Question

On December 31, 2013, before the yearly financial statements were prepared, the controller of the STN Corporation reviewed certain transactions that affected accounts receivable and

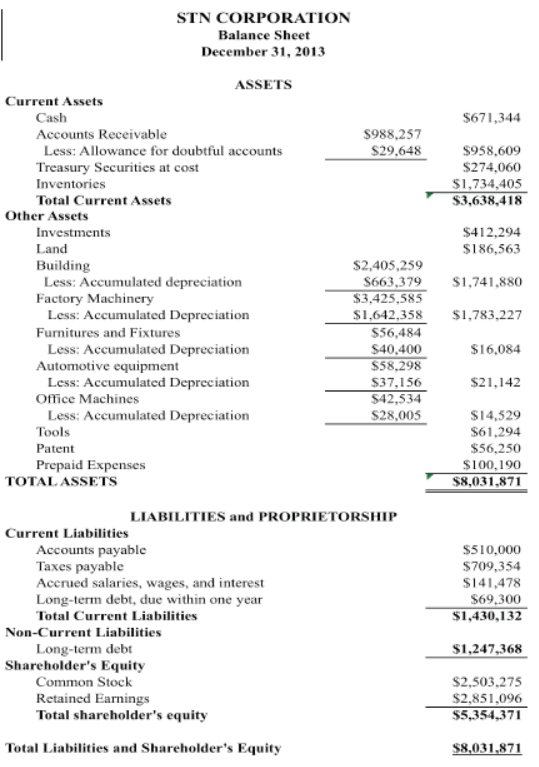

On December 31, 2013, before the yearly financial statements were prepared, the controller of the STN Corporation reviewed certain transactions that affected accounts receivable and the allowance for doubtful accounts. The controller first examined the December 31, 2012, balance sheet (Exhibit 1). A subsequent review of the year's transactions applicable to accounts receivable revealed the items listed below: 1. Sales on account during 2013 amounted to $9,965,575. 2. Payment received on accounts receivable during 2013 totaled $9,685,420. 3. During the year, accounts receivable totaling $26,854 were deemed uncollectible and were written off. 4. Two accounts that had been written off as uncollectible in 2012 were collected in 2013. One account for $2,108 was paid in full. A partial payment of $1,566 was made by the Hollowell Company on another account that originally had amounted to $2,486. The controller was reasonably sure this account would be paid in full because reliable reports were circulating that the trustee in bankruptcy for the Hollowell Company would pay all obligations 100 cents on the dollar. 5. The Allowance for Bad Debts was adjusted to equal 3% of the balance in Accounts Receivable at the end of the year. Questions: 1. Analyze the effect of each of these transactions in terms of its effect on Account Receivable, Allowance for Doubtful Accounts, and any other account that may be involved, and prepare necessary journal entries. 2. Give the correct totals for Accounts Receivable and the Allowance for Doubtful Accounts as of December 31, 2013, after the transaction affecting them had been recorded. 3. Calculate the current ratio, acid-test ratio, and days' receivables figures as of December 31, 2013. Assume that the amounts for the items other than those described in the case are the same as on December 31, 2012.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started