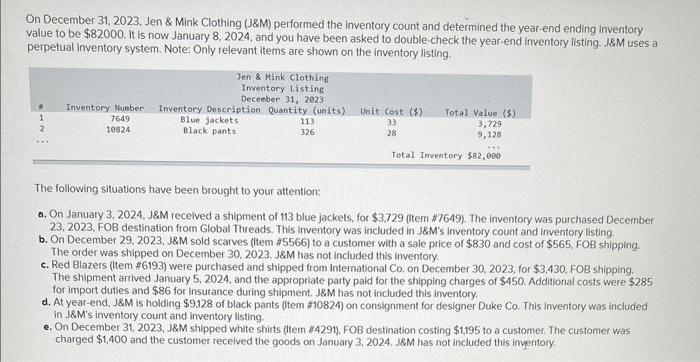

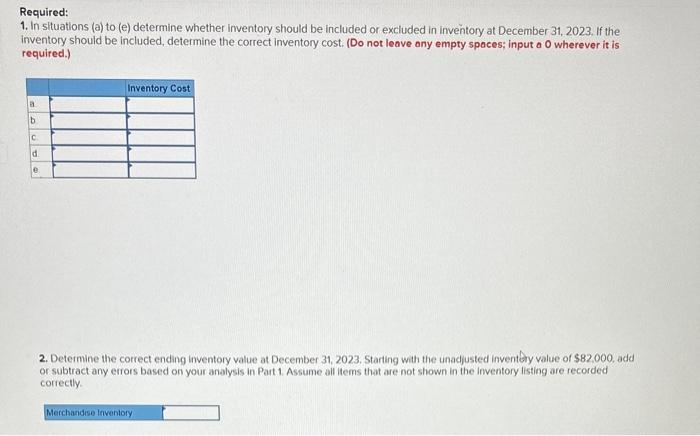

On December 31, 2023, Jen \& Mink Clothing (J\&M) performed the inventory count and determined the year-end ending inventory value to be $82000. It is now January 8,2024 , and you have been asked to double-check the year-end inventory listing. J\&M uses a perpetual inventory system. Note: Only relevant items are shown on the inventory listing. The following situations have been brought to your attention: a. On January 3, 2024. J\&M recelved a shipment of 113 blue jackets, for $3,729 (ttem \#7649). The inventory was purchased December 23, 2023, FOB destination from Global Threads. This inventory was included in J\&M's inventory count and inventory listing. b. On December 29, 2023, J\&M sold scarves (ttem \#5566) to a customer with a sale price of $830 and cost of $565. FOB shipping. The order was shipped on December 30.2023. J\&M has not included this inventory. c. Red Blazers (ttem #6193 ) were purchased and shipped from international Co. on December 30,2023, for $3,430, FOB shipping. The shipment arrived January 5, 2024. and the appropriate party paid for the shipping charges of $450. Additional costs were $285 for import duties and $86 for insurance during shipment. J\&M has not included this inventory. d. At year-end, J $M is holding $9.128 of black pants (Item A10824) on consignment for designer Duke Co. This inventory was included in J\&M's inventory count and inventory listing. e. On December 31, 2023, J\&M shipped white shirts (tiem \#4291). FOB destination costing $1,195 to a customer. The customer was charged $1,400 and the customer recelved the goods on January 3, 2024. J\&M has not included this inventory. Required: 1. In situations (a) to (e) determine whether inventory should be included or excluded in inventory at December 31,2023 , If the inventory should be included, determine the correct inventory cost. (Do not leave any empty spoces; input a 0 wherever it is required.) 2. Determine the correct ending inventory value at December 31, 2023. Starting with the unadjusted inventoly value of $82.000, add or subtract any errors based on your analysis in Part 1 . Assume all items that are not shown in the inventory listing are recorded correctly