Answered step by step

Verified Expert Solution

Question

1 Approved Answer

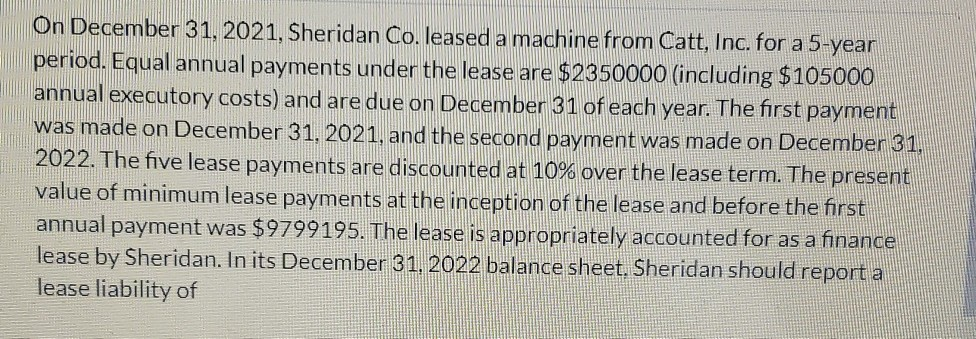

On December 31, 2021, Sheridan Co. leased a machine from Catt, Inc. for a 5-year period. Equal annual payments under the lease are $2350000 (including

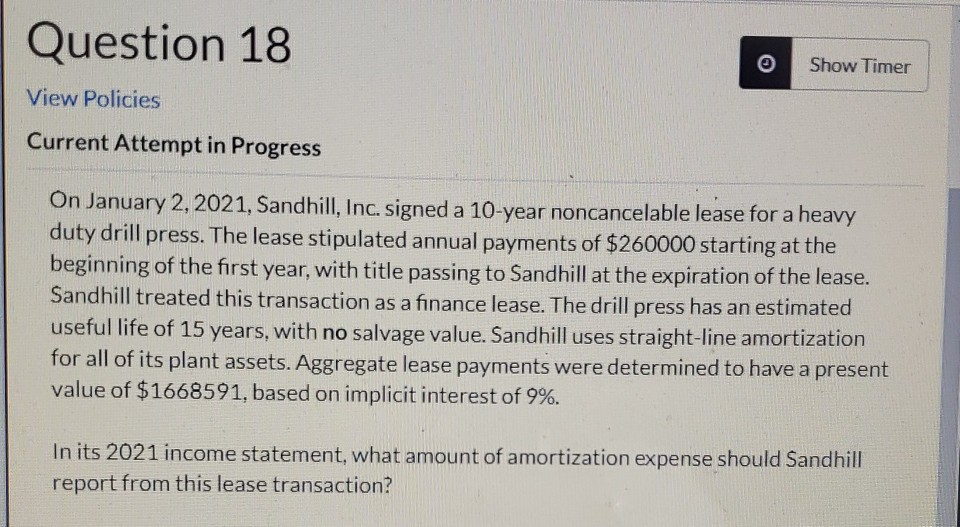

On December 31, 2021, Sheridan Co. leased a machine from Catt, Inc. for a 5-year period. Equal annual payments under the lease are $2350000 (including $105000 annual executory costs) and are due on December 31 of each year. The first payment was made on December 31, 2021, and the second payment was made on December 31, 2022. The five lease payments are discounted at 10% over the lease term. The present value of minimum lease payments at the inception of the lease and before the first annual payment was $9799195. The lease is appropriately accounted for as a finance lease by Sheridan. In its December 31, 2022 balance sheet. Sheridan should report a lease liability of Question 18 Show Timer View Policies Current Attempt in Progress On January 2, 2021, Sandhill, Inc. signed a 10-year noncancelable lease for a heavy duty drill press. The lease stipulated annual payments of $260000 starting at the beginning of the first year, with title passing to Sandhill at the expiration of the lease. Sandhill treated this transaction as a finance lease. The drill press has an estimated useful life of 15 years, with no salvage value. Sandhill uses straight-line amortization for all of its plant assets. Aggregate lease payments were determined to have a present value of $1668591, based on implicit interest of 9%. In its 2021 income statement, what amount of amortization expense should Sandhill report from this lease transaction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started