Question

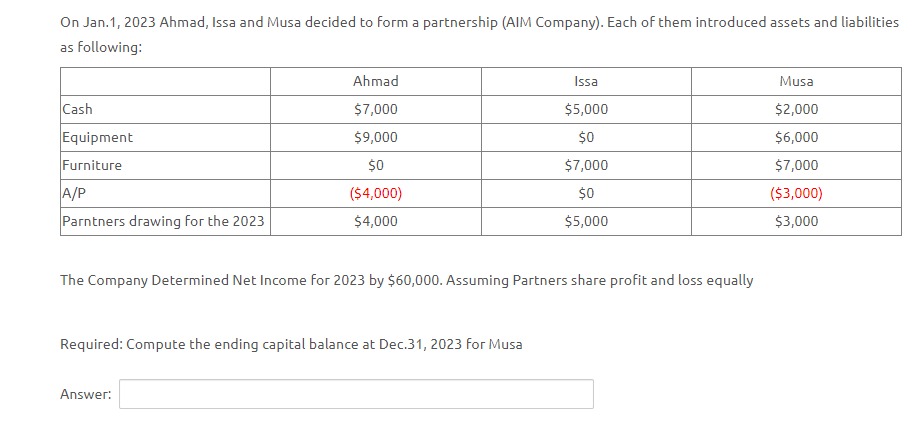

On Jan.1, 2023 Ahmad, Issa and Musa decided to form a partnership (AIM Company). Each of them introduced assets and liabilities as following: Cash

On Jan.1, 2023 Ahmad, Issa and Musa decided to form a partnership (AIM Company). Each of them introduced assets and liabilities as following: Cash Equipment Furniture A/P Parntners drawing for the 2023 Ahmad $7,000 $9,000 $0 ($4,000) $4,000 Required: Compute the ending capital balance at Dec.31, 2023 for Musa Answer: Issa The Company Determined Net Income for 2023 by $60,000. Assuming Partners share profit and loss equally $5,000 $0 $7,000 $0 $5,000 Musa $2,000 $6,000 $7,000 ($3,000) $3,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image shows a table that lists the contributions of assets and liabilities by three partnersAhma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Glencoe Accounting First Year Course

Authors: Andrée Vary

1st Edition

978-0078688294, 0078688299

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App