On February 14, 2012 Tyler, Assistant Treasurer at Allied Digital (AD) is required to complete a Hedge

The hedge is a dividend due on September 15th from AD Germany.

The Hamburg office has automatic permission to repatriate 3 million September 15th.

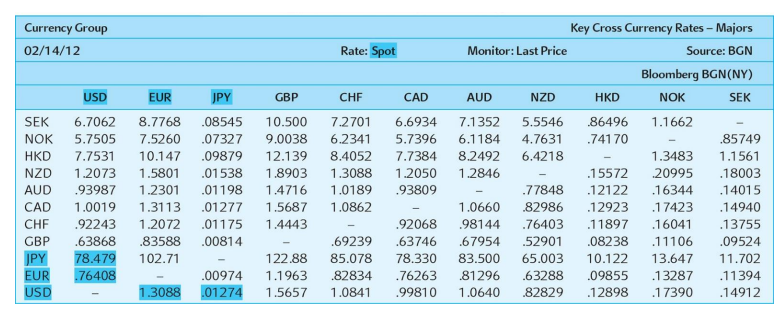

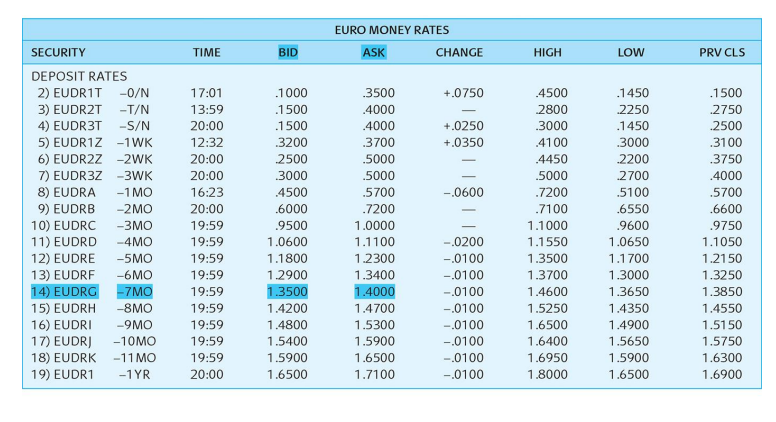

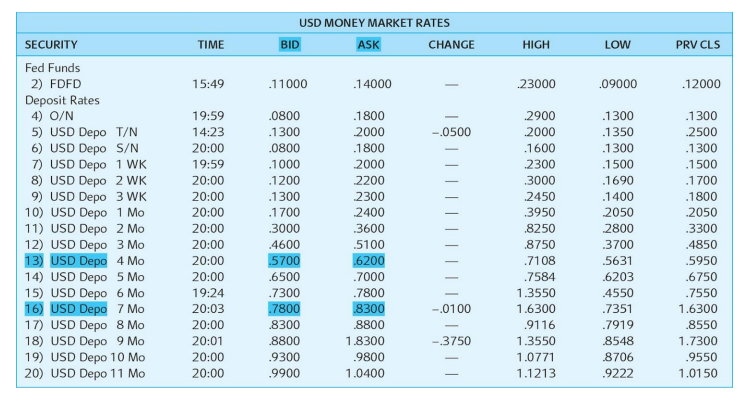

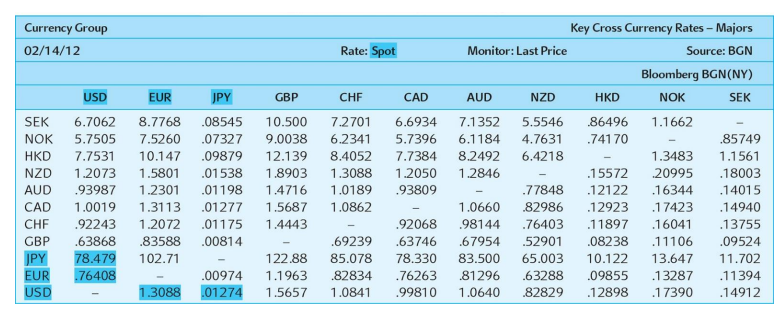

Tyler in his office has been printing spot, forward and currency options and futures quotations from the companys Bloomberg terminal.

