Answered step by step

Verified Expert Solution

Question

1 Approved Answer

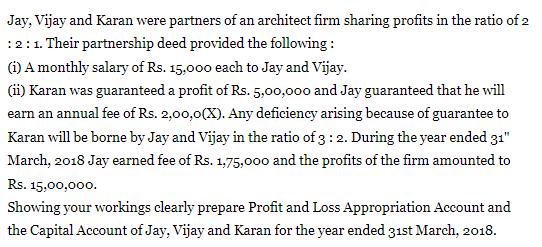

Jay, Vijay and Karan were partners of an architect firm sharing profits in the ratio of 2 : 2:1. Their partnership deed provided the

Jay, Vijay and Karan were partners of an architect firm sharing profits in the ratio of 2 : 2:1. Their partnership deed provided the following: (i) A monthly salary of Rs. 15,000 each to Jay and Vijay. (ii) Karan was guaranteed a profit of Rs. 5,00,000 and Jay guaranteed that he will earn an annual fee of Rs. 2,00,0(X). Any deficiency arising because of guarantee to Karan will be borne by Jay and Vijay in the ratio of 3: 2. During the year ended 31" March, 2018 Jay earned fee of Rs. 1,75,000 and the profits of the firm amounted to Rs. 15,00,000. Showing your workings clearly prepare Profit and Loss Appropriation Account and the Capital Account of Jay, Vijay and Karan for the year ended 31st March, 2018.

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Solution Verified by Toppr Profit and Loss Appropriation Account For the year ended 31 st March 2018 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started