Answered step by step

Verified Expert Solution

Question

1 Approved Answer

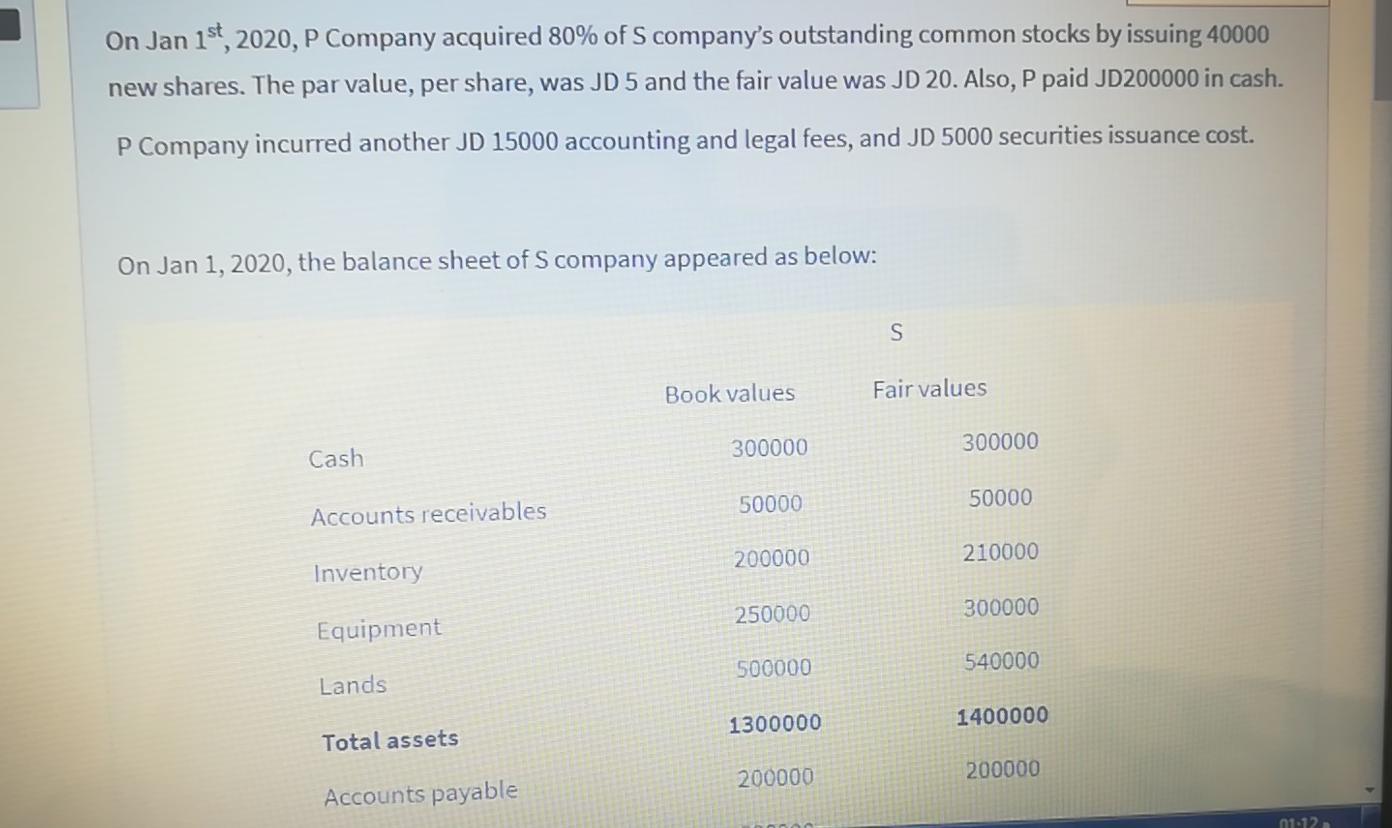

On Jan 1st, 2020, P Company acquired 80% of S company's outstanding common stocks by issuing 40000 new shares. The par value, per share,

