Question

On April 15, 2003, Gary and his friends Alex and Matt decided to setup a partnership to run a BaskinRobbins franchise. The business consisted of

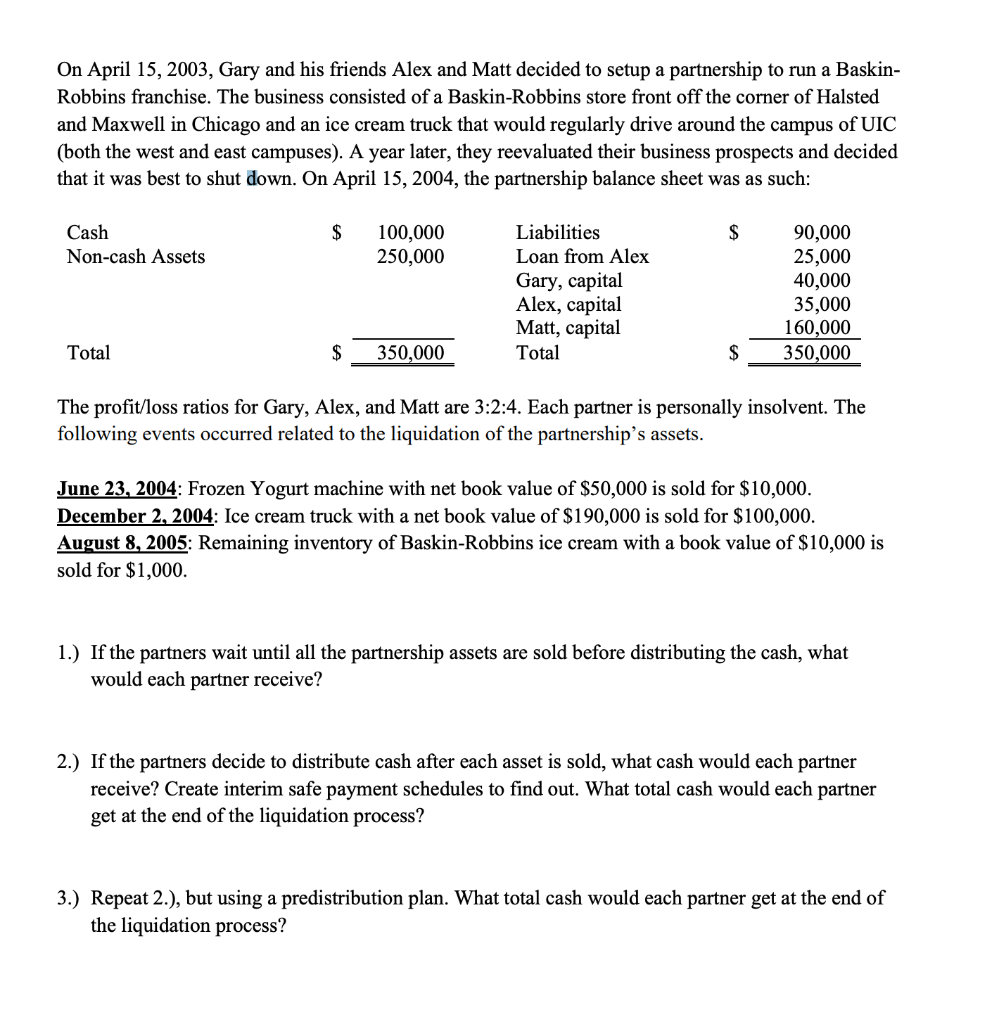

On April 15, 2003, Gary and his friends Alex and Matt decided to setup a partnership to run a BaskinRobbins franchise. The business consisted of a Baskin-Robbins store front off the corner of Halsted and Maxwell in Chicago and an ice cream truck that would regularly drive around the campus of UIC (both the west and east campuses). A year later, they reevaluated their business prospects and decided that it was best to shut down. On April 15, 2004, the partnership balance sheet was as such:

On April 15, 2003, Gary and his friends Alex and Matt decided to setup a partnership to run a BaskinRobbins franchise. The business consisted of a Baskin-Robbins store front off the corner of Halsted and Maxwell in Chicago and an ice cream truck that would regularly drive around the campus of UIC (both the west and east campuses). A year later, they reevaluated their business prospects and decided that it was best to shut down. On April 15, 2004, the partnership balance sheet was as such:

Cash $ 100,000 Liabilities $ 90,000 Non-cash Assets 250,000 Loan from Alex 25,000 Gary, capital 40,000 Alex, capital 35,000 Matt, capital 160,000 Total $ 350,000 Total $ 350,000

The profit/loss ratios for Gary, Alex, and Matt are 3:2:4. Each partner is personally insolvent. The following events occurred related to the liquidation of the partnerships assets.

June 23, 2004: Frozen Yogurt machine with net book value of $50,000 is sold for $10,000. December 2, 2004: Ice cream truck with a net book value of $190,000 is sold for $100,000. August 8, 2005: Remaining inventory of Baskin-Robbins ice cream with a book value of $10,000 is sold for $1,000

1.) If the partners wait until all the partnership assets are sold before distributing the cash, what would each partner receive?

2.) If the partners decide to distribute cash after each asset is sold, what cash would each partner receive? Create interim safe payment schedules to find out. What total cash would each partner get at the end of the liquidation process?

3.) Repeat 2.), but using a predistribution plan. What total cash would each partner get at the end of the liquidation process?

On April 15, 2003, Gary and his friends Alex and Matt decided to setup a partnership to run a Baskin- Robbins franchise. The business consisted of a Baskin-Robbins store front off the corner of Halsted and Maxwell in Chicago and an ice cream truck that would regularly drive around the campus of UIC (both the west and east campuses). A year later, they reevaluated their business prospects and decided A that it was best to shut down. On April 15, 2004, the partnership balance sheet was as such: $ $ Cash Non-cash Assets 100,000 250,000 Liabilities Loan from Alex Gary, capital Alex, capital Matt, capital Total 90,000 25,000 40,000 35,000 160,000 350,000 Total 350,000 The profit/loss ratios for Gary, Alex, and Matt are 3:2:4. Each partner is personally insolvent. The following events occurred related to the liquidation of the partnership's assets. June 23, 2004: Frozen Yogurt machine with net book value of $50,000 is sold for $10,000. December 2, 2004: Ice cream truck with a net book value of $190,000 is sold for $100,000. August 8, 2005: Remaining inventory of Baskin-Robbins ice cream with a book value of $10,000 is sold for $1,000. 1.) If the partners wait until all the partnership assets are sold before distributing the cash, what would each partner receive? 2.) If the partners decide to distribute cash after each asset is sold, what cash would each partner receive? Create interim safe payment schedules to find out. What total cash would each partner get at the end of the liquidation process? 3.) Repeat 2.), but using a predistribution plan. What total cash would each partner get at the end of the liquidation processStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started