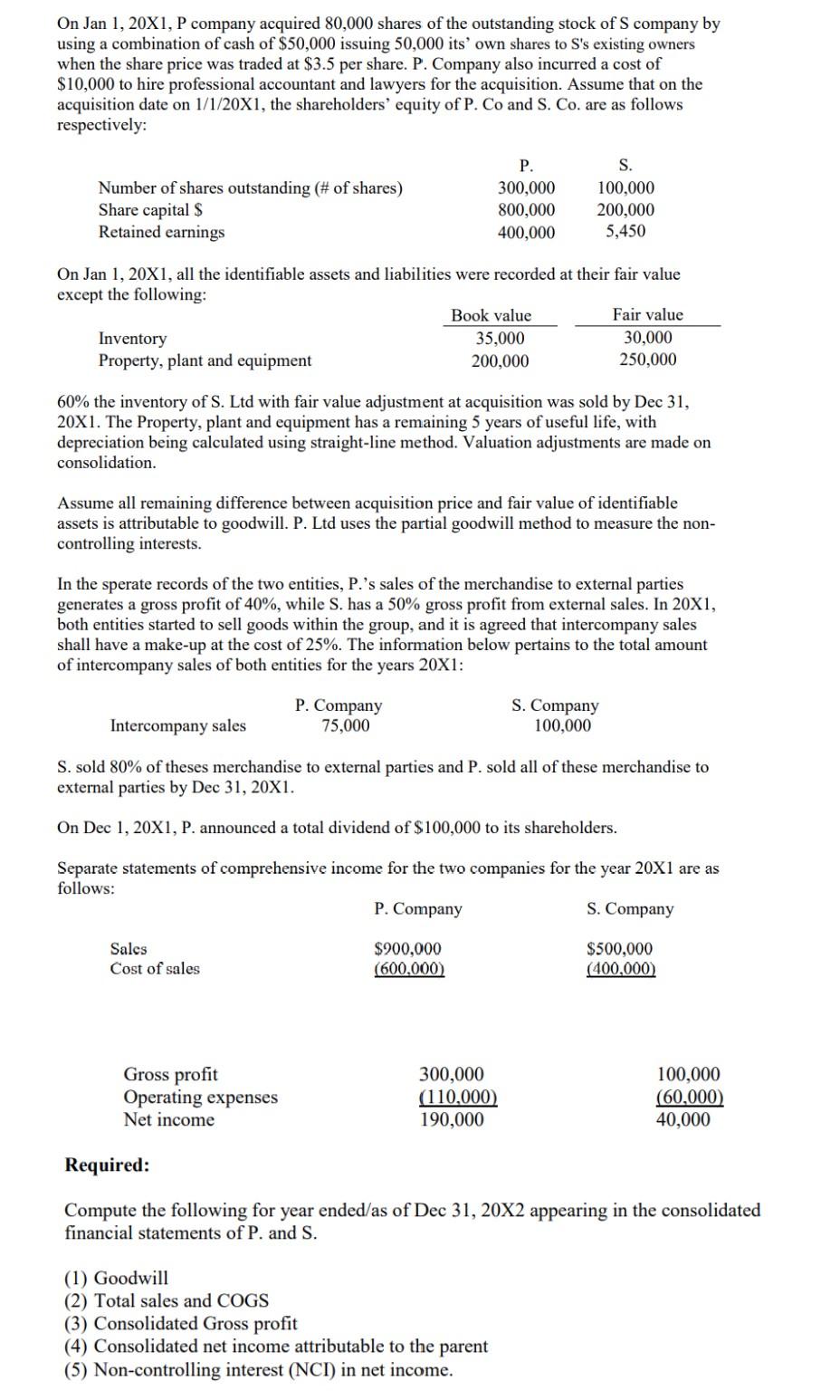

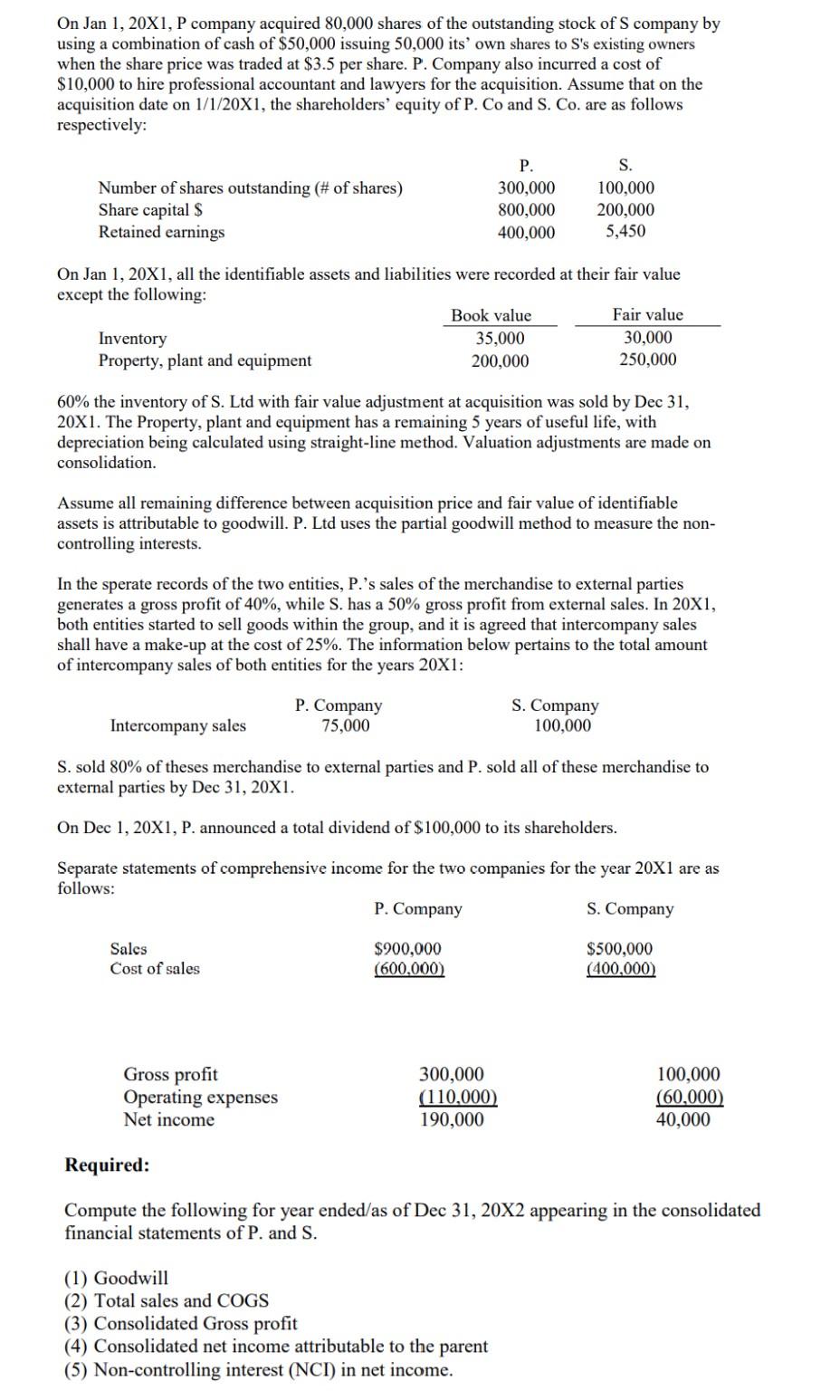

On Jan 1, 20X1, P company acquired 80,000 shares of the outstanding stock of S company by using a combination of cash of $50,000 issuing 50,000 its' own shares to S's existing owners when the share price was traded at $3.5 per share. P. Company also incurred a cost of $10,000 to hire professional accountant and lawyers for the acquisition. Assume that on the acquisition date on 1/1/20X1, the shareholders' equity of P. Co and S. Co. are as follows respectively: On Jan 1, 20X1, all the identifiable assets and liabilities were recorded at their fair value except the following: 60% the inventory of S. Ltd with fair value adjustment at acquisition was sold by Dec 31 , 20X1. The Property, plant and equipment has a remaining 5 years of useful life, with depreciation being calculated using straight-line method. Valuation adjustments are made on consolidation. Assume all remaining difference between acquisition price and fair value of identifiable assets is attributable to goodwill. P. Ltd uses the partial goodwill method to measure the noncontrolling interests. In the sperate records of the two entities, P.'s sales of the merchandise to external parties generates a gross profit of 40%, while S. has a 50% gross profit from external sales. In 20X1, both entities started to sell goods within the group, and it is agreed that intercompany sales shall have a make-up at the cost of 25%. The information below pertains to the total amount of intercompany sales of both entities for the years 20X1: IntercompanysalesP.Company75,000S.Company100,000 S. sold 80% of theses merchandise to external parties and P. sold all of these merchandise to external parties by Dec 31,20X1. On Dec 1, 20X1, P. announced a total dividend of $100,000 to its shareholders. Separate statements of comprehensive income for the two companies for the year 20X1 are as follows: Required: Compute the following for year ended/as of Dec 31, 20X2 appearing in the consolidated financial statements of P. and S. (1) Goodwill (2) Total sales and COGS (3) Consolidated Gross profit (4) Consolidated net income attributable to the parent (5) Non-controlling interest ( NCI) in net income