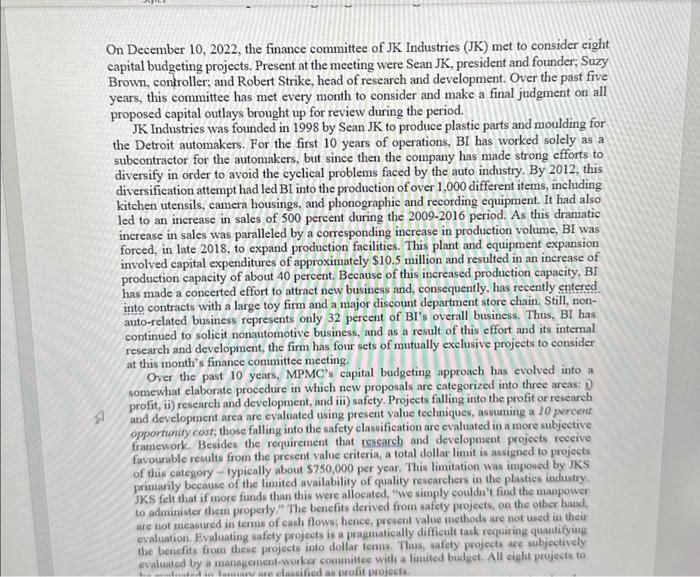

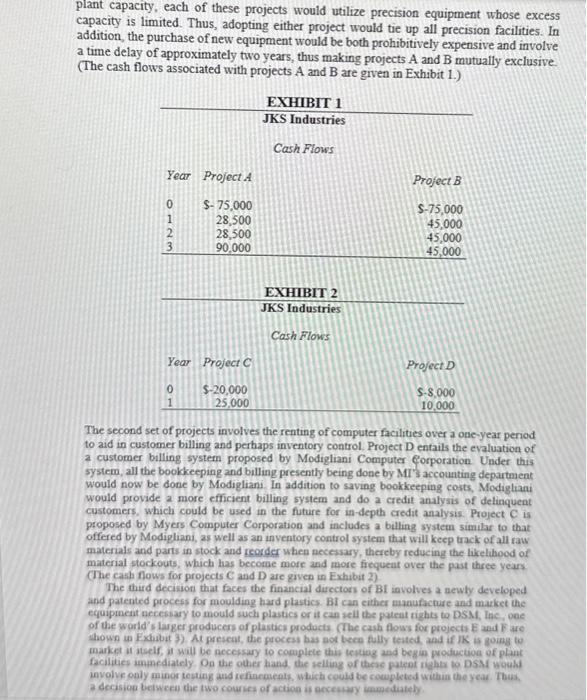

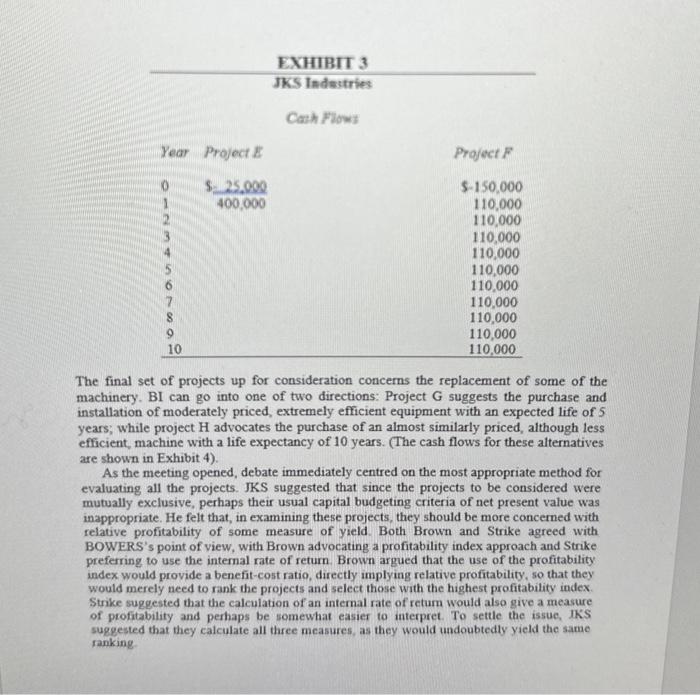

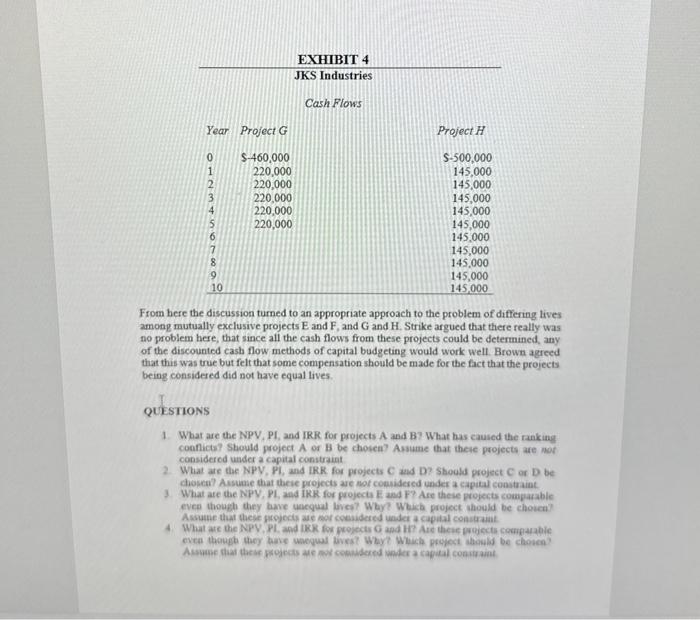

On December 10,2022, the finance committee of JK Industries (JK) met to consider eight capital budgeting projects. Present at the meeting were Sean JK, president and founder; Suzy Brown, controller; and Robert Strike, head of research and development. Over the past five years, this committee has met every month to consider and make a final judgment on all proposed capital outlays brought up for review during the period. JK Industries was founded in 1998 by Sean JK to produce plastic parts and moulding for the Detroit automakers. For the first 10 years of operations, BI has worked solely as a subcontractor for the automakers, but since then the company has made strong efforts to diversify in order to avoid the cyclical problems faced by the auto industry. By 2012, this diversification attempt had led Bl into the production of over 1,000 different items, including kitchen utensils, camera housings, and phonographic and recording equipment. It had also led to an increase in sales of 500 percent during the 2009-2016 period. As this dramatic increase in sales was paralleled by a corresponding increase in production volume, BI was forced, in late 2018, to expand production facilities. This plant and equipment expansion involved capital expenditures of approximately $10.5 million and resulted in an increase of production capacity of about 40 percent. Because of this increased production capacity, BI has made a concerted effort to attract new business and, consequently, has recently entered. into contracts with a large toy firm and a major discount department store chain. Still, nonauto-related business represents only 32 percent of BI's overall business. Thus, BI has continued to solicit nonautomotive business, and as a result of this effort and its internal research and development, the firm has four sets of mutually exelusive projects to consider at this month's finance committee meeting. Over the past 10 years, MPMC's capital budgeting approach has evolved into a somewhat elaborate procedure in which new proposals are categorized into three areas: 0 profit, ii) research and development, and iii) safety. Projects falling into the profit or research and development area are evaluated using present value techniques, assuming a 10 percent opportunify cost; those falling into the safety classification are evaluated in a more subjective framework. Besides the requirement that research and development projects receive favourable results from the present value criteria, a total dollar limit is assigned to projects of this category - typically about $750,000 per year. This limitation was imposed by JKS primarily because of the limited availability of quality researehers in the plastics industry JKS felt that if more funds than this were allocated, "we simply couldn't find the manpower to administer them properly." The benefits derived from safety projects, on the other hand, are not measured in terms of cash flown; henee, present value methods are not used in their cyaluation. Evaluating safety projects is a pragmatically difficult task requiring quantifying the benefits from these projects into dollar terms. Thus, safety projects are subjectively plant capacity, each of these projects would utilize precision equipment whose excess capacity is limited. Thus, adopting either project would tie up all precision facilities. In addition, the purchase of new equipment would be both prohibitively expensive and involve a time delay of approximately two years, thus making projects A and B mutually exclusive. (The cash flows associated with projects A and B are given in Exhibit 1.) The second set of projects involves the renting of computer facilities over a one-year period to aid in customer billing and perhaps inventory control. Project D entails the evaluation of a customer billing system proposed by Modigliani Computer Corporation. Under this system, all