Answered step by step

Verified Expert Solution

Question

1 Approved Answer

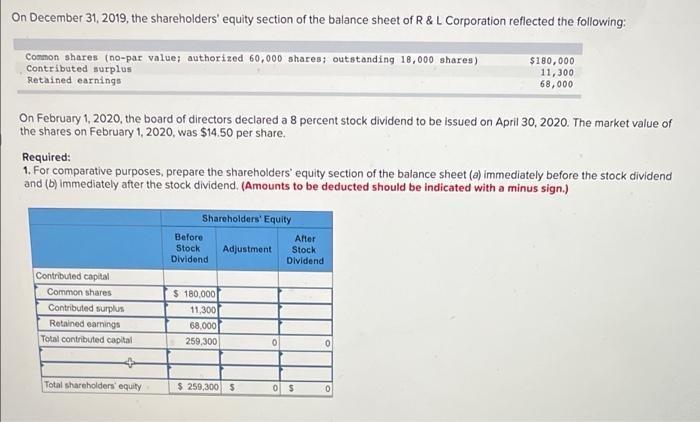

On December 31, 2019, the shareholders' equity section of the balance sheet of R&L Corporation reflected the following: Common shares (no-par value; authorized 60,000

On December 31, 2019, the shareholders' equity section of the balance sheet of R&L Corporation reflected the following: Common shares (no-par value; authorized 60,000 shares; outstanding 18,000 shares) Contributed surplus Retained earnings On February 1, 2020, the board of directors declared a 8 percent stock dividend to be issued on April 30, 2020. The market value of the shares on February 1, 2020, was $14.50 per share. Required: 1. For comparative purposes, prepare the shareholders' equity section of the balance sheet (a) immediately before the stock dividend and (b) immediately after the stock dividend. (Amounts to be deducted should be indicated with a minus sign.) Contributed capital Common shares Contributed surplus Retained earnings Total contributed capital Total shareholders' equity Shareholders' Equity Before Stock Dividend $ 180,000 11,300 68,000 259,300 Adjustment $ 259,300 $ 0 After Stock Dividend 0 $ $180,000 11,300 68,000 0 0

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Saluation Amount of Stock dividend 18000 Shares x 8 x 145...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started