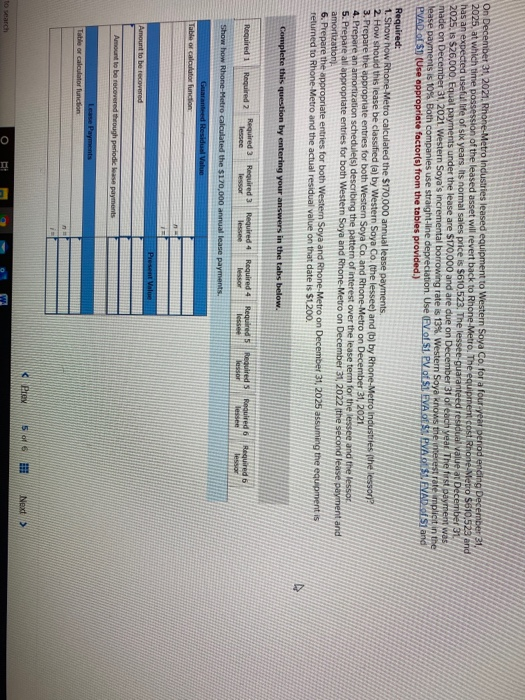

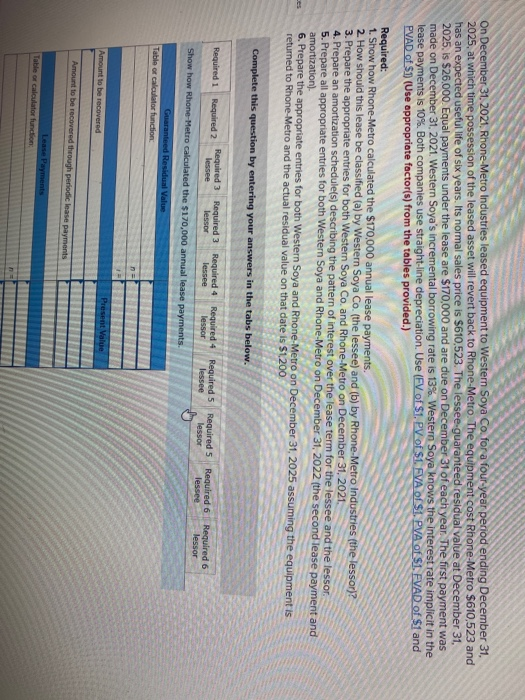

On December 31, 2021. Rhone-Metro Industries leased equipment to Western Soya Co.for a four year benod ending December 31 2025, at which time possession of the leased asset will revert back to Rhone Metro. The equipment content Me S10.523 and has an expected useful life of six years. Its normal sales price is $610,523. The lessee guaranteed re l ve December 31 2025.15 526,000. Equal Payments under the lease are $170,000 and are due on December 31 f chwar The fast payment was made on December 31, 2024 Western Soya's incremental borrowing rate is 13% Western Soya knows the interest rate implicit in the lease payments is 10% Both companies use straight-line depreciation. Use of 51. PV. SIEVA GAMA S YAD51 and PVAD (51) (Use appropriate factor(s) from the tables provided.) Required: 1. Show now Rhone Metro calculated the $170,000 annual lease payments 2. How should this Tease be classified (a) by Western Soya Co. (the lessee) and (b) by Rhone-Metro Industries the lesson 3. Prepare the appropriate entries for both Western Soya Co. and Rhone-Metro on December 31, 2021 4. Prepare an amortization schedules describing the pattern of interest over the lease term for the lessee and the lesson 5. Prepare all appropriate entries for both Western Soya and Rhone Metro on December 31, 2022 (the second lease payment and amortization 6. Prepare the appropriate entries for both Western Soya and Rhone Metro on December 31, 2025 asuming the equipments returned to Rhone Metro and the actual residual value on that date is $1200. Complete this question by entering your answers in the tabs below Required 1 Required 2 tred 3 lessee Required 3 lessor Required 4 Required 4 Required 6 Required Show how Rhone-Metro calculated the $170,000 annual lease payments. Guaranteed Residual Value Table of calculator function Present Value Amount to be recovered A nd to be covered through periodic base payments Lease Payments Prey 5 of 6 H Next > to search O R ! 9 W On December 31, 2021, Rhone-Metro Industries leased equipment to Western Soya Co. for a four-year period ending December 31, 2025, at which time possession of the leased asset will revert back to Rhone-Metro. The equipment cost Rhone-Metro $610,523 and has an expected useful life of six years. Its normal sales price is $610,523. The lessee-guaranteed residual value at December 31, 2025, is $26.000 Equal payments under the lease are $170,000 and are due on December 31 of each year. The first payment was made on December 31, 2021. Western Soya's incremental borrowing rate is 13%. Western Soya knows the interest rate implicit in the lease payments is 10%. Both companies use straight-line depreciation. Use (FV of $1. PV SLEVA OS1.PVA of S1, EVAD of $1 and PVAD of S1) (Use appropriate factor(s) from the tables provided.) Required: 1. Show how Rhone-Metro calculated the $170,000 annual lease payments. 2. How should this lease be classified (a) by Western Soya Co. (the lessee) and (b) by Rhone-Metro Industries (the lessor)? 3. Prepare the appropriate entries for both Western Soya Co. and Rhone-Metro on December 31, 2021 4. Prepare an amortization schedule(s) describing the pattern of interest over the lease term for the lessee and the lessor. 5. Prepare all appropriate entries for both Western Soya and Rhone-Metro on December 31, 2022 (the second lease payment and amortization) 6. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 31, 2025 assuming the equipment is returned to Rhone-Metro and the actual residual value on that date is $1200 Complete this question by entering your answers in the tabs below. Required 1 Bad Required 2 Required 3 lessee Required 3 lessor Required 4 lessee Required 4 lessor Required 5 Required 5 lessee Required 6 lessee Required 6 lessor Show how Rhone-Metro calculated the $170,000 annual lease payments Guaranteed Residual Value Table or calculator function Amount to be recovered Present Value Amount to be recovered through periodic lease payments Lease Payments Table or calculator fundon