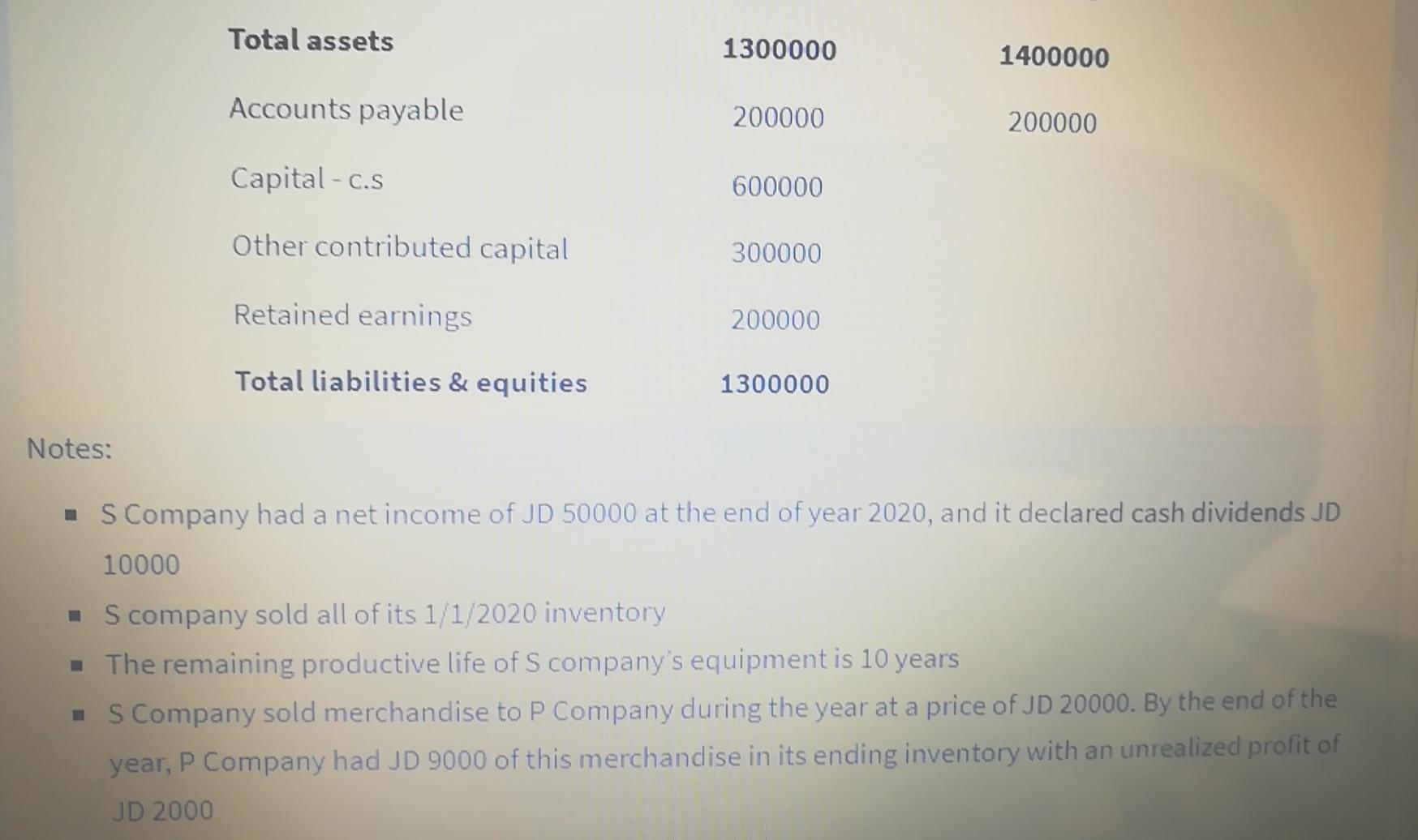

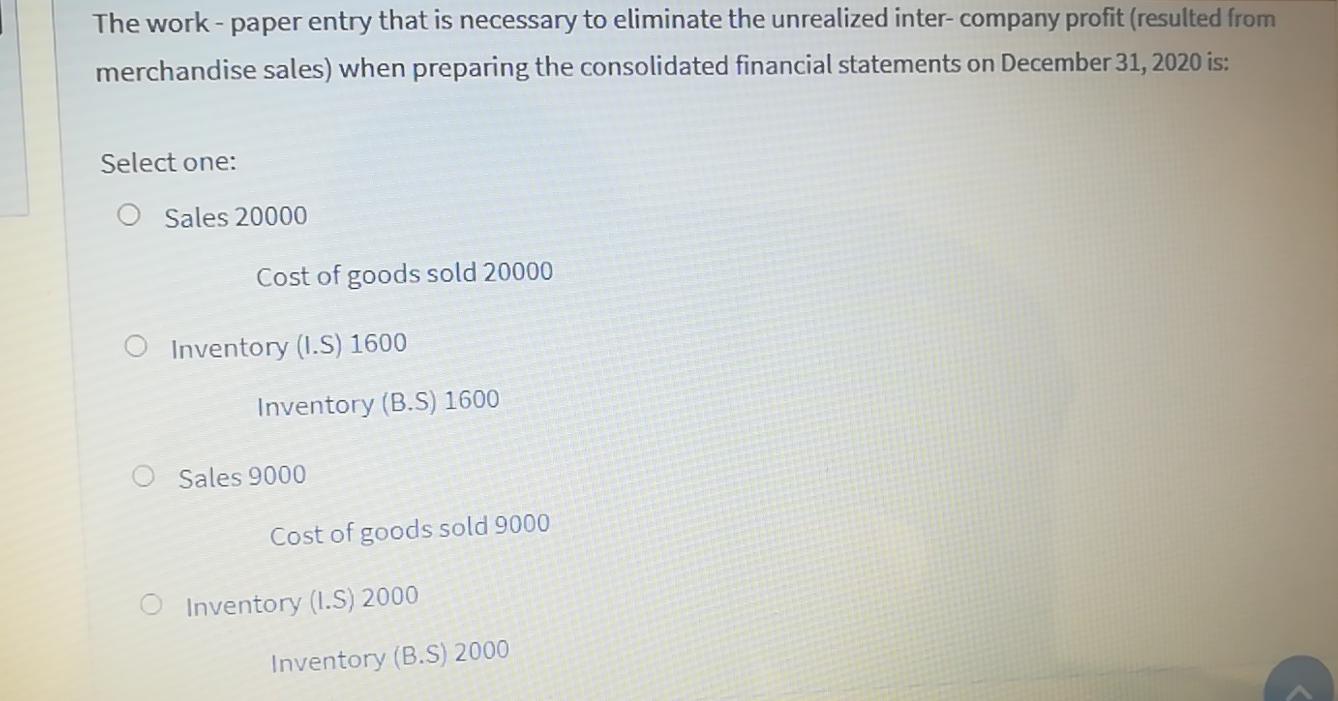

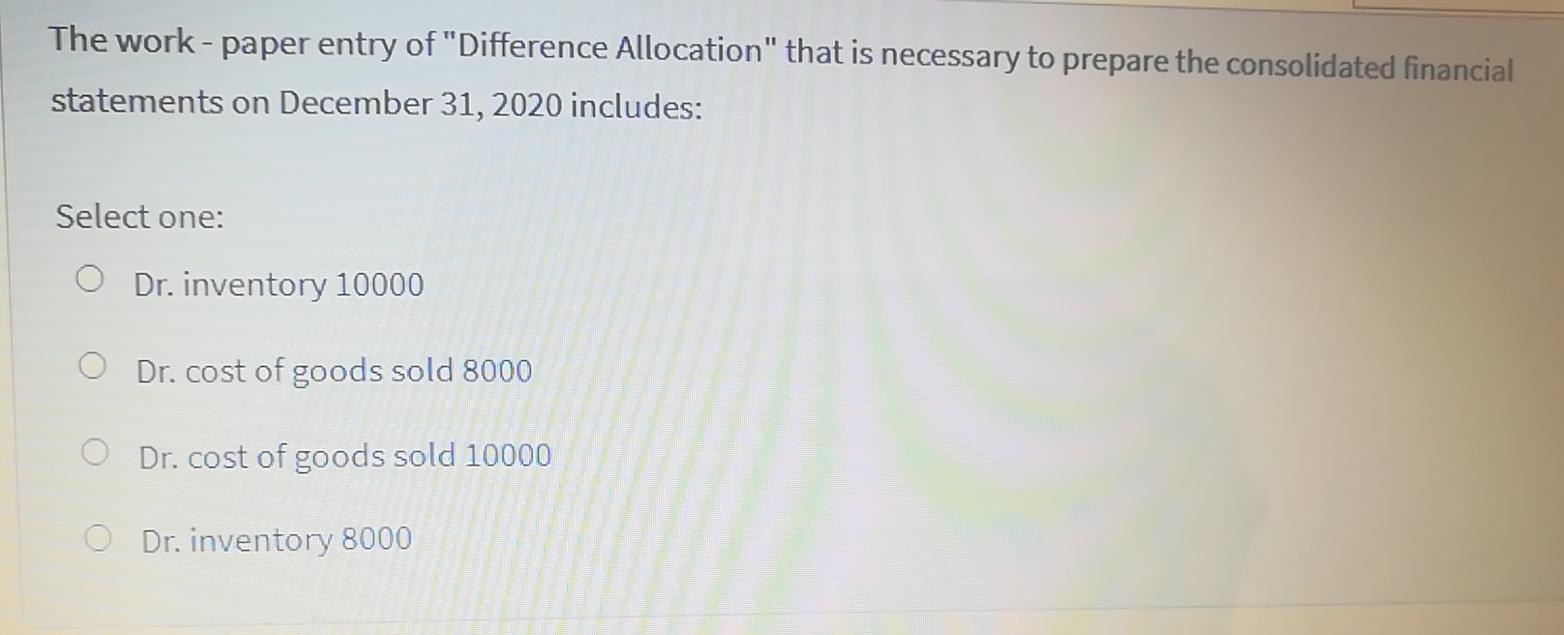

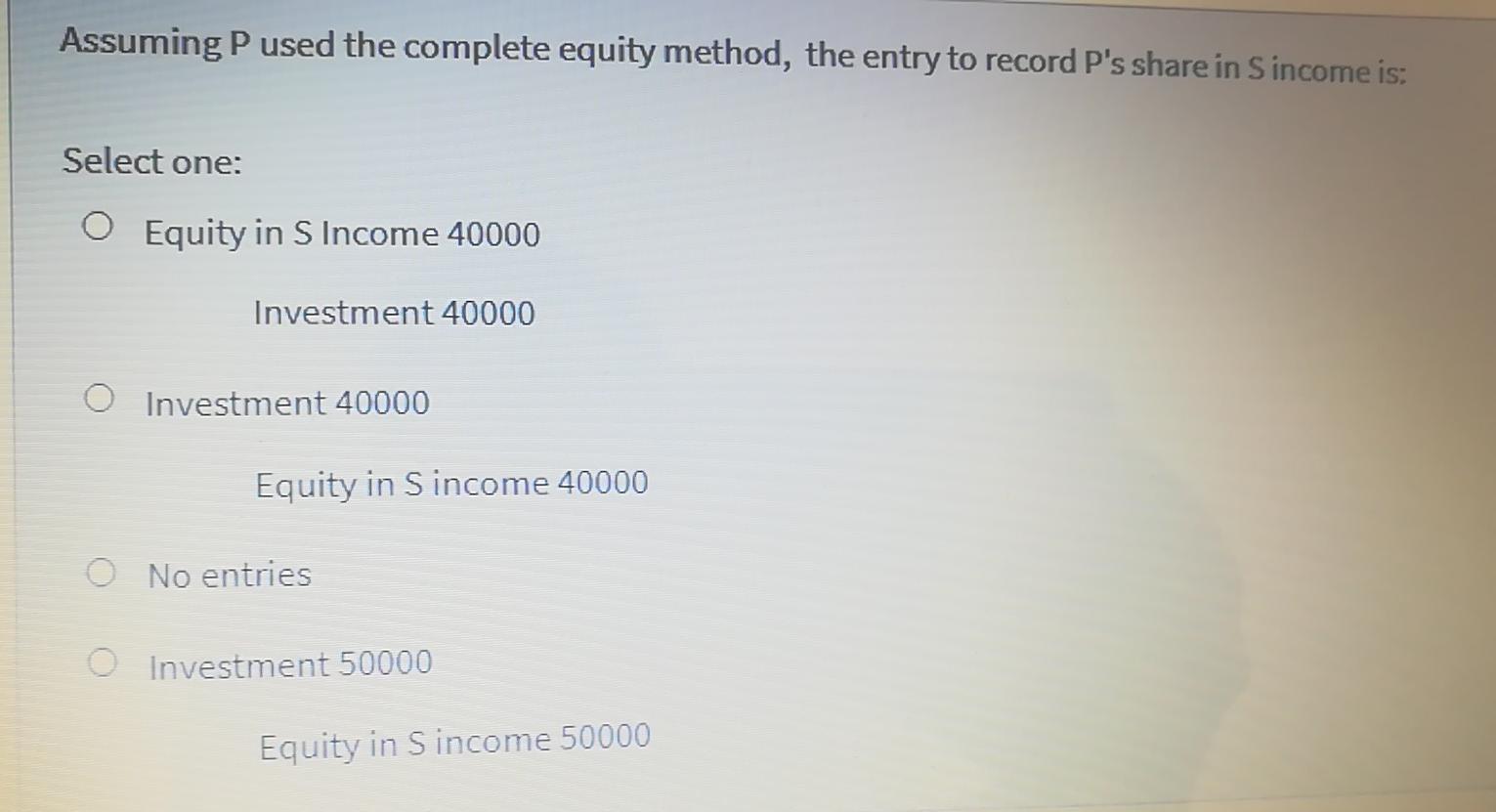

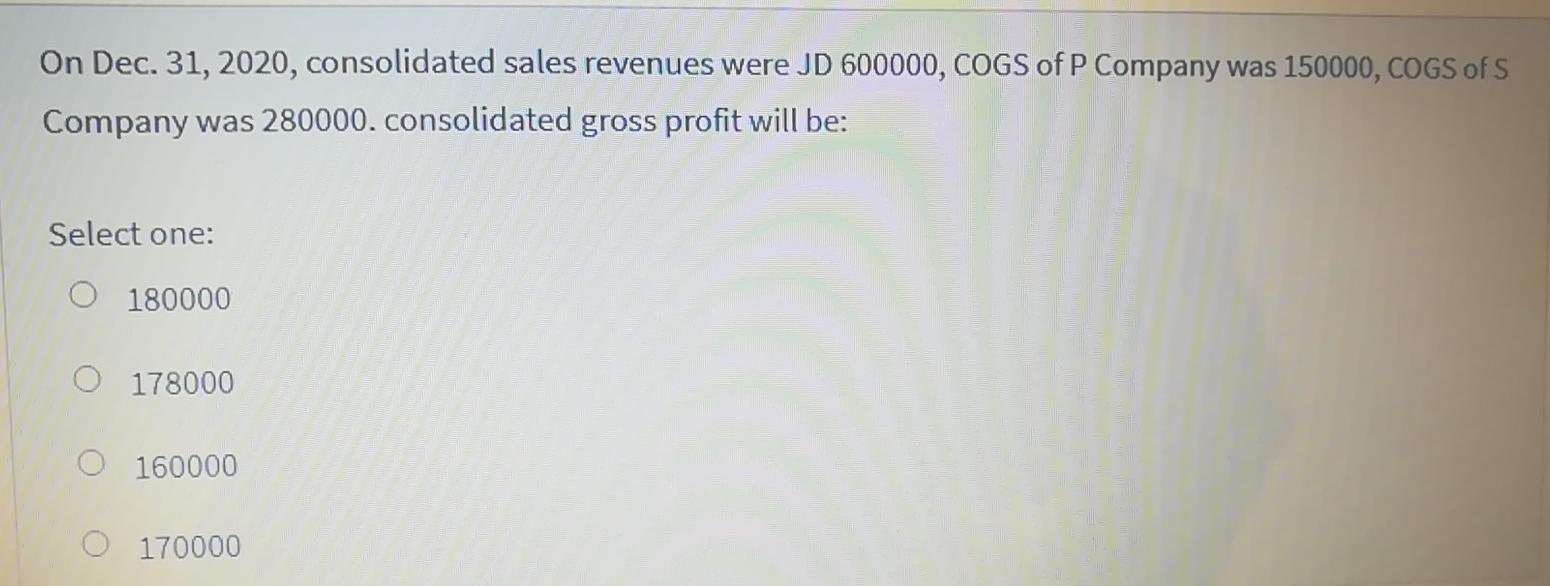

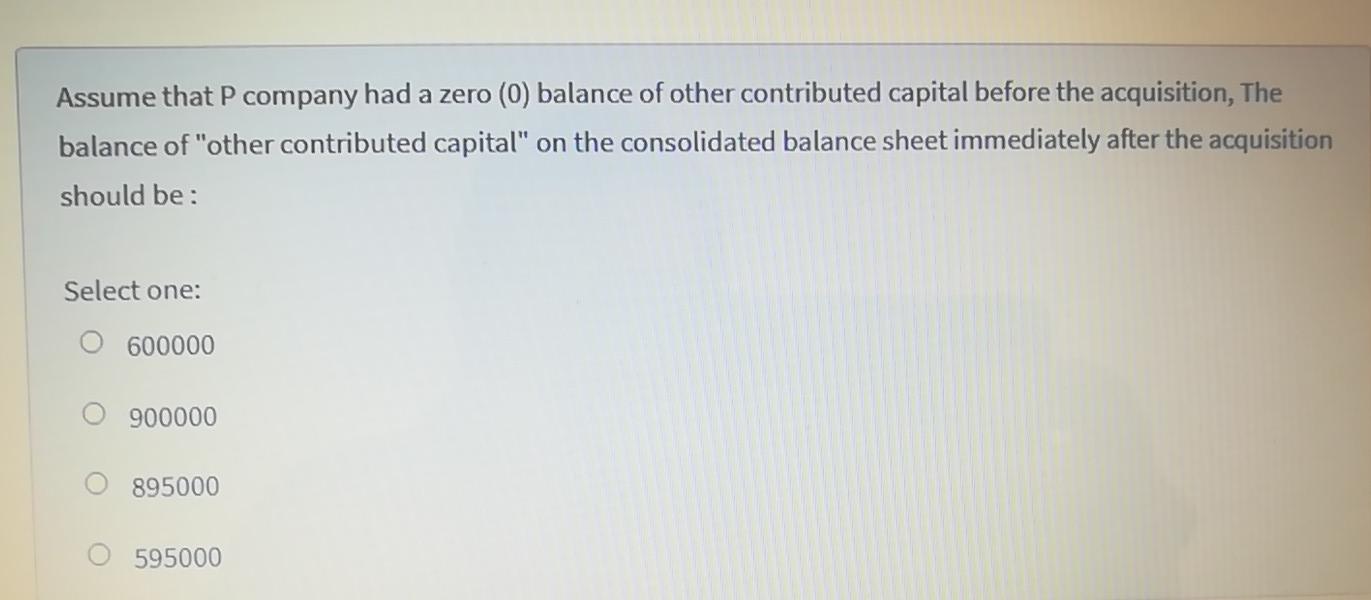

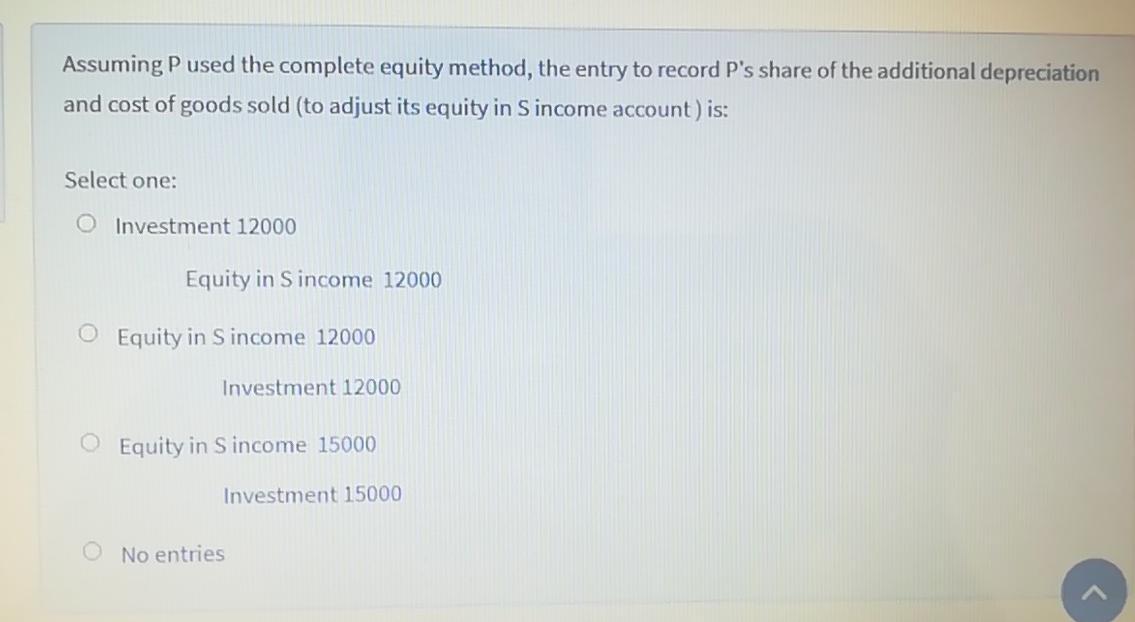

On Jan 1st, 2020, P Company acquired 80% of S company's outstanding common stocks by issuing 40000 new shares. The par value, per share, was JD 5 and the fair value was JD 20. Also, P paid JD200000 in cash. P Company incurred another JD 15000 accounting and legal fees, and