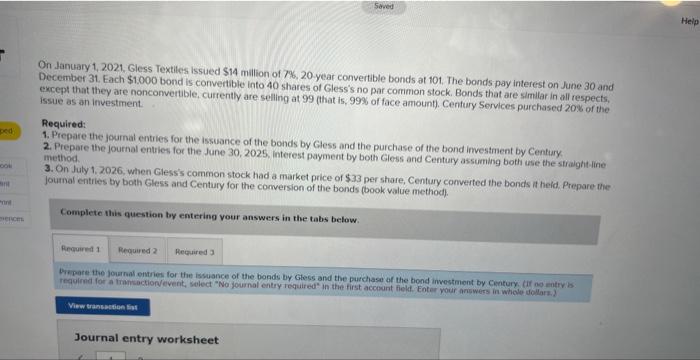

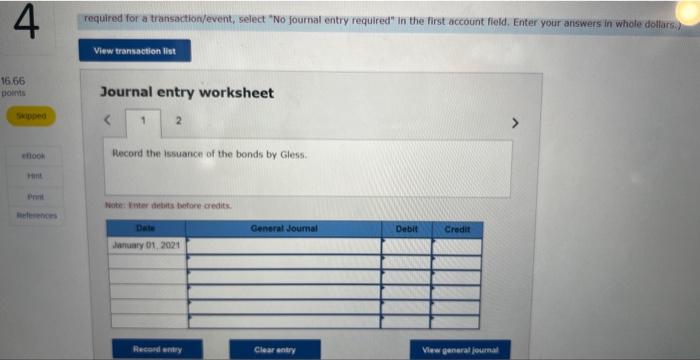

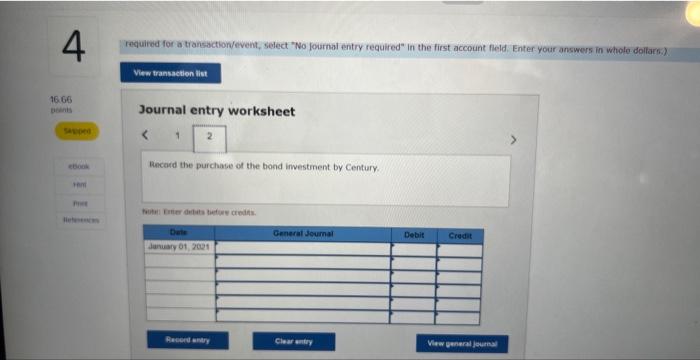

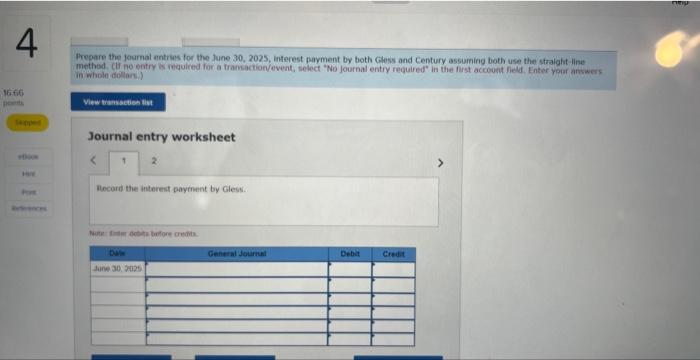

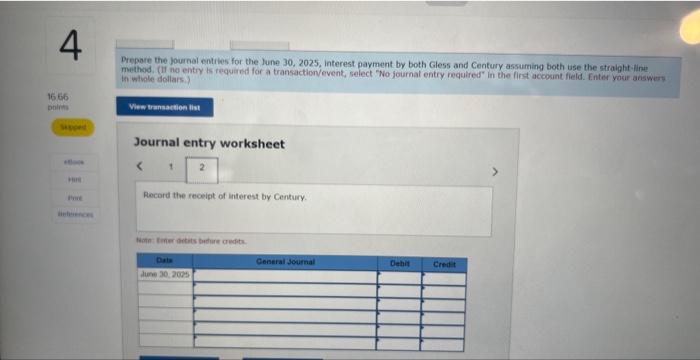

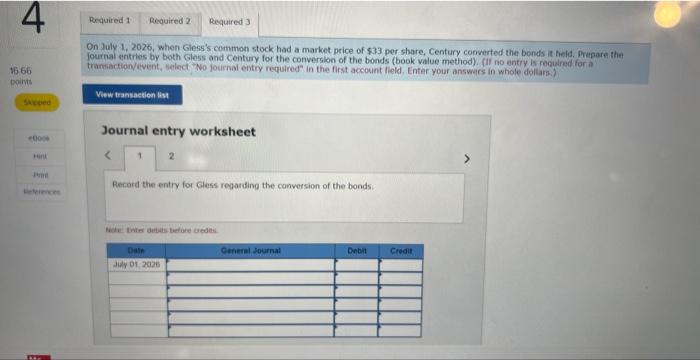

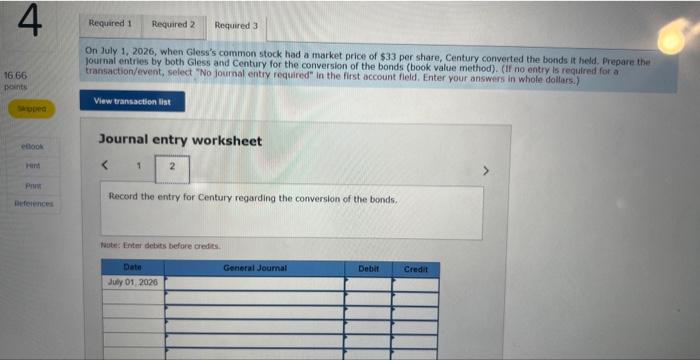

On danuary 1, 2021, Gless Textiles issued $14 million of 7%,20 year convertible bonds at 101. The bonds pay interest on June 30 and December 3t. Fach $1.000 bond is convertible into 40 shares of Gless's no par common stock. Bonds that are similar in all respects, except that they are nonconvertible, currently are selling at 99 (that is, 998 of face amount). Century Services purchased 208 of the issue as an investment. Required: 1. Prepare the journal entries for the issuance of the bonds by Gless and the purchase of the bond imvestrient by Century 2. Prepare the journal entries for the June 30,2025, interest payment by both Gless and Century assuming bothi use the straight-line method. 3. On July 1,2026, when Glessis common stock had a market price of $33 per share, Century converted the bonds it heid. Prepare mhe joumal entries by both Gless and Century for the comversion of the bonds (book value methocf). Complete this question by entering vour answers in the tabs below. Prepare the journal entries for the issuance of the bonds by Gess and the purchase of the hond invostment by Ciotury (ir no menvib: requirnd for a transiactionevent, select "No journal entry required" in the first acconit field. Eoter your answers in whole tollars. ? Journal entry worksheet Journal entry worksheet Record the issuance of the bonds by Gless. Wots Inter drtats twofore credits. required for a transaction/event, select "No fournal entry required" in the first account field. Enter