Answered step by step

Verified Expert Solution

Question

1 Approved Answer

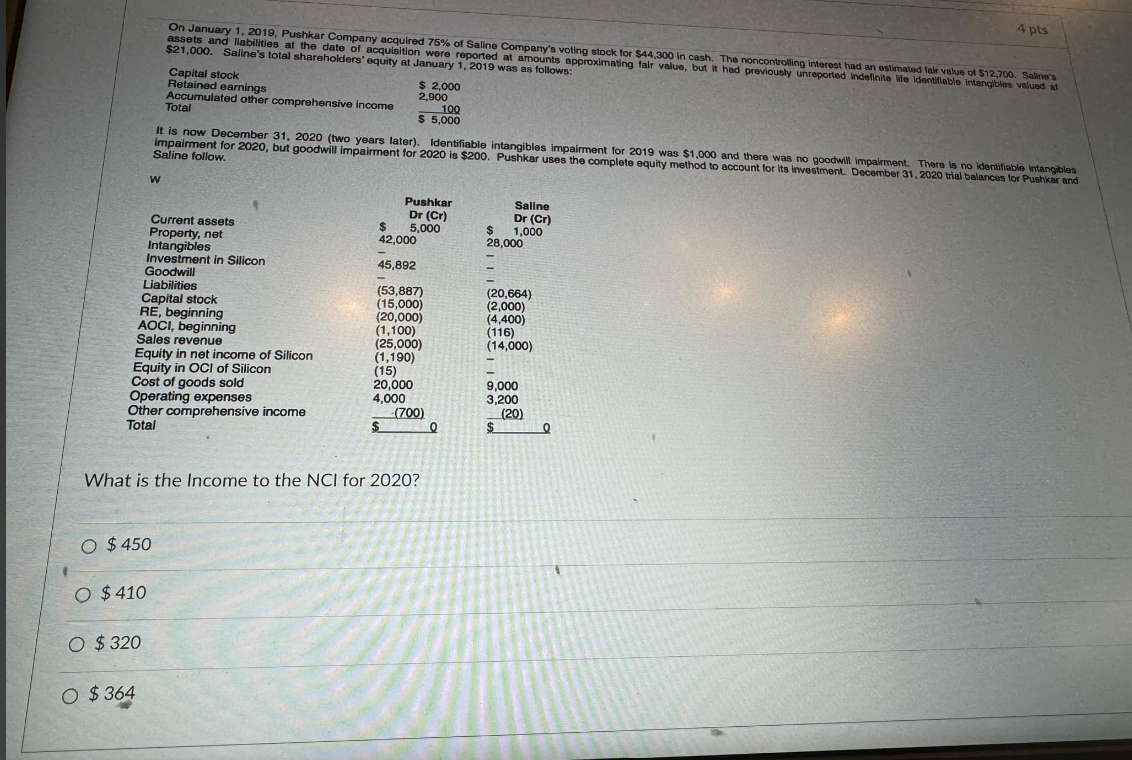

On January 1 , 2 0 1 9 , Pushkar Company acquired 7 5 % of Saline Company's voting stock for $ 4 4 ,

On January Pushkar Company acquired of Saline Company's voting stock for $ in cash. The noncontrolling interest had an estimated lair value of $ Saline's

$ Saline's total the date of acquisition were reported at amounts approximating falr value, but it had previously unreported indefinite life identillable intanglibles valued at

$ Saline's total shareholders' equity at January was as follows:

It is now December two years later Identifiable intangibles impairment for was $ and there was no goodwill impairment. There is no identitiable intangibles

impairment for but goodwill impairment for is $ Pushkar uses the complete equity method to account for its investment. December trial balances for Pushkar and

Saline follow.

w

Current assets

Property, net

Intangibles

Investment in Silicon

Goodwill

Liabilities

Capital stock

RE beginning

AOCI, beginning

Sales revenue

Equity in net income of Silicon

Equity in OCl of Silicon

Cost of goods sold

Operating expenses

Other comprehensive income

Total

$

What is the Income to the NCI for

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started