the bookkeeping and billing presently being done by MI' 3 accounting department would now be done by Modigliani. In addition to saving bookkeeping costs, Modighani would provide 2 more efficient billing system and do a credit analysis of delinquent customers, which could be used in the future for in-depth credit analysis. Project C is proposed by Myers Computer Corporation and includes a billing system similar to that offered by Modipliani, as well as an inventory control system that wili keep track of all raw materials and parts in stock and reorder when necessary, thereby reducing the likelihood of material stockouts, which has become mote and more frequeat over the past three years Whe cash nows for projects C and D are given in Exhibit 2) The third docision that faces the financial dirccioss of BI involves a newly developed and patented process for moulding hard plastics. BI can either manufacture and market the equipment necessary to mould such plastics or it cas rell the puteat tights to DSM, Inc, oee of the world's larger producers of plastici prodocts. (The cash flows for projects E and F are hows un Fxhibit 3). At prescat, the process bas not bece fully tested, and if IK is going to market it atself, it will be necessary to complete this ketug and begie production of plant facilities impediately. Op the other hand, we relling of these patent rights to DSM wouks involve oaly minor testing and iefinements, which couts be cowpleted withia the year. Thus. The final set of projects up for consideration concerns the replacement of some of the machinery. BI can go into one of two directions: Project G suggests the purchase and installation of moderately priced, extremely efficient equipment with an expected life of 5 years; while project H advocates the purchase of an almost similarly priced, although less efficient, machine with a life expectancy of 10 years. (The cash flows for these alternatives are shown in Exhibit 4). As the meeting opened, debate immediately centred on the most appropriate method for evaluating all the projects. JKS suggested that since the projects to be considered were mutually exclusive, perhaps their usual capital budgeting criteria of net present value was inappropriate. He felt that, in examining these projects, they should be more concerned with relative profitability of some measure of yield. Both Brown and Strike agreed with BOWERS's point of view, with Brown advocating a profitability index approach and Strike preferring to use the internal rate of return. Brown argued that the use of the profitability index would provide a benefit-cost ratio, directly implying relative profitability, so that they would merely need to rank the projects and select those with the highest profitability index. Strike suggested that the calculation of an internal rate of return would also give a measure of profitability and perhaps be somewhat easier to interpret. To settle the issue, IKS suggested that they calculate all three measures, as they would undoubtedly yield the same ranking. From here the discussion turned to an appropriate approach to the problem of differing lives among mutually exclusive projects E and F, and G and H. Strike argued that there really was no problem here, that since all the cash flows from these projects could be determined, any of the discounted cash flow methods of capital budgeting would work well. Brown agreed that this was true but felt that some compensation should be made for the fact that the projects being considered did not have equal lives. QUESTIONS 1. What are the NPV, PI, and IRR for projects A and B? What has caused the ranking conflicts? should groject A or B be chosen? Asaume that theie projects are not considered under a capital constraint 2. What ate the NPY, PL, and IRK for projects C and D ? Should project C or D be dosen? Asuase that these projects are nof comidered under a capital conianiat. 