Question

Wendy ONeil (SSN 412-34-5670), who is single, worked full-time as the director at a local charity. She resides at 1501 Front Street, Highland, AZ 85711.

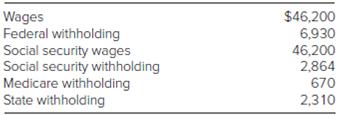

Wendy O’Neil (SSN 412-34-5670), who is single, worked full-time as the director at a local charity. She resides at 1501 Front Street, Highland, AZ 85711. For the year, she had the following reported on her W-2:

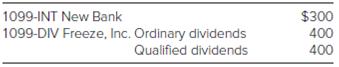

Other information follows:

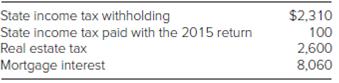

Wendy had the following itemized deductions:

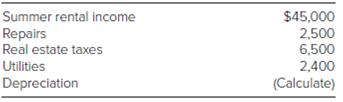

Wendy inherited a beach house in North Carolina (rental only) on January 2, 2016, from her father. The FMV at the father’s death was $850,000. He had purchased the house 20 years earlier for $100,000.

On December 29, 2016, Wendy properly conducted a like-kind exchange for rental real estate located at 128 Lake Blvd., Hot Town, AZ. She received rental property with an FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2017.

Prepare Form 1040 for Wendy for 2016. The taxpayer had qualifying health care coverage at all times during the tax year. You will also need Schedule A, Schedule D, Schedule E, Form 4562, and Form 8824.

Wages Federal withholding Social security wages Social security withholding Medicare withholding State withholding $46,200 6,930 46,200 2,864 670 2,310

Step by Step Solution

3.29 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER For the year Jan 1Dec 31 2017 or other tak yea beginning Your first name and inilial 2017 end...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started