your answers in whofo dollars) Journal entry worksheet Bhcond the purchase of the hond investment by Century. Thepare the joumal antries for the June 30,2025 , interest payment by both Gless and Century assuming both use the straight -line method. (If no entry is required for a framaction/event, select "No journal entry required" in the first account fielf, Enter yoar anwwers in wholin dollaris.) Journal entry worksheet Hecard the interent payrinent by Gless. Prepore the journol entiles for the lune 30, 2025, interest payment by both Gless and Century assuming both use the stralght-inize method. (II no entry is required for a transactionvevent, select "No journal entry required" in the first accosint field. Enter your answers in whole dollars.) Journal entry worksheet On luly 1, 2026, when Gless's common stock had a market price of 533 per share, Century converted the bonds it helid, Prepare the fournal eritries by both Gless and Century for the conversion of the bonds (book value method). (If no entry is reculred for a tramsactionvevent, select "No jourial entry required" in the first account fleld. Enter your answars in whole dollara.) Journal entry worksheet Record the entry for Gless regarding the conversion of the bonds: Bute linter autuais beture wedes. On July 1. 2026, when Gless's common stock had a market price of $33 per share, Century converted the bonds it held. Prepare the journal entries by both Gless and Century for the conversion of the bonds (book value method). (If no entry is required for a transaction/event, select "No journal entiy required" in the first account field, Enter your answers in whole dollars.). Journal entry worksheet Record the entry for Century regarding the conversion of the bonds. Rates Intmi debits before creals