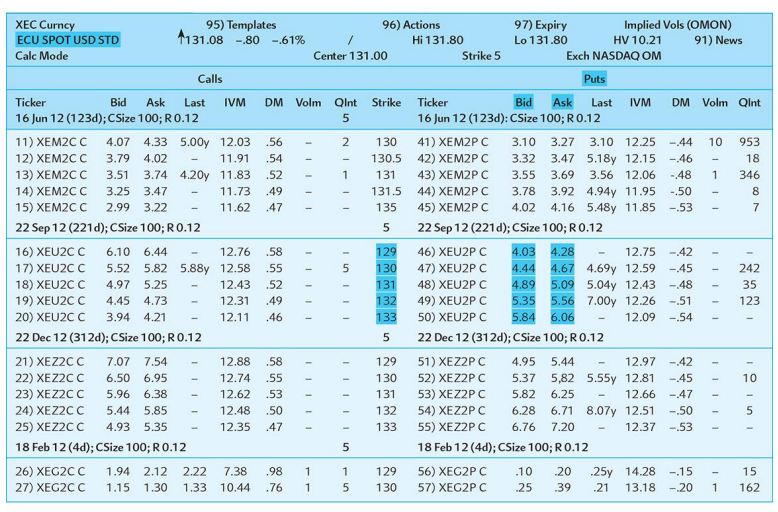

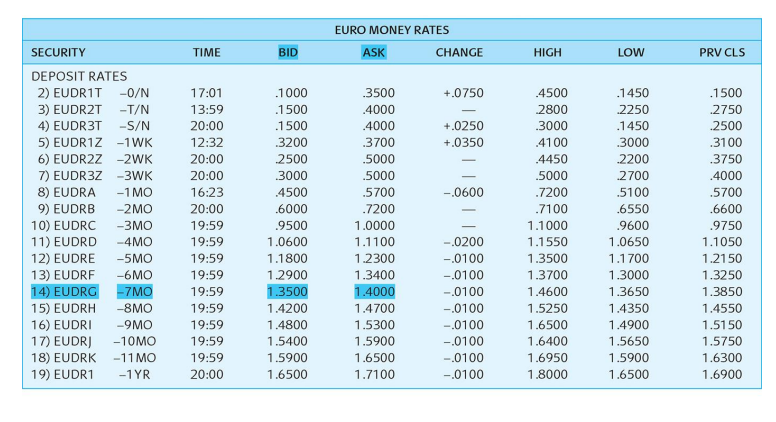

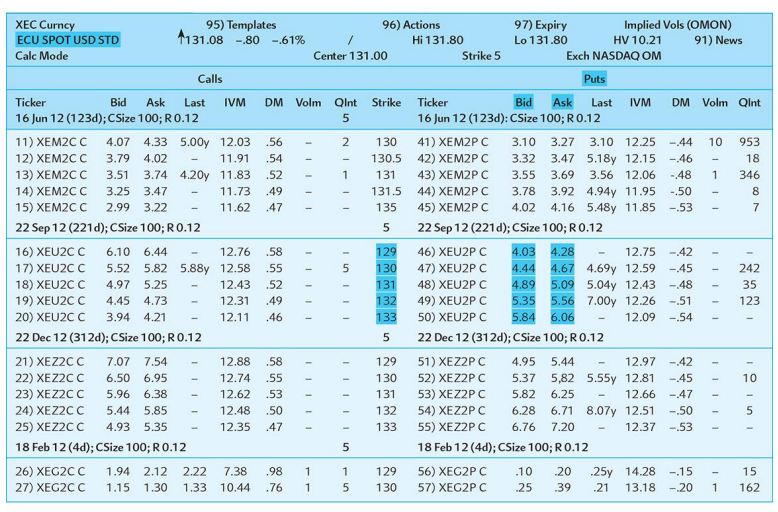

The option prices are quoted in U.S. cents per euro. Yen are quoted in hundredths of a cent.

