Question

On August 31, 2024, the general ledger of Ballet Shoes shows a balance for cash of $7,794. Cash receipts yet to be deposited into the

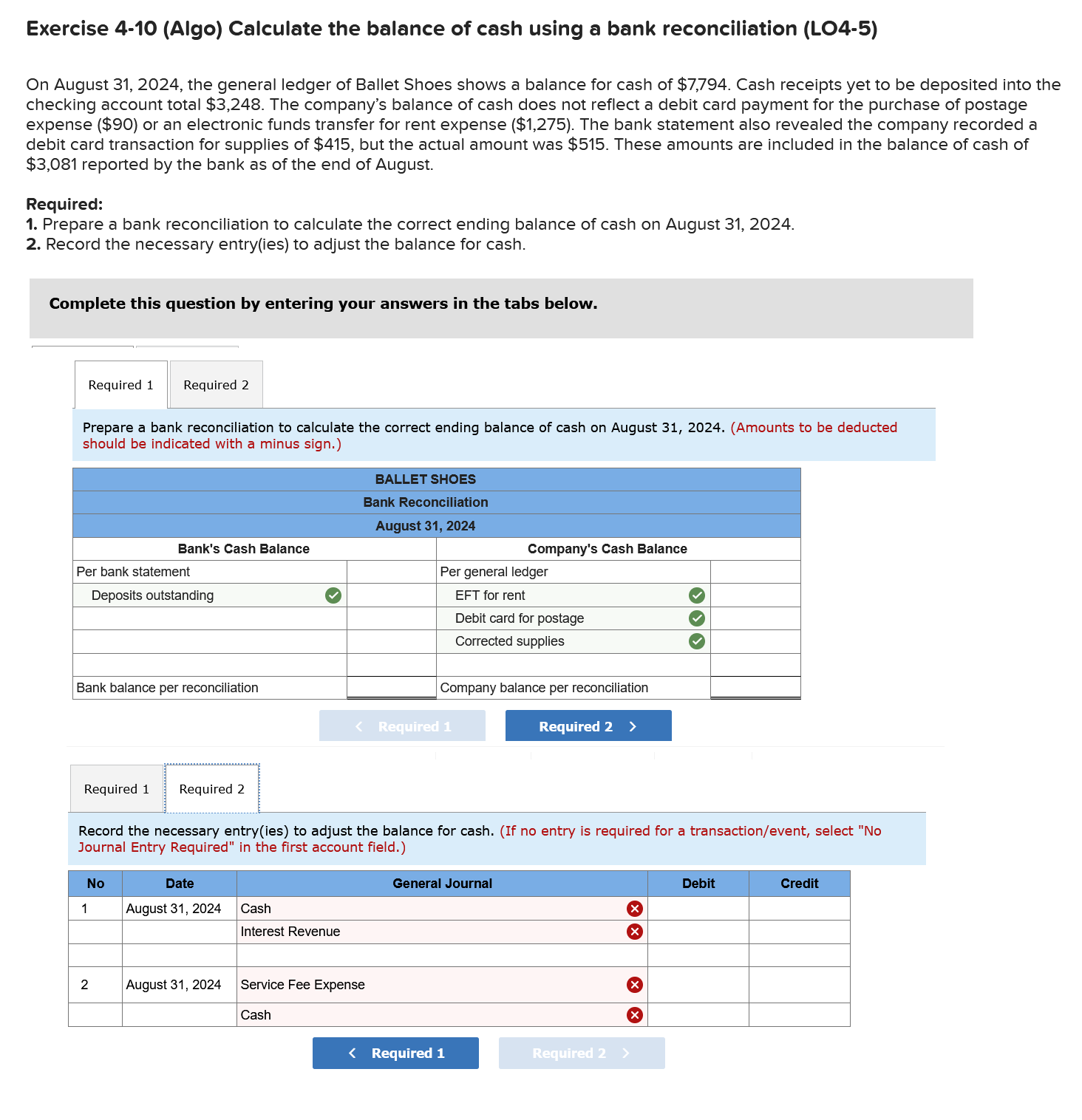

On August 31, 2024, the general ledger of Ballet Shoes shows a balance for cash of $7,794. Cash receipts yet to be deposited into the checking account total $3,248. The companys balance of cash does not reflect a debit card payment for the purchase of postage expense ($90) or an electronic funds transfer for rent expense ($1,275). The bank statement also revealed the company recorded a debit card transaction for supplies of $415, but the actual amount was $515. These amounts are included in the balance of cash of $3081 reported by the bank as of the end of August.

If you could explain how you got your answer that would be great. Thank you!

Exercise 4-10 (Algo) Calculate the balance of cash using a bank reconciliation (LO4-5) On August 31, 2024, the general ledger of Ballet Shoes shows a balance for cash of $7,794. Cash receipts yet to be deposited into the checking account total $3,248. The company's balance of cash does not reflect a debit card payment for the purchase of postage expense ($90) or an electronic funds transfer for rent expense ($1,275). The bank statement also revealed the company recorded a debit card transaction for supplies of $415, but the actual amount was $515. These amounts are included in the balance of cash of $3,081 reported by the bank as of the end of August. Required: 1. Prepare a bank reconciliation to calculate the correct ending balance of cash on August 31, 2024. 2. Record the necessary entry(ies) to adjust the balance for cash. Complete this question by entering your answers in the tabs below. Prepare a bank reconciliation to calculate the correct ending balance of cash on August 31, 2024. (Amounts to be deducted should be indicated with a minus sign.) Record the necessary entry(ies) to adjust the balance for cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Exercise 4-10 (Algo) Calculate the balance of cash using a bank reconciliation (LO4-5) On August 31, 2024, the general ledger of Ballet Shoes shows a balance for cash of $7,794. Cash receipts yet to be deposited into the checking account total $3,248. The company's balance of cash does not reflect a debit card payment for the purchase of postage expense ($90) or an electronic funds transfer for rent expense ($1,275). The bank statement also revealed the company recorded a debit card transaction for supplies of $415, but the actual amount was $515. These amounts are included in the balance of cash of $3,081 reported by the bank as of the end of August. Required: 1. Prepare a bank reconciliation to calculate the correct ending balance of cash on August 31, 2024. 2. Record the necessary entry(ies) to adjust the balance for cash. Complete this question by entering your answers in the tabs below. Prepare a bank reconciliation to calculate the correct ending balance of cash on August 31, 2024. (Amounts to be deducted should be indicated with a minus sign.) Record the necessary entry(ies) to adjust the balance for cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started