Answered step by step

Verified Expert Solution

Question

1 Approved Answer

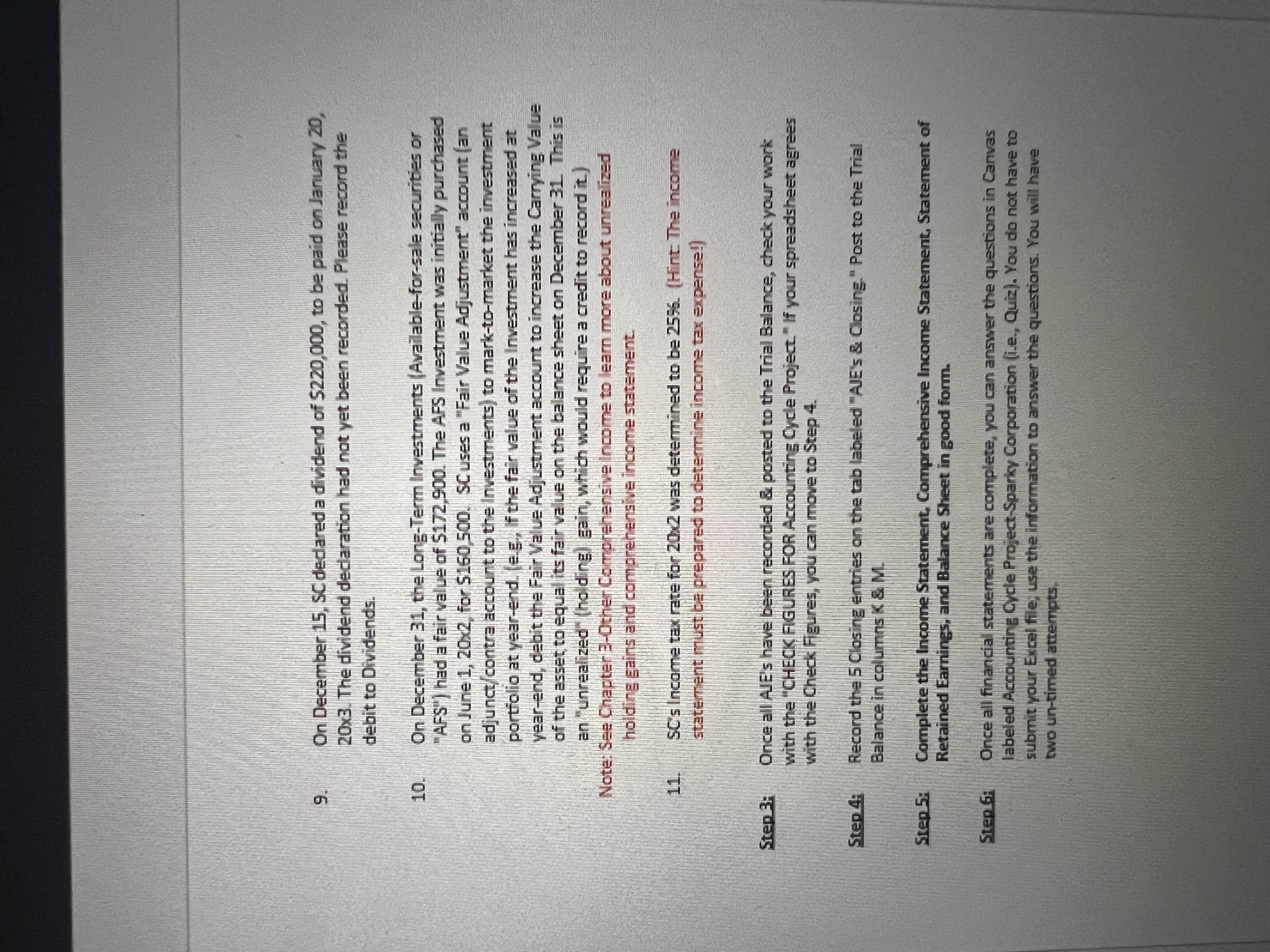

On December 1 5 , SC dedared a dividend of $ 2 2 0 , 0 0 0 , to be paid on January 2

On December SC dedared a dividend of $ to be paid on January The dividend declaration had not yet been recorded. Please record the debit to Dividends.

On December the LonETerm Investments Availableforsale securities or "AFS" had a fair value of $ The AFS Investment was initially purchased on June times for $ SCuses a "Fair Value Adjustment" account an adjunctcontra account to the investments to marktomarket the investment portiolio at yarend. e If the fair value of the Investment has increased at yearend, debit the Fair Yalue Adjustment account to increase the Carrying Value of the asset to equal its fair value on the balance sheet on December This is an "unrealized" holding gain, which would require a credit to record it

Note: See Chapter Other Comprehensive income to learn more about unrealized holding gains and comprehensive income statement.

SCs income tax rate for was determined to be Hint: The income statement must be prepared to determine income tax expense!

Step : Once all AJE's have been recorded & posted to the Trial Balance, check your work with the "CHECK FGGURES FOR Accounting Cycle Project." If your spreadsheet agrees with the Check Figures, you can move to Step

Step : Record the Closing entries on the tab labeled "AIE's & Closing." Post to the Trial Balance in columns &

Step : Complete the Income Statement, Comprehensive Income Statement, Statement of Retained Earnings, and Balance Sheet in good form.

Step : Once all financial statements are complete, you can answer the quertions in Canvas labeled Accounting Cycle ProjectSparky Corporation ie Quia You do not have to submit your Excel file; use the information to answer the questions. You will have two untimed attempts,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started