Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2018, Tracy Co. signed a 4-year, noncancelable lease for a right of use of machine requiring P150,000 annual payments beginning December 31,2018

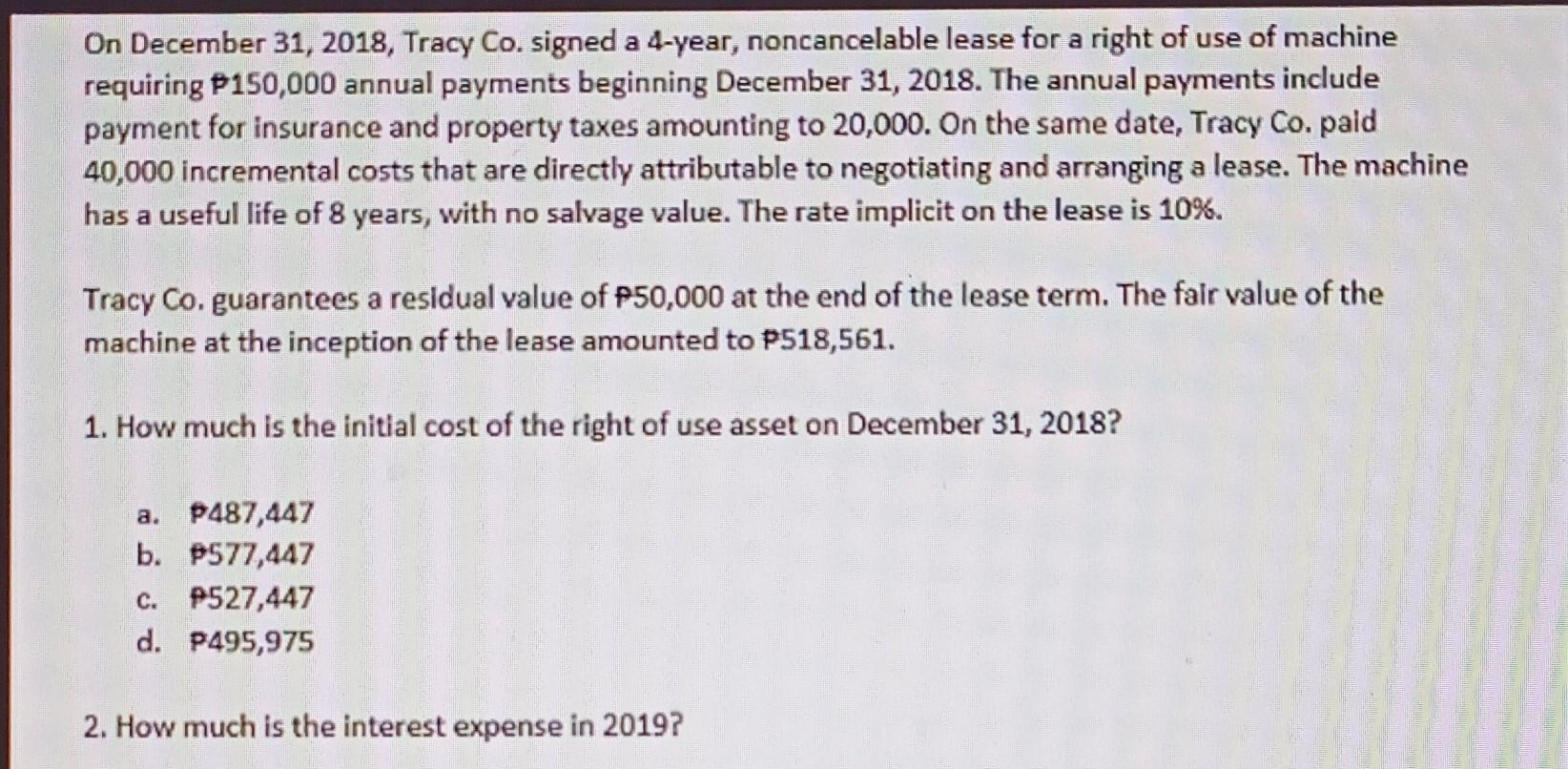

On December 31, 2018, Tracy Co. signed a 4-year, noncancelable lease for a right of use of machine requiring P150,000 annual payments beginning December 31,2018 . The annual payments include payment for insurance and property taxes amounting to 20,000 . On the same date, Tracy Co. paid 40,000 incremental costs that are directly attributable to negotiating and arranging a lease. The machine has a useful life of 8 years, with no salvage value. The rate implicit on the lease is 10%. Tracy Co. guarantees a residual value of P50,000 at the end of the lease term. The fair value of the machine at the inception of the lease amounted to P518,561. 1. How much is the initial cost of the right of use asset on December 31,2018 ? a. 9887,447 b. 9577,447 c. 9527,447 d. P495,975 2. How much is the interest expense in 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started