Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On Feb 1, 2009, Kirby, Inc. issued $600,000, 6% bonds at 86.4095. Market rate is 8%. Interest is payable semiannually on February 1 and August

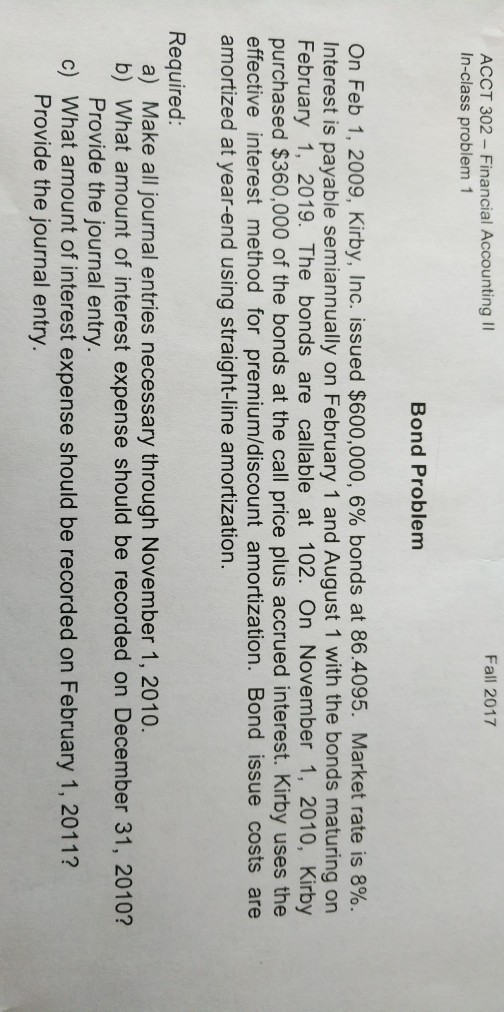

On Feb 1, 2009, Kirby, Inc. issued $600,000, 6% bonds at 86.4095. Market rate is 8%. Interest is payable semiannually on February 1 and August 1 with the bonds maturing on February 1, 2019. The bonds are callable at 102. On November 1, 2010, Kirby purchased $360,000 of the bonds at the call price plus accrued interest. Kirby uses the effective interest method for premium/discount amortization. Bond issue costs are amortized at year-end using straight-line amortization. a) Make all journal entries necessary through November 1, 2010. b) What amount of interest expense should be recorded on December 31, 2010? Provide the journal entry. c) What amount of interest expense should be recorded on February 1, 2011? Provide the journal entry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started