3. What are the NPY, PI, and IRK for projects E and F? Ase these projects compasable evep though they bave unequal lives? Why? Which project should be chosen? Assume that theje grejocts ate nor coevidered under a capalal conitraia. On December 10,2022, the finance committee of JK Industries (JK) met to consider eight capital budgeting projects. Present at the meeting were Sean JK, president and founder; Suzy Brown, controller; and Robert Strike, head of research and development. Over the past five years, this committee has met every month to consider and make a final judgment on all proposed capital outlays brought up for review during the period. JK Industries was founded in 1998 by Sean JK to produce plastic parts and moulding for the Detroit automakers. For the first 10 years of operations, BI has worked solely as a subcontractor for the automakers, but since then the company has made strong efforts to diversify in order to avoid the cyclical problems faced by the auto industry. By 2012, this diversification attempt had led Bl into the production of over 1,000 different items, including kitchen utensils, camera housings, and phonographic and recording equipment. It had also led to an increase in sales of 500 percent during the 2009-2016 period. As this dramatic increase in sales was paralleled by a corresponding increase in production volume, BI was forced, in late 2018, to expand production facilities. This plant and equipment expansion involved capital expenditures of approximately $10.5 million and resulted in an increase of production capacity of about 40 percent. Because of this increased production capacity, BI has made a concerted effort to attract new business and, consequently, has recently entered. into contracts with a large toy firm and a major discount department store chain. Still, nonauto-related business represents only 32 percent of BI's overall business. Thus, BI has continued to solicit nonautomotive business, and as a result of this effort and its internal research and development, the firm has four sets of mutually exelusive projects to consider at this month's finance committee meeting. Over the past 10 years, MPMC's capital budgeting approach has evolved into a somewhat elaborate procedure in which new proposals are categorized into three areas: 0 profit, ii) research and development, and iii) safety. Projects falling into the profit or research and development area are evaluated using present value techniques, assuming a 10 percent opportunify cost; those falling into the safety classification are evaluated in a more subjective framework. Besides the requirement that research and development projects receive favourable results from the present value criteria, a total dollar limit is assigned to projects of this category - typically about $750,000 per year. This limitation was imposed by JKS primarily because of the limited availability of quality researehers in the plastics industry JKS felt that if more funds than this were allocated, "we simply couldn't find the manpower to administer them properly." The benefits derived from safety projects, on the other hand, are not measured in terms of cash flown; henee, present value methods are not used in their cyaluation. Evaluating safety projects is a pragmatically difficult task requiring quantifying the benefits from these projects into dollar terms. Thus, safety projects are subjectively plant capacity, each of these projects would utilize precision equipment whose excess capacity is limited. Thus, adopting either project would tie up all precision facilities. In addition, the purchase of new equipment would be both prohibitively expensive and involve a time delay of approximately two years, thus making projects A and B mutually exclusive. (The cash flows associated with projects A and B are given in Exhibit 1.) The second set of projects involves the renting of computer facilities over a one-year period to aid in customer billing and perhaps inventory control. Project D entails the evaluation of a customer billing system proposed by Modigliani Computer Corporation. Under this system, all the bookkeeping and billing presently being done by MI' 3 accounting department