Question

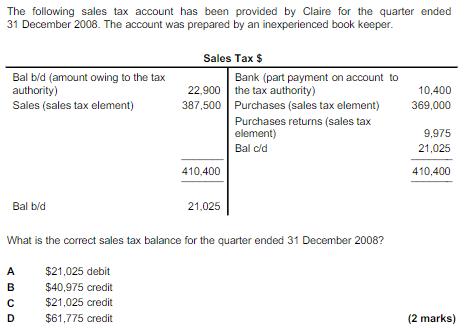

The following sales tax account has been provided by Claire for the quarter ended 31 December 2008. The account was prepared by an inexperienced

The following sales tax account has been provided by Claire for the quarter ended 31 December 2008. The account was prepared by an inexperienced book keeper. Bal b/d (amount owing to the tax authority) Sales (sales tax element) Bal b/d ABCD D Sales Tax $ $21,025 debit $40,975 credit $21,025 credit $61,775 credit 22,900 387,500 410,400 What is the correct sales tax balance for the quarter ended 31 December 2008? 21,025 Bank (part payment on account to the tax authority) Purchases (sales tax element) Purchases returns (sales tax element) Bal c/d 10,400 369,000 9,975 21,025 410,400 (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

C EXPLANATION The sales tax account should have a credit balance of 21025 at the end of the quarter ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles Volume 1

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

15th Canadian Edition

1259259803, 978-1259259807

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App