Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On February 1, 2024, Splish Company purchased 95% of the outstanding common stock of Carol Company and 85% of the outstanding common stock of Steven

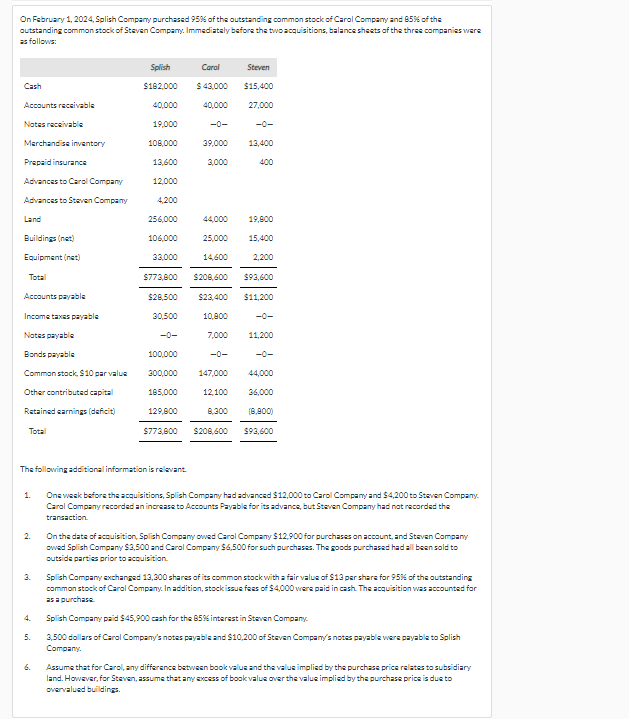

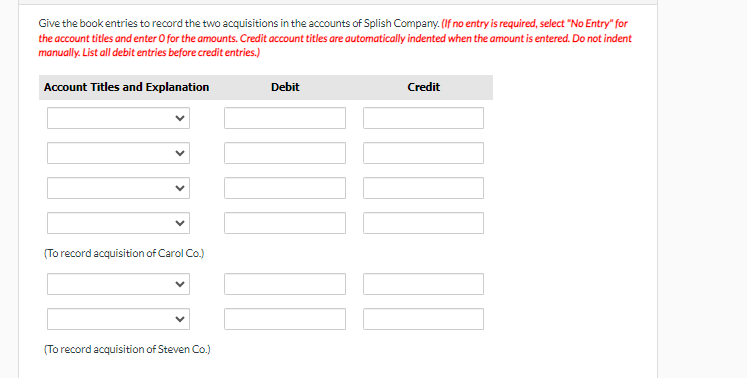

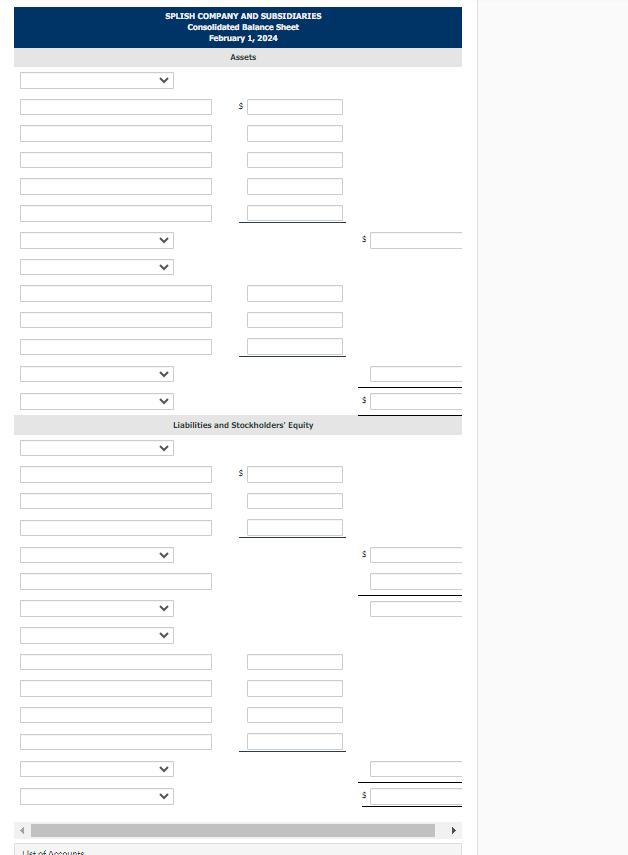

On February 1, 2024, Splish Company purchased 95% of the outstanding common stock of Carol Company and 85% of the outstanding common stock of Steven Company. Immediataly before the two acquisitions, balance sheets of the three companies were as follows: The following additional information is relevant. 1. Ona wakk befora the acquisitions, Splish Company had advanced \$12,000 to Carol Company and \$4,200 to Steven Company. Carol Companyracorded an increase to Accounts Payabla for its advance, but Steven Company had nat recordad the tranaction. 2. On the date of accuisition, Splish Company owed Carol Company $12,900 for purchases an account, and Stavan Company owad Splish Company \$3,500 and Carol Company $6,500 for such purchases. The goods purchased had all been sold to outsida parties prior to accuisition. 3. Splish Company exchanzed 13,300 shares of its common stock with a fair value of $13 par share for 95% of the outstanding common stock of Carol Company. In addition, stockissue fees of $4,000 were paid in cash. The acquisition was accounted for as a purchase. 4. Splish Company paid \$45,900 cash for the 85% interest in Steven Company. 5. 3,500 dollars of Carol Company's notes payabla and $10,200 of Steven Company's notes payable wara payabla to Splish Company. 6. Bssume that for Carol, any difference between bookvalue and the value impliad by the purchase price relates to subsidiary land. However, for Steven, assume that any avess of bookvalue over the value implied by the purchase price is due to overvalued buildines. Give the book entries to record the two acquisitions in the accounts of Splish Company. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) SPLISH COMPANY AND SUBSIDIARIES Consolidated Balance sheet February 1, 2024 Assets $ $ s Liabilities and Stockholders' Equity $ s On February 1, 2024, Splish Company purchased 95% of the outstanding common stock of Carol Company and 85% of the outstanding common stock of Steven Company. Immediataly before the two acquisitions, balance sheets of the three companies were as follows: The following additional information is relevant. 1. Ona wakk befora the acquisitions, Splish Company had advanced \$12,000 to Carol Company and \$4,200 to Steven Company. Carol Companyracorded an increase to Accounts Payabla for its advance, but Steven Company had nat recordad the tranaction. 2. On the date of accuisition, Splish Company owed Carol Company $12,900 for purchases an account, and Stavan Company owad Splish Company \$3,500 and Carol Company $6,500 for such purchases. The goods purchased had all been sold to outsida parties prior to accuisition. 3. Splish Company exchanzed 13,300 shares of its common stock with a fair value of $13 par share for 95% of the outstanding common stock of Carol Company. In addition, stockissue fees of $4,000 were paid in cash. The acquisition was accounted for as a purchase. 4. Splish Company paid \$45,900 cash for the 85% interest in Steven Company. 5. 3,500 dollars of Carol Company's notes payabla and $10,200 of Steven Company's notes payable wara payabla to Splish Company. 6. Bssume that for Carol, any difference between bookvalue and the value impliad by the purchase price relates to subsidiary land. However, for Steven, assume that any avess of bookvalue over the value implied by the purchase price is due to overvalued buildines. Give the book entries to record the two acquisitions in the accounts of Splish Company. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) SPLISH COMPANY AND SUBSIDIARIES Consolidated Balance sheet February 1, 2024 Assets $ $ s Liabilities and Stockholders' Equity $ s