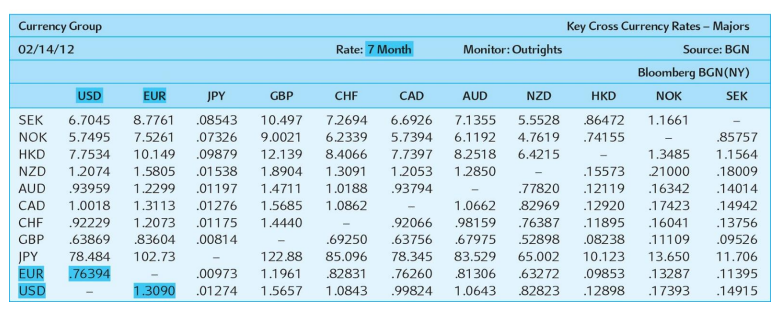

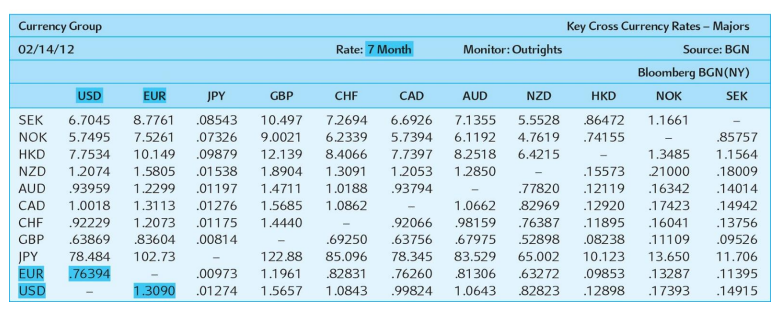

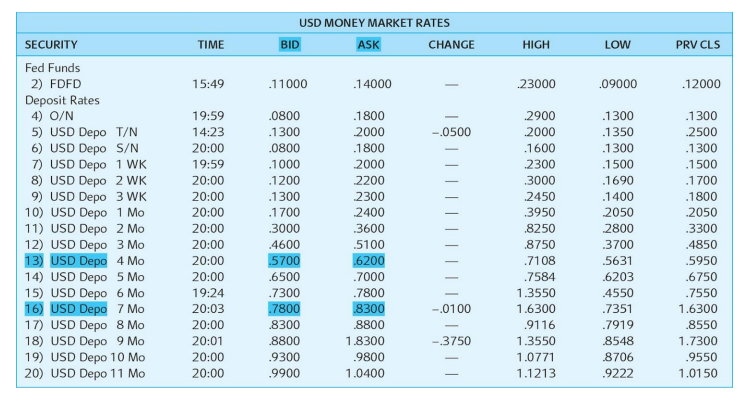

Tyler makes a mental note that AD can typically borrow in the Eurocurrency market at LIBOR + 1% and lend at LIBID.

Are currency options a better means of hedging exchange risk for an international firm than traditional forward exchange contracts or futures contracts.

Show which hedging is better (forward, money market or option). Why?

HINTS:

Find the euro receivable

In table 3, you find the 7-month forward rate.

Borrowing and lending interest rates are given in the tables Euro Money Rates and USD Money Market Rates.

AD can borrow in the Eurocurrency market at LIBOR + 1%, you have to add 1% with the rate you pick from table 3.

Since youre given both bid and ask, you borrow at ask rate and lend it bid rate.

Remember that these interest rates are annualized. So, when you calculate PV or FV of borrowing or investment you need to take account actual number of days for hedging period, that means, interest rates need to be multiplied with (actual number of days/360).

The option premium is given in cents per euro or cents.

