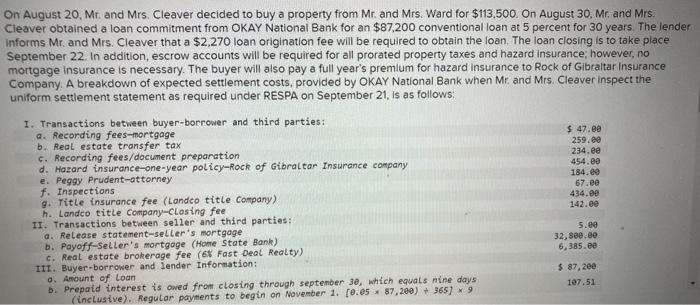

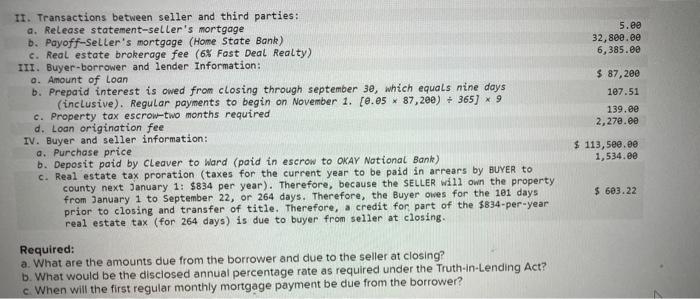

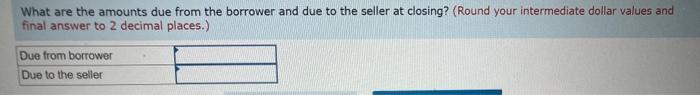

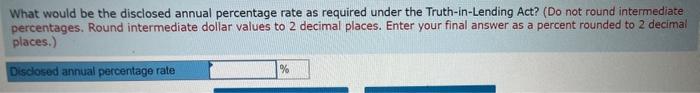

On August 20, Mr. and Mrs. Cleaver decided to buy a property from Mr. and Mrs. Ward for $113,500. On August 30 , Mr, and Mrs. Cleaver obtained a loan commitment from OKAY National Bank for an $87,200 conventional loan at 5 percent for 30 years The lendef informs Mr. and Mrs. Cleaver that a $2,270 loan origination fee will be required to obtain the loan. The loan closing is to take place September 22. In addition, escrow accounts will be required for all prorated property taxes and hazard insurance; however, no mortgage insurance is necessary. The buyer will also pay a full year's premium for hazard insurance to Rock of Gibraltar insurance Company. A breakdown of expected settlement costs, provided by OKAY National Bank when Mr. and Mrs. Cleaver inspect the uniform settlement statement as required under RESPA on September 21, is as follows: When will the first regular monthly mortgage payment be due from the borrower? II. Transactions between seller and third parties: a. Release statement-seller's mortgage 5.00 b. Payoff-Seller's mortgage (Hame State Bank) 32,800,00 6,385.00 c. Real estate brokerage fee (6\% Fast Deal Realty) $87,200 III. Buyer-borrower and lender Information: o. Amount of Loan b. Prepaid interest is owed from closing through september 30 , which equals nine days (inclusive). Regular payments to begin on November 1.[0.0587,200)365]9 107.51 c. Property tax escrow-two months required 139.60 d. Loan origination fee 2,270.00 IV. Buyer and seller information: a. Purchase price b. Deposit paid by Cleaver to Ward (paid in escrow to OKAY Notional Bank) $113,500,00 c. Real estate tax proration (taxes for the current year to be paid in arrears by BUYER to 1,534.00 county next January 1: $834 per year). Therefore, because the SELLER wi11 own the property from January 1 to September 22 , or 264 days. Therefore, the Buyer oves for the 101 days $603.22 prior to closing and transfer of title. Therefore, a credit for part of the $834-per-year real estate tax (for 264 days) is due to buyer from seller at closing. Required: a. What are the amounts due from the borrower and due to the seller at closing? b. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? c. When will the first regular monthly mortgage payment be due from the borrower? What are the amounts due from the borrower and due to the seller at closing? (Round your intermediate dollar values and final answer to 2 decimal places.) What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? (Do not round intermediate percentages. Round intermediate dollar values to 2 decimal places. Enter your final answer as a percent rounded to 2 decimal places.)