Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On Jan 1, Salem Company acquired a controlling interest in Abdulla Company by purchasing 15,000 shares of Abdulla Company's stock from a local stock

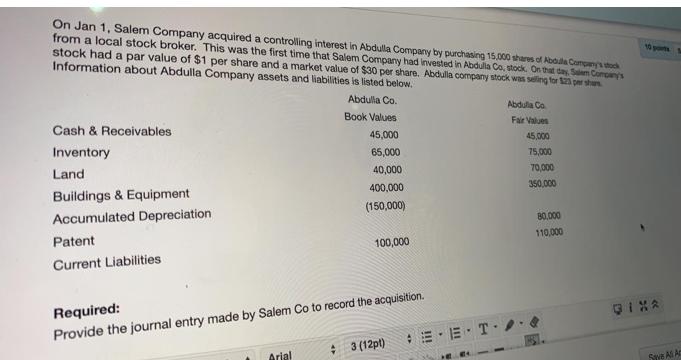

On Jan 1, Salem Company acquired a controlling interest in Abdulla Company by purchasing 15,000 shares of Abdulla Company's stock from a local stock broker. This was the first time that Salem Company had invested in Abdulla Co, stock. On that day, Salem Company's stock had a par value of $1 per share and a market value of $30 per share. Abdulla company stock was selling for $23 per shar Information about Abdulla Company assets and liabilities is listed below. Abdulla Co. Book Values 45,000 65,000 40,000 400,000 (150,000) Cash & Receivables Inventory Land Buildings & Equipment Accumulated Depreciation Patent Current Liabilities 100,000 Required: Provide the journal entry made by Salem Co to record the acquisition. Arial + 3 (12pt) EET Abdulla Co Fair Values 45,000 75,000 70,000 350,000 80,000 110,000 QIXA Save As Ac

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started