If you want to buy a call or a put, you pay the ask since the dealer wants to sell at that premium

Currency Group 02/14/12 Rate: Spot Key Cross Currency Rates - Majors Monitor: Last Price Source: BGN Bloomberg BGN(NY) AUD NZD HKD NOK SEK USD EUR GBP CHF CAD 1.1662 .86496 .741 70 5.5546 4.7631 6.4218 SEK NOK HKD NZD AUD CAD CHF GBP JPY EUR USD JPY .08545 .07327 .09879 .01538 .01198 .01277 .01175 .00814 6.7062 5.7505 7.7531 1.2073 .93987 1.0019 .92243 .63868 78.479 .76408 8.7768 7.5260 10.147 1.5801 1.2301 1.3113 1.2072 .83588 102.71 6.6934 5.7396 7.7384 1.2050 .93809 7.1352 6.1184 8.2492 1.2846 10.500 9.0038 12.139 1.8903 1.4716 1.5687 1.4443 7.2701 6.2341 8.4052 1.3088 1.0189 1.0862 1.0660 98144 .67954 83.500 .81296 1.0640 .15572 .12122 .12923 .11897 .08238 10.122 .09855 .12898 .77848 .82986 .76403 .52901 65.003 .63288 .82829 .92068 .63746 78.330 .76263 199810 .85749 1.1561 .18003 .14015 .14940 .13755 .09524 11.702 .11394 .14912 1.3483 20995 .16344 .17423 .16041 .11106 13.647 .13287 .17390 .69239 85.078 .82834 1.0841 122.88 1.1963 1.5657 .00974 .01274 1.3088 Currency Group 02/14/12 Rate: 7 Month USD EUR GBP CHF CAD SEK NOK HKD NZD AUD CAD CHF GBP JPY EUR USD 6.7045 5.7495 7.7534 1.2074 193959 1.0018 .92229 .63869 78.484 .76394 8.7761 7.5261 10.149 1.5805 1.2299 1.3113 1.2073 .83604 102.73 JPY .08543 .07326 .09879 .01538 .01197 .01276 .01175 .00814 10.497 9.0021 12.139 1.8904 1.4711 1.5685 1.4440 7.2694 6.2339 8.4066 1.3091 1.0188 1.0862 6.6926 5.7394 7.7397 1.2053 .93794 Key Cross Currency Rates Majors Monitor: Outrights Source: BGN Bloomberg BGN(NY) AUD NZD HKD NOK SEK 7.1355 5.5528 .86472 1.1661 6.1192 4.7619 .74155 .85757 8.2518 6.4215 1.3485 1.1564 1.2850 .15573 21000 .18009 .77820 .12119 .16342 .14014 1.0662 .82969 .12920 .17423 .14942 .98159 .76387 .11895 .16041 .13756 .67975 .52898 .08238 .11109 .09526 83.529 65.002 10.123 13.650 11.706 .81306 .63272 .09853 .13287 .11395 1.0643 .82823 .12898 .17393 .14915 .69250 85.096 .82831 1.0843 122.88 1.1961 1.5657 .92066 .63756 78.345 .76260 .99824 .00973 .01274 1.3090 EURO MONEY RATES ASK CHANGE TIME BID HIGH LOW PRV CLS +.0750 +.0250 +.0350 -0600 SECURITY DEPOSIT RATES 2) EUDR1T -0/N 3) EUDRZT -T/N 4) EUDR3T -S/N 5) EUDR1Z -1WK 6) EUDR2Z -2WK 7) EUDR3Z -3WK 8) EUDRA -1 MO 9) EUDRB -2 MO 10) EUDRC -3MO 11) EUDRD -4MO 12) EUDRE -5MO 13) EUDRF -6 MO 14) EUDRG - 7 MO 15) EUDRH -8MO 16) EUDRI -9MO 17) EUDR) -10MO 18) EUDRK -11 MO 19) EUDR1 -1 YR 17:01 13:59 20:00 12:32 20:00 20:00 16:23 20:00 19:59 19:59 19:59 19:59 19:59 19:59 19:59 19:59 19:59 20:00 .1000 .1500 .1500 .3200 2500 3000 .4500 .6000 .9500 1.0600 1.1800 1.2900 1.3500 1.4200 1.4800 1.5400 1.5900 1.6500 3500 .4000 .4000 3700 .5000 5000 5700 .7200 1.0000 1.1100 1.2300 1.3400 1.4000 1.4700 1.5300 1.5900 1.6500 1.7100 .4500 2800 .3000 .4100 .4450 .5000 .7200 .7100 1.1000 1.1550 1.3500 1.3700 1.4600 1.5250 1.6500 1.6400 1.6950 1.8000 .1450 .2250 .1450 .3000 2200 2700 .5100 .6550 .9600 1.0650 1.1700 1.3000 1.3650 1.4350 1.4900 1.5650 1.5900 1.6500 .1500 .2750 .2500 .3100 .3750 .4000 .5700 .6600 .9750 1.1050 1.2150 1.3250 1.3850 1.4550 1.5150 1.5750 1.6300 1.6900 -.0200 -.0100 -.0100 -.0100 -.0100 -.0100 -.0100 -.0100 -0100 USD MONEY MARKET RATES BID ASK CHANGE SECURITY TIME HIGH LOW PRV CLS 15:49 .11000 .14000 23000 .09000 .12000 -.0500 Fed Funds 2) FDFD Deposit Rates 4) 0/N 5) USD Depo T/N 6) USD Depo S/N 7) USD Depo 1 WK 8) USD Depo 2 WK 9) USD Depo 3 WK 10) USD Depo 1 Mo 11) USD Depo 2 Mo 12) USD Depo 3 Mo 13) USD Depo 4 Mo 14) USD Depo 5 Mo 15) USD Depo 6 Mo 16) USD Depo 7 Mo 17) USD Depo 8 Mo 18) USD Depo 9 Mo 19) USD Depo 10 Mo 20) USD Depo 11 Mo 19:59 14:23 20:00 19:59 20:00 20:00 20:00 20:00 20:00 20:00 20:00 19:24 20:03 20:00 20:01 20:00 20:00 .0800 .1300 .0800 .1000 .1200 .1300 .1700 .3000 4600 5700 .6500 .7300 .7800 .8300 .8800 .9300 .9900 .1800 2000 .1800 2000 2200 2300 2400 .3600 .5100 6200 .7000 .7800 8300 8800 1.8300 .9800 1.0400 .2900 2000 .1600 2300 3000 .2450 .3950 .8250 .8750 .7108 .7584 1.3550 1.6300 .9116 1.3550 1.0771 1.1213 .1300 .1350 .1300 .1500 .1690 .1400 2050 2800 .3700 .5631 .6203 .4550 .7351 .7919 .8548 .8706 .9222 .1300 2500 .1300 .1500 .1700 .1800 2050 .3300 .4850 .5950 .6750 .7550 1.6300 .8550 1.7300 .9550 1.0150 -.0100 -.3750 11 I! 5 XEC Curney 95) Templates 96) Actions 97) Expiry Implied Vols (OMON) ECU SPOT USD STD 1131.08 -.80 -.61% Hi 131.80 Lo 131.80 HV 10.21 91) News Calc Mode Center 131.00 Strike 5 Exch NASDAQ OM Calls Puts Ticker Bid Ask Last IVM DM Volm Qint Strike Ticker Bid Ask Last IVM DM Volm Qint 16 Jun 12 (123d); CSize 100; R 0.12 5 16 Jun 12 (123d): CSize 100; R 0.12 11) XEM2CC 4.07 4.33 5.00y 12.03 .56 2 130 41) XEM2P C 3.10 3.27 3.10 12.25 -44 10 953 12) XEM2CC 3.79 4.02 11.91 .54 130.5 42) XEMZPC 3.32 3.47 5.18y 12.15 -.46 18 13) XEM2CC 3.51 3.74 4.20y 11.83 .52 1 131 43) XEM2PC 3.55 3.69 3.56 12.06 -.48 1 346 