Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On Friday, NOV 2, 2018 stock ACDC was trading for $25/share. 1. ACDC's annual VOL was: = 53%. 2. T-bills traded on NOV 2,

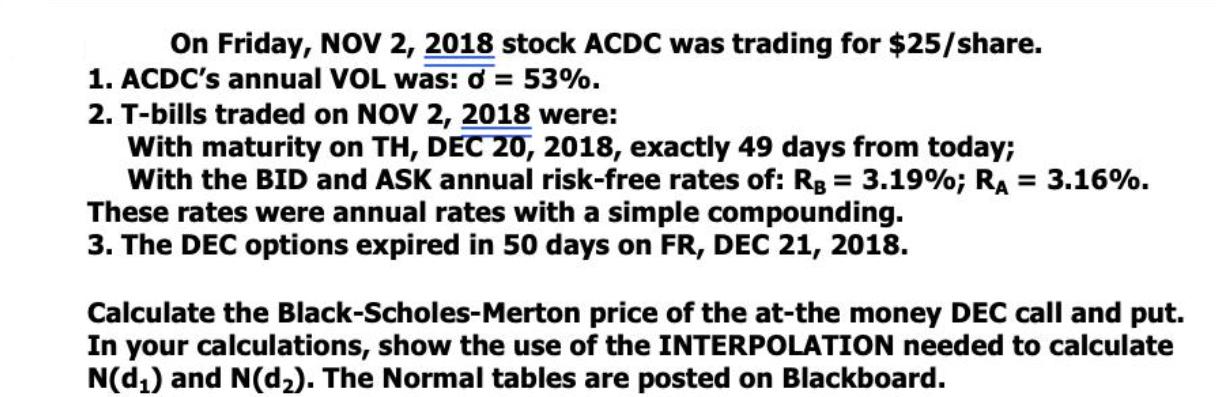

On Friday, NOV 2, 2018 stock ACDC was trading for $25/share. 1. ACDC's annual VOL was: = 53%. 2. T-bills traded on NOV 2, 2018 were: With maturity on TH, DEC 20, 2018, exactly 49 days from today; With the BID and ASK annual risk-free rates of: RB = 3.19%; RA = 3.16%. These rates were annual rates with a simple compounding. 3. The DEC options expired in 50 days on FR, DEC 21, 2018. Calculate the Black-Scholes-Merton price of the at-the money DEC call and put. In your calculations, show the use of the INTERPOLATION needed to calculate N(d) and N(d). The Normal tables are posted on Blackboard.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainly Lets calculate the BlackScholesMerton price for the atthemoney December DEC call and put o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started