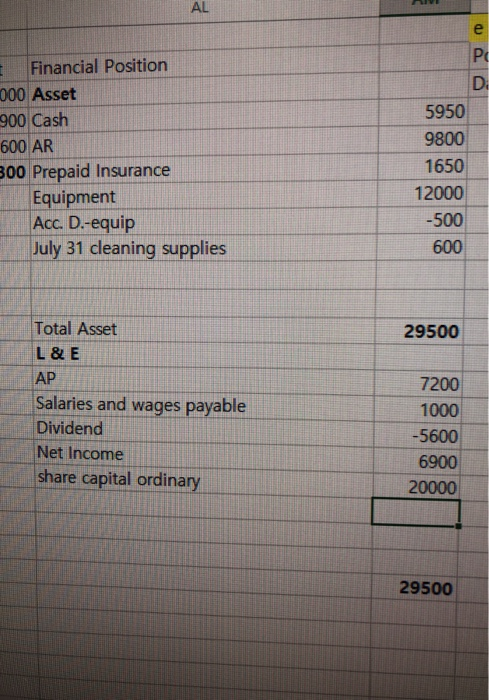

On # d, I've got Total asset 29500, but book says 34300. The difference 4800 still occurs at #g. I would like to know why the 4800 is omitted and the correct solution for #d and #g.

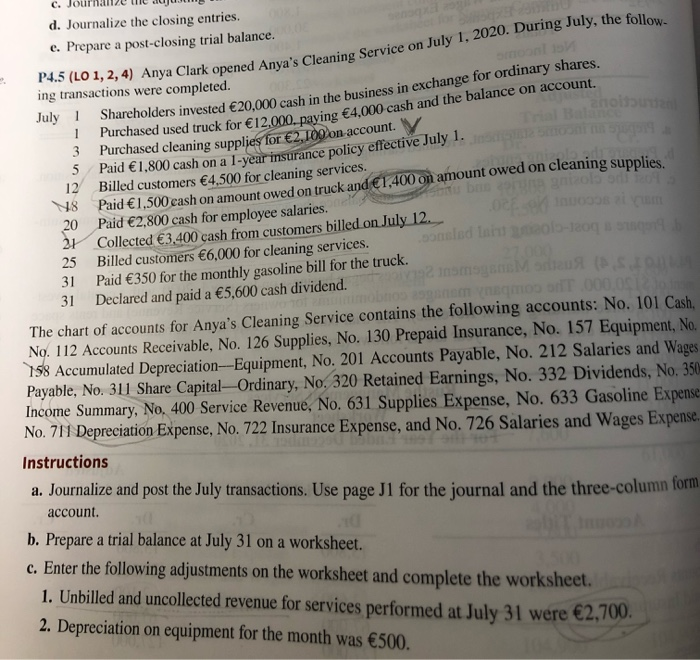

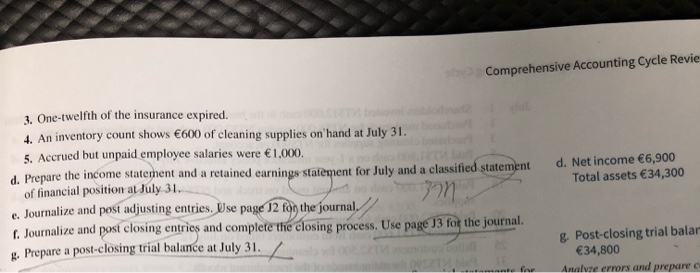

holz C. Journale te duum d. Journalize the closing entries. e. Prepare a post-closing trial balance. July 1, 2020. During July, the follow- P4.5 (LO 1, 2, 4) Anya Clark opened Anya's Cleaning Ser ing transactions were completed. July 1 Shareholders invested 20,000 cash in the business in holders invested 20,000 cash in the business in exchange for ordinary shares. sed used truck for 12.000. naving 4.000 cash and the balance on account, 3 Purchased cleaning supplies for 2,100 on account. 5 Paid 1.800 cash on a 1-year insurance policy effective July 12 Billed customers 4,500 for cleaning services. 08 Paid 1.500 cash on amount owed on truck and 1,400 on amount owed on Cleaning supplies 20 Paid 2,800 cash for employee salaries. O s cum 1 Collected 3.400 cash from customers billed on July 12 25 Billed customers 6.000 for cleaning services. boneladinh 15-1209 31 Paid 350 for the monthly gasoline bill for the truck. 31 Declared and paid a 5,600 cash dividend. 2. EMOSI The chart of accounts for Anya's Cleaning Service contains the following accounts: No. 101 Cash No. 112 Accounts Receivable, No. 126 Supplies, No. 130 Prepaid Insurance, No. 157 Equipment, No. 158 Accumulated Depreciation Equipment, No. 201 Accounts Payable, No. 212 Salaries and Wages Payable, No. 311 Share Capital-Ordinary, No. 320 Retained Earnings, No. 332 Dividends, No. 350 Income Summary, No. 400 Service Revenue, No. 631 Supplies Expense, No. 633 Gasoline Expense No. 711 Depreciation Expense, No. 722 Insurance Expense, and No. 726 Salaries and Wages Expense, Instructions a. Journalize and post the July transactions. Use page Jl for the journal and the three-column form account b. Prepare a trial balance at July 31 on a worksheet. c. Enter the following adjustments on the worksheet and complete the worksheet. 1. Unbilled and uncollected revenue for services performed at July 31 were 2,700. 2. Depreciation on equipment for the month was 500. Comprehensive Accounting Cycle Revie d e Total assets 34,300 3. One-twelfth of the insurance expired. 4. An inventory count shows 600 of cleaning supplies on hand at July 31. 5. Accrued but unpaid employee salaries were 1.000. d. Prepare the income statement and a retained earnings statement for July and a classified statement of financial position at July 31. e Journalize and post adjusting entries. Use page 12 for the journal. Journalize and post closing entries and complete the closing process. Use page 13 for the journal. Prepare a post-closing trial balance at July 31. for 779 g. Post-closing trial balar 34,800 Analyse errors and prepare AL Financial Position 000 Asset 900 Cash 600 AR 300 Prepaid Insurance Equipment Acc. D.-equip July 31 cleaning supplies 5950 9800 1650 12000 -500 600 29500 Total Asset L & E AP Salaries and wages payable Dividend Net Income share capital ordinary 7200 1000 -5600 6900 20000 29500