Answered step by step

Verified Expert Solution

Question

1 Approved Answer

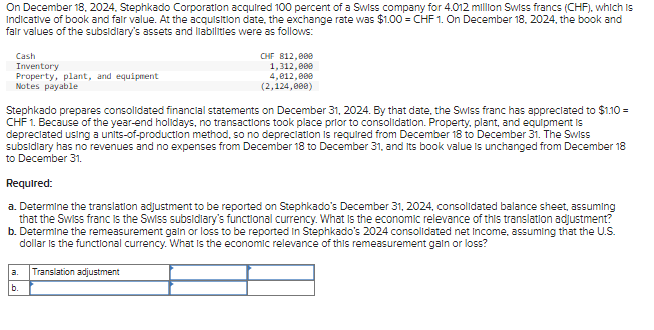

On December 1 8 , 2 0 2 4 , Stephkado Corporation acquired 1 0 0 percent of a SwIss company for 4 . 0

On December Stephkado Corporation acquired percent of a SwIss company for million Swlss francs CHF which is

Indicatlive of book and fair value. At the acquisition date, the exchange rate was $ CHF On December the book and

falr values of the subsidlary's assets and liabilitles were as follows:

Stephkado prepares consolidated financlal statements on December By that date, the SwIss franc has appreclated to $

CHF Because of the yearend holidays, no transactions took place prior to consolidation. Property, plant, and equipment is

depreclated using a unitsofproduction method, so no depreclation is required from December to December The Swiss

subsidlary has no revenues and no expenses from December to December and its book value is unchanged from December

to December

Required:

a Determine the translation adjustment to be reported on Stephkado's December consolidated balance sheet, assuming

that the SWiss franc is the SWiss subsidlary's functional currency. What is the economic relevance of this translation adjustment?

b Determine the remeasurement gain or loss to be reported In Stephkado's consolidated net Income, assuming that the US

dollar is the functional currency. What is the economic relevance of this remeasurement galn or loss?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started