would now be done by Modigliani. In addition to saving bookkeeping costs, Modighani would provide 2 more efficient billing system and do a credit analysis of delinquent customers, which could be used in the future for in-depth credit analysis. Project C is proposed by Myers Computer Corporation and includes a billing system similar to that offered by Modipliani, as well as an inventory control system that wili keep track of all raw materials and parts in stock and reorder when necessary, thereby reducing the likelihood of material stockouts, which has become mote and more frequeat over the past three years Whe cash nows for projects C and D are given in Exhibit 2) The third docision that faces the financial dirccioss of BI involves a newly developed and patented process for moulding hard plastics. BI can either manufacture and market the equipment necessary to mould such plastics or it cas rell the puteat tights to DSM, Inc, oee of the world's larger producers of plastici prodocts. (The cash flows for projects E and F are hows un Fxhibit 3). At prescat, the process bas not bece fully tested, and if IK is going to market it atself, it will be necessary to complete this ketug and begie production of plant facilities impediately. Op the other hand, we relling of these patent rights to DSM wouks involve oaly minor testing and iefinements, which couts be cowpleted withia the year. Thus. The final set of projects up for consideration concerns the replacement of some of the machinery. BI can go into one of two directions: Project G suggests the purchase and installation of moderately priced, extremely efficient equipment with an expected life of 5 years; while project H advocates the purchase of an almost similarly priced, although less efficient, machine with a life expectancy of 10 years. (The cash flows for these alternatives are shown in Exhibit 4). As the meeting opened, debate immediately centred on the most appropriate method for evaluating all the projects. JKS suggested that since the projects to be considered were mutually exclusive, perhaps their usual capital budgeting criteria of net present value was inappropriate. He felt that, in examining these projects, they should be more concerned with relative profitability of some measure of yield. Both Brown and Strike agreed with BOWERS's point of view, with Brown advocating a profitability index approach and Strike preferring to use the internal rate of return. Brown argued that the use of the profitability index would provide a benefit-cost ratio, directly implying relative profitability, so that they would merely need to rank the projects and select those with the highest profitability index. Strike suggested that the calculation of an internal rate of return would also give a measure of profitability and perhaps be somewhat easier to interpret. To settle the issue, IKS suggested that they calculate all three measures, as they would undoubtedly yield the same ranking. From here the discussion turned to an appropriate approach to the problem of differing lives among mutually exclusive projects E and F, and G and H. Strike argued that there really was no problem here, that since all the cash flows from these projects could be determined, any of the discounted cash flow methods of capital budgeting would work well. Brown agreed that this was true but felt that some compensation should be made for the fact that the projects being considered did not have equal lives. QUESTIONS 1. What are the NPV, PI, and IRR for projects A and B? What has caused the ranking conflicts? should groject A or B be chosen? Asaume that theie projects are not considered under a capital constraint 2. What ate the NPY, PL, and IRK for projects C and D ? Should project C or D be dosen? Asuase that these projects are nof comidered under a capital conianiat. 3. What are the NPY, PI, and IRK for projects E and F? Ase these projects compasable evep though they bave unequal lives? Why? Which project should be chosen? Assume that theje grejocts ate nor coevidered under a capalal conitraia