Question

On December 31, 2021, Rhone-Metro Industries leased equipment to Western Soya Co. for a four-year period ending December 31, 2025, at which time possession of

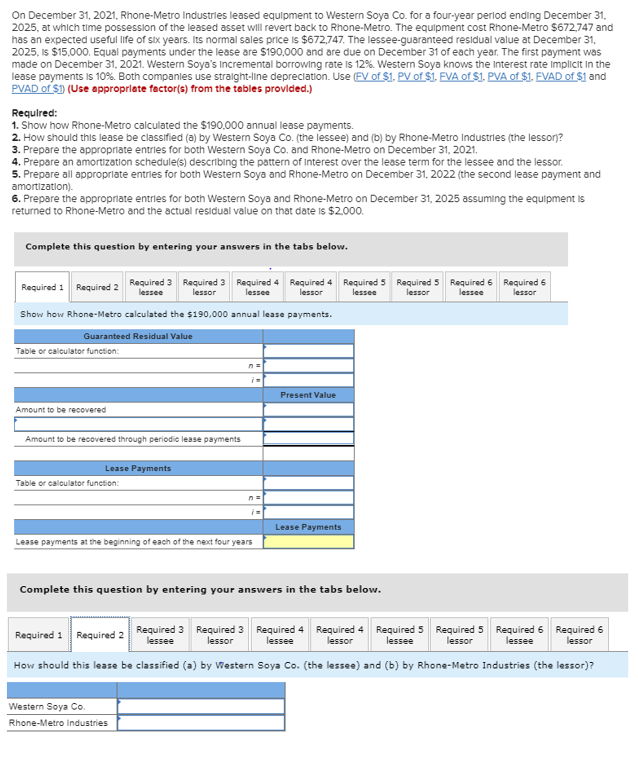

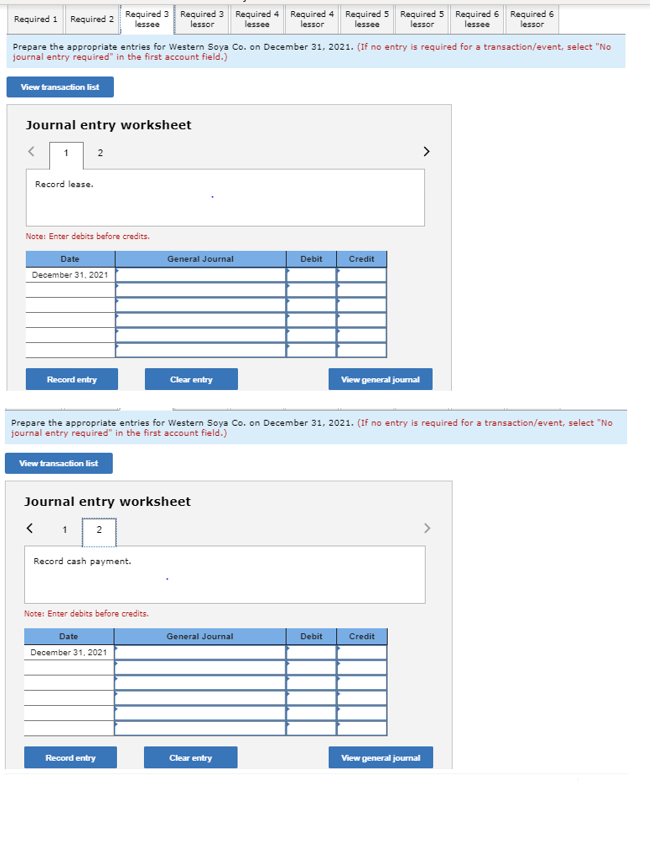

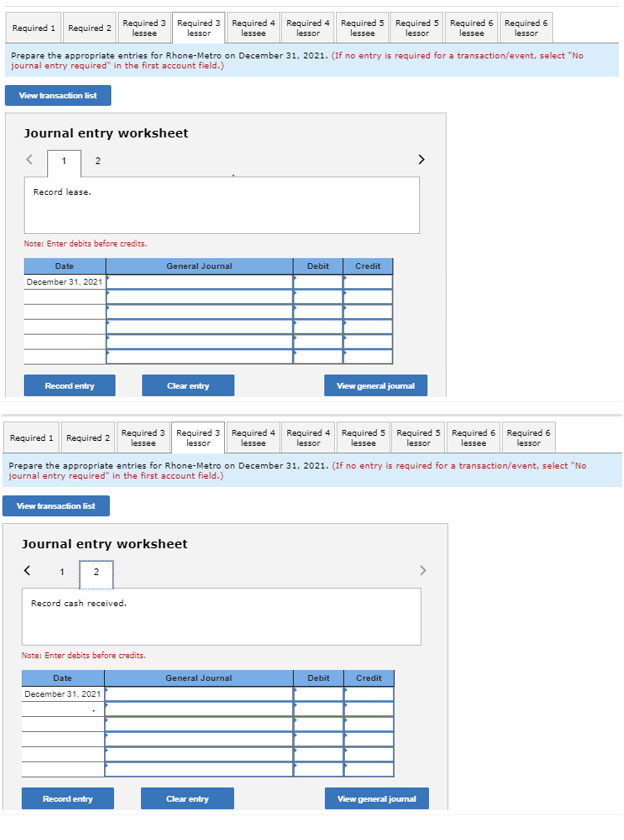

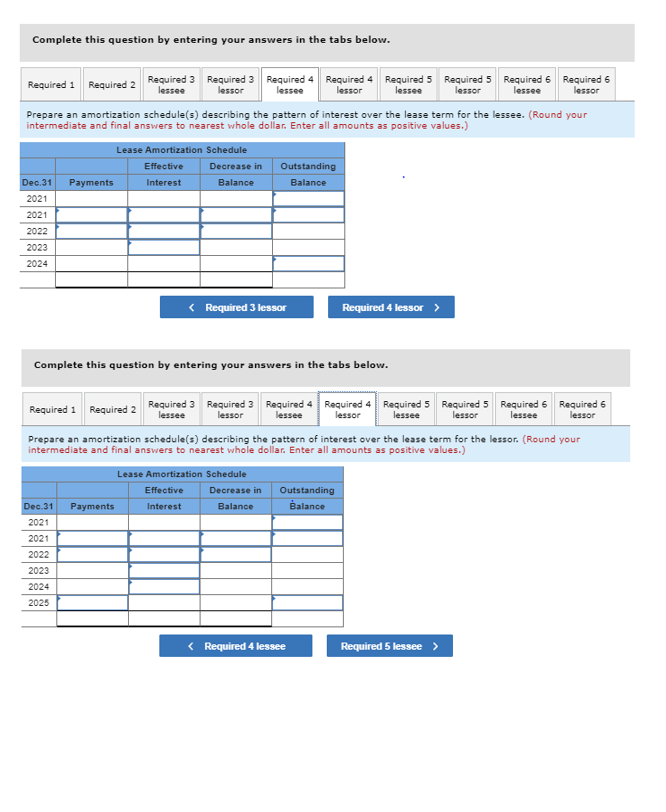

On December 31, 2021, Rhone-Metro Industries leased equipment to Western Soya Co. for a four-year period ending December 31, 2025, at which time possession of the leased asset will revert back to Rhone-Metro. The equipment cost Rhone-Metro $672,747 and has an expected useful life