On February 1, 2024, Splish Company purchased 95% of the outstanding common stock of Carol Company and 85% of the outstanding common stock of Steven Company. Immediataly before the two acquisitions, balance sheets of the three companies were as follows: The following additional information is relevant. 1. Ona wakk befora the acquisitions, Splish Company had advanced \$12,000 to Carol Company and \$4,200 to Steven Company. Carol Companyracorded an increase to Accounts Payabla for its advance, but Steven Company had nat recordad the tranaction. 2. On the date of accuisition, Splish Company owed Carol Company $12,900 for purchases an account, and Stavan Company owad Splish Company \$3,500 and Carol Company $6,500 for such purchases. The goods purchased had all been sold to outsida parties prior to accuisition. 3. Splish Company exchanzed 13,300 shares of its common stock with a fair value of $13 par share for 95% of the outstanding common stock of Carol Company. In addition, stockissue fees of $4,000 were paid in cash. The acquisition was accounted for as a purchase. 4. Splish Company paid \$45,900 cash for the 85% interest in Steven Company. 5. 3,500 dollars of Carol Company's notes payabla and $10,200 of Steven Company's notes payable wara payabla to Splish Company. 6. Bssume that for Carol, any difference between bookvalue and the value impliad by the purchase price relates to subsidiary land. However, for Steven, assume that any avess of bookvalue over the value implied by the purchase price is due to overvalued buildines. Give the book entries to record the two acquisitions in the accounts of Splish Company. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) SPLISH COMPANY AND SUBSIDIARIES Consolidated Balance sheet February 1, 2024 Assets $ $ s Liabilities and Stockholders' Equity $ s On February 1, 2024, Splish Company purchased 95% of the outstanding common stock of Carol Company and 85% of the outstanding common stock of Steven Company. Immediataly before the two acquisitions, balance sheets of the three companies were as follows: The following additional information is relevant. 1. Ona wakk befora the acquisitions, Splish Company had advanced \$12,000 to Carol Company and \$4,200 to Steven Company. Carol Companyracorded an increase to Accounts Payabla for its advance, but Steven Company had nat recordad the tranaction. 2. On the date of accuisition, Splish Company owed Carol Company $12,900 for purchases an account, and Stavan Company owad Splish Company \$3,500 and Carol Company $6,500 for such purchases. The goods purchased had all been sold to outsida parties prior to accuisition. 3. Splish Company exchanzed 13,300 shares of its common stock with a fair value of $13 par share for 95% of the outstanding common stock of Carol Company. In addition, stockissue fees of $4,000 were paid in cash. The acquisition was accounted for as a purchase. 4. Splish Company paid \$45,900 cash for the 85% interest in Steven Company. 5. 3,500 dollars of Carol Company's notes payabla and $10,200 of Steven Company's notes payable wara payabla to Splish Company. 6. Bssume that for Carol, any difference between bookvalue and the value impliad by the purchase price relates to subsidiary land. However, for Steven, assume that any avess of bookvalue over the value implied by the purchase price is due to overvalued buildines. Give the book entries to record the two acquisitions in the accounts of Splish Company. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) SPLISH COMPANY AND SUBSIDIARIES Consolidated Balance sheet February 1, 2024 Assets $ $ s Liabilities and Stockholders' Equity $ s Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started