14) XEM2CC 3.25 3.47 11.73 .49 131.5 44) XEM2PC 3.78 3.92 4.94y 11.95 -.50 8 15) XEM2CC 2.99 3.22 11.62 .47 135 45) XEM2P C 4.02 4.16 5.48y 11.85 -.53 7 22 Sep 12 (221d); CSize 100; R 0.12 5 22 Sep 12 (221d); CSize 100; R0.12 16) XEU2CC 6.10 6.44 12.76 .58 129 46) XEU2PC 4.03 4.28 12.75 - 42 17) XEU2CC 5.52 5.82 5.88y 12.58 .55 5 130 47) XEU2PC 4.44 4.67 4.69y 12.59 -.45 242 18) XEU2CC 4.97 5.25 12.43 .52 131 48) XEU2PC 4.89 5.09 5.04y 12.43 -.48 35 19) XEU2CC 4.45 4.73 12.31 .49 132 49) XEU2PC 5.35 5.56 7.00y 12.26 -.51 123 20) XEU2CC 3.94 4.21 12.11 .46 133 50) XEU2PC 5.84 6.06 12.09 -.54 22 Dec 12 (312d); CSize 100; R0.12 5 22 Dec 12 (312d); CSize 100; R0.12 21) XEZ2CC 7.07 7.54 12.88 .58 129 51) XEZ2PC 4.95 5.44 12.97 -.42 22) XEZ2CC 6.50 6.95 12.74 .55 130 52) XEZ2PC 5.37 5,82 5.55y 12.81 -.45 10 23) XEZ2CC 5.96 6.38 12.62 .53 131 53) XEZ2PC 5.82 6.25 12.66 -.47 24) XEZ2CC 5.44 5.85 12.48 .50 132 54) XEZ2PC 6.28 6.71 8.07y 12.51 -.50 5 25) XEZ2CC 4.93 5.35 12.35 .47 133 55) XEZ2PC 6.76 7.20 12.37 -53 18 Feb 12 (4d); CSize 100; R 0.12 5 18 Feb 12 (4d); CSize 100; R0.12 26) XEC2CC 1.94 2.12 2.22 7.38 .98 1 1 129 56) XEG2PC .10 20 .25y 14.28 -.15 15 27) XEG2CC 1.15 1.30 1.33 10.44 .76 1 5 130 57) XEG2PC .25 .39 .21 13.18 -20 1 162 I in II III 1 . Currency Group 02/14/12 Rate: Spot Key Cross Currency Rates - Majors Monitor: Last Price Source: BGN Bloomberg BGN(NY) AUD NZD HKD NOK SEK USD EUR GBP CHF CAD 1.1662 .86496 .741 70 5.5546 4.7631 6.4218 SEK NOK HKD NZD AUD CAD CHF GBP JPY EUR USD JPY .08545 .07327 .09879 .01538 .01198 .01277 .01175 .00814 6.7062 5.7505 7.7531 1.2073 .93987 1.0019 .92243 .63868 78.479 .76408 8.7768 7.5260 10.147 1.5801 1.2301 1.3113 1.2072 .83588 102.71 6.6934 5.7396 7.7384 1.2050 .93809 7.1352 6.1184 8.2492 1.2846 10.500 9.0038 12.139 1.8903 1.4716 1.5687 1.4443 7.2701 6.2341 8.4052 1.3088 1.0189 1.0862 1.0660 98144 .67954 83.500 .81296 1.0640 .15572 .12122 .12923 .11897 .08238 10.122 .09855 .12898 .77848 .82986 .76403 .52901 65.003 .63288 .82829 .92068 .63746 78.330 .76263 199810 .85749 1.1561 .18003 .14015 .14940 .13755 .09524 11.702 .11394 .14912 1.3483 20995 .16344 .17423 .16041 .11106 13.647 .13287 .17390 .69239 85.078 .82834 1.0841 122.88 1.1963 1.5657 .00974 .01274 1.3088 Currency Group 02/14/12 Rate: 7 Month USD EUR GBP CHF CAD SEK NOK HKD NZD AUD CAD CHF GBP JPY EUR USD 6.7045 5.7495 7.7534 1.2074 193959 1.0018 .92229 .63869 78.484 .76394 8.7761 7.5261 