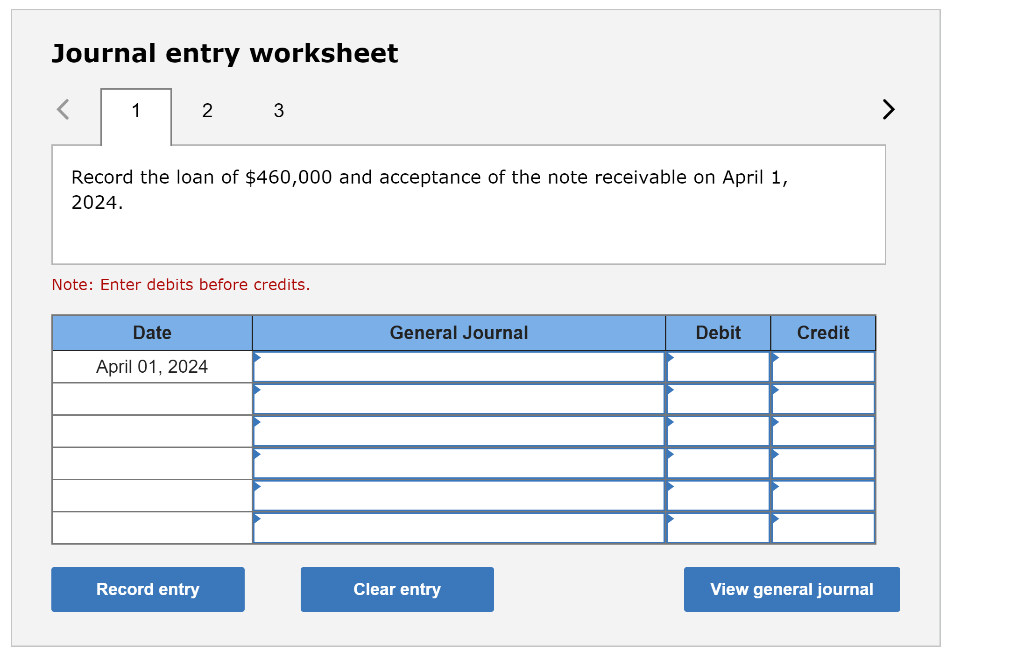

On April 1, 2024, Oakland Corporation realizes that one of its main suppliers is having difficulty meeting delivery schedules, which is hurting Oakland's business. The supplier explains that it has a temporary lack of funds that is slowing its production cycle. Oakland agrees to lend $460,000 to its supplier using a 12-month, 10% note. Required: Record the following transactions for Oakland Corporation: 1. The loan of $460,000 and acceptance of the note receivable on April 1, 2024. 2. The adjusting entry for accrued interest on December 31, 2024. 3. Cash collection of the note and interest on April 1, 2025. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 1 2 3 > Record the loan of $460,000 and acceptance of the note receivable on April 1, 2024. Journal entry worksheet 1 2 3 Record the loan of $460,000 and acceptance of the note receivable on April 1, 2024. Note: Enter debits before credits. Date General Journal Debit Credit April 01, 2024 Record entry View general journal Clear entry

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

2197 answers Date General Journal Debit Credit April 1 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started