of six years. Its normal sales price is $672,747. The lessee-guaranteed residual value at December 31, 2025, is $15,000. Equal payments under the lease are $190,000 and are due on December 31 of each year. The first payment was made on December 31, 2021. Western Soya's incremental borrowing rate is 12%. Western

Soya knows the interest rate implicit in the lease payments is 10%. Both companies use straight-line depreciation.

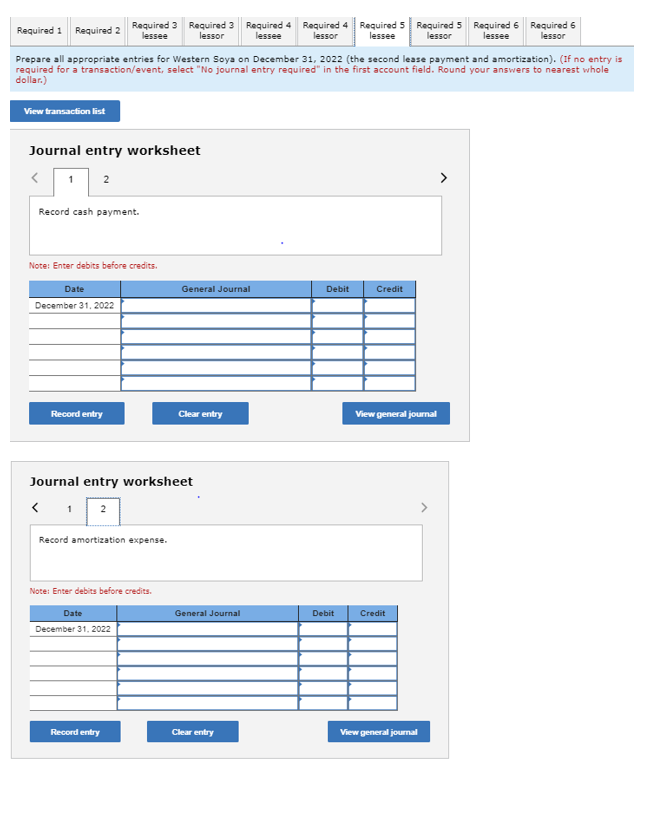

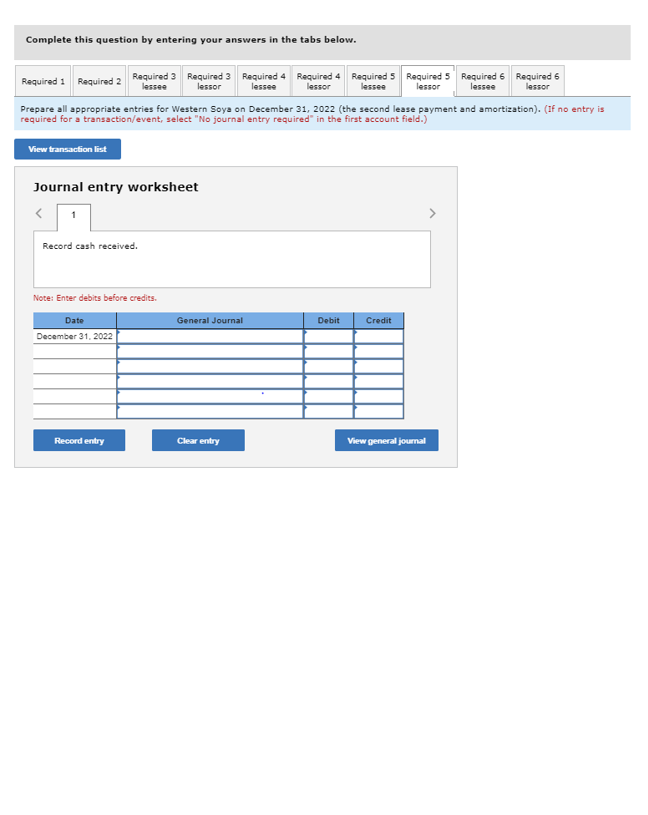

The below screen shots illustrate the question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started