10.149 1.5805 1.2299 1.3113 1.2073 .83604 102.73 JPY .08543 .07326 .09879 .01538 .01197 .01276 .01175 .00814 10.497 9.0021 12.139 1.8904 1.4711 1.5685 1.4440 7.2694 6.2339 8.4066 1.3091 1.0188 1.0862 6.6926 5.7394 7.7397 1.2053 .93794 Key Cross Currency Rates Majors Monitor: Outrights Source: BGN Bloomberg BGN(NY) AUD NZD HKD NOK SEK 7.1355 5.5528 .86472 1.1661 6.1192 4.7619 .74155 .85757 8.2518 6.4215 1.3485 1.1564 1.2850 .15573 21000 .18009 .77820 .12119 .16342 .14014 1.0662 .82969 .12920 .17423 .14942 .98159 .76387 .11895 .16041 .13756 .67975 .52898 .08238 .11109 .09526 83.529 65.002 10.123 13.650 11.706 .81306 .63272 .09853 .13287 .11395 1.0643 .82823 .12898 .17393 .14915 .69250 85.096 .82831 1.0843 122.88 1.1961 1.5657 .92066 .63756 78.345 .76260 .99824 .00973 .01274 1.3090 EURO MONEY RATES ASK CHANGE TIME BID HIGH LOW PRV CLS +.0750 +.0250 +.0350 -0600 SECURITY DEPOSIT RATES 2) EUDR1T -0/N 3) EUDRZT -T/N 4) EUDR3T -S/N 5) EUDR1Z -1WK 6) EUDR2Z -2WK 7) EUDR3Z -3WK 8) EUDRA -1 MO 9) EUDRB -2 MO 10) EUDRC -3MO 11) EUDRD -4MO 12) EUDRE -5MO 13) EUDRF -6 MO 14) EUDRG - 7 MO 15) EUDRH -8MO 16) EUDRI -9MO 17) EUDR) -10MO 18) EUDRK -11 MO 19) EUDR1 -1 YR 17:01 13:59 20:00 12:32 20:00 20:00 16:23 20:00 19:59 19:59 19:59 19:59 19:59 19:59 19:59 19:59 19:59 20:00 .1000 .1500 .1500 .3200 2500 3000 .4500 .6000 .9500 1.0600 1.1800 1.2900 1.3500 1.4200 1.4800 1.5400 1.5900 1.6500 3500 .4000 .4000 3700 .5000 5000 5700 .7200 1.0000 1.1100 1.2300 1.3400 1.4000 1.4700 1.5300 1.5900 1.6500 1.7100 .4500 2800 .3000 .4100 .4450 .5000 .7200 .7100 1.1000 1.1550 1.3500 1.3700 1.4600 1.5250 1.6500 1.6400 1.6950 1.8000 .1450 .2250 .1450 .3000 2200 2700 .5100 .6550 .9600 1.0650 1.1700 1.3000 1.3650 1.4350 1.4900 1.5650 1.5900 1.6500 .1500 .2750 .2500 .3100 .3750 .4000 .5700 .6600 .9750 1.1050 1.2150 1.3250 1.3850 1.4550 1.5150 1.5750 1.6300 1.6900 -.0200 -.0100 -.0100 -.0100 -.0100 -.0100 -.0100 -.0100 -0100 USD MONEY MARKET RATES BID ASK CHANGE SECURITY TIME HIGH LOW PRV CLS 15:49 .11000 .14000 23000 .09000 .12000 -.0500 Fed Funds 2) FDFD Deposit Rates 4) 0/N 5) USD Depo T/N 6) USD Depo S/N 7) USD Depo 1 WK 8) USD Depo 2 WK 9) USD Depo 3 WK 10) USD Depo 1 Mo 11) USD Depo 2 Mo 12) USD Depo 3 Mo 13) USD Depo 4 Mo 14) USD Depo 5 Mo 15) USD Depo 6 Mo 16) USD Depo 7 Mo 17) USD Depo 8 Mo 18) USD Depo 9 Mo 19) USD Depo 10 Mo 20) USD Depo 11 Mo 19:59 14:23 20:00 19:59 20:00 20:00 20:00 20:00 20:00 20:00 20:00 19:24 