JD 5000 securities issuance cost. On Jan 1, 2020, the balance sheet of S company appeared as below: Cash Accounts receivables Inventory Equipment Lands Total assets Accounts payable Book values 300000 50000 200000 250000 500000 1300000 200000 S Fair values 300000 50000 210000 300000 540000 1400000 200000 01-12 Notes: Total assets Accounts payable Capital-c.s Other contributed capital Retained earnings Total liabilities & equities 1300000 200000 600000 300000 200000 1300000 1400000 200000 S Company had a net income of JD 50000 at the end of year 2020, and it declared cash dividends JD 10000 S company sold all of its 1/1/2020 inventory The remaining productive life of S company's equipment is 10 years S Company sold merchandise to P Company during the year at a price of JD 20000. By the end of the year, P Company had JD 9000 of this merchandise in its ending inventory with an unrealized profit of JD 2000 The work-paper entry that is necessary to eliminate the unrealized inter- company profit (resulted from merchandise sales) when preparing the consolidated financial statements on December 31, 2020 is: Select one: Sales 20000 Cost of goods sold 20000 O Inventory (I.S) 1600 Inventory (B.S) 1600 Sales 9000 Cost of goods sold 9000 Inventory (I.S) 2000 Inventory (B.S) 2000 The work - paper entry of "Difference Allocation" that is necessary to prepare the consolidated financial statements on December 31, 2020 includes: Select one: Dr. inventory 10000 Dr. cost of goods sold 8000 Dr. cost of goods sold 10000 Dr. inventory 8000 Assuming P used the complete equity method, the entry to record P's share in S income is: Select one: O Equity in S Income 40000 Investment 40000 O Investment 40000 Equity in S income 40000 No entries O Investment 50000 Equity in Sincome 50000 On Dec. 31, 2020, consolidated sales revenues were JD 600000, COGS of P Company was 150000, COGS of S Company was 280000. consolidated gross profit will be: Select one: 180000 O 178000 160000 O 170000 Assume that P company had a zero (0) balance of other contributed capital before the acquisition, The balance of "other contributed capital" on the consolidated balance sheet immediately after the acquisition should be: Select one: 600000 900000 895000 595000 Assuming P used the complete equity method, the entry to record P's share of the additional depreciation and cost of goods sold (to adjust its equity in Sincome account) is: Select one: O Investment 12000 Equity in S income 12000 O Equity in Sincome 12000 Investment 12000 O Equity in S income 15000 No entries Investment 15000

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Lets go through each question and calculate the relevant values step by step 1 To calculate the number of shares issued by P Company we div...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started