20:03 20:00 20:01 20:00 20:00 .0800 .1300 .0800 .1000 .1200 .1300 .1700 .3000 4600 5700 .6500 .7300 .7800 .8300 .8800 .9300 .9900 .1800 2000 .1800 2000 2200 2300 2400 .3600 .5100 6200 .7000 .7800 8300 8800 1.8300 .9800 1.0400 .2900 2000 .1600 2300 3000 .2450 .3950 .8250 .8750 .7108 .7584 1.3550 1.6300 .9116 1.3550 1.0771 1.1213 .1300 .1350 .1300 .1500 .1690 .1400 2050 2800 .3700 .5631 .6203 .4550 .7351 .7919 .8548 .8706 .9222 .1300 2500 .1300 .1500 .1700 .1800 2050 .3300 .4850 .5950 .6750 .7550 1.6300 .8550 1.7300 .9550 1.0150 -.0100 -.3750 11 I! 5 XEC Curney 95) Templates 96) Actions 97) Expiry Implied Vols (OMON) ECU SPOT USD STD 1131.08 -.80 -.61% Hi 131.80 Lo 131.80 HV 10.21 91) News Calc Mode Center 131.00 Strike 5 Exch NASDAQ OM Calls Puts Ticker Bid Ask Last IVM DM Volm Qint Strike Ticker Bid Ask Last IVM DM Volm Qint 16 Jun 12 (123d); CSize 100; R 0.12 5 16 Jun 12 (123d): CSize 100; R 0.12 11) XEM2CC 4.07 4.33 5.00y 12.03 .56 2 130 41) XEM2P C 3.10 3.27 3.10 12.25 -44 10 953 12) XEM2CC 3.79 4.02 11.91 .54 130.5 42) XEMZPC 3.32 3.47 5.18y 12.15 -.46 18 13) XEM2CC 3.51 3.74 4.20y 11.83 .52 1 131 43) XEM2PC 3.55 3.69 3.56 12.06 -.48 1 346 14) XEM2CC 3.25 3.47 11.73 .49 131.5 44) XEM2PC 3.78 3.92 4.94y 11.95 -.50 8 15) XEM2CC 2.99 3.22 11.62 .47 135 45) XEM2P C 4.02 4.16 5.48y 11.85 -.53 7 22 Sep 12 (221d); CSize 100; R 0.12 5 22 Sep 12 (221d); CSize 100; R0.12 16) XEU2CC 6.10 6.44 12.76 .58 129 46) XEU2PC 4.03 4.28 12.75 - 42 17) XEU2CC 5.52 5.82 5.88y 12.58 .55 5 130 47) XEU2PC 4.44 4.67 4.69y 12.59 -.45 242 18) XEU2CC 4.97 5.25 12.43 .52 131 48) XEU2PC 4.89 5.09 5.04y 12.43 -.48 35 19) XEU2CC 4.45 4.73 12.31 .49 132 49) XEU2PC 5.35 5.56 7.00y 12.26 -.51 123 20) XEU2CC 3.94 4.21 12.11 .46 133 50) XEU2PC 5.84 6.06 12.09 -.54 22 Dec 12 (312d); CSize 100; R0.12 5 22 Dec 12 (312d); CSize 100; R0.12 21) XEZ2CC 7.07 7.54 12.88 .58 129 51) XEZ2PC 4.95 5.44 12.97 -.42 22) XEZ2CC 6.50 6.95 12.74 .55 130 52) XEZ2PC 5.37 5,82 5.55y 12.81 -.45 10 23) XEZ2CC 5.96 6.38 12.62 .53 131 53) XEZ2PC 5.82 6.25 12.66 -.47 24) XEZ2CC 5.44 5.85 12.48 .50 132 54) XEZ2PC 6.28 6.71 8.07y 12.51 -.50 5 25) XEZ2CC 4.93 5.35 12.35 .47 133 55) XEZ2PC 6.76 7.20 12.37 -53 18 Feb 12 (4d); CSize 100; R 0.12 5 18 Feb 12 (4d); CSize 100; R0.12 26) XEC2CC 1.94 2.12 2.22 7.38 .98 1 1 129 56) XEG2PC .10 20 .25y 14.28 -.15 15 27) XEG2CC 1.15 1.30 1.33 10.44 .76 1 5 130 57) XEG2PC .25 .39 .21 13.18 -20 1 162 I in II III 1