Answered step by step

Verified Expert Solution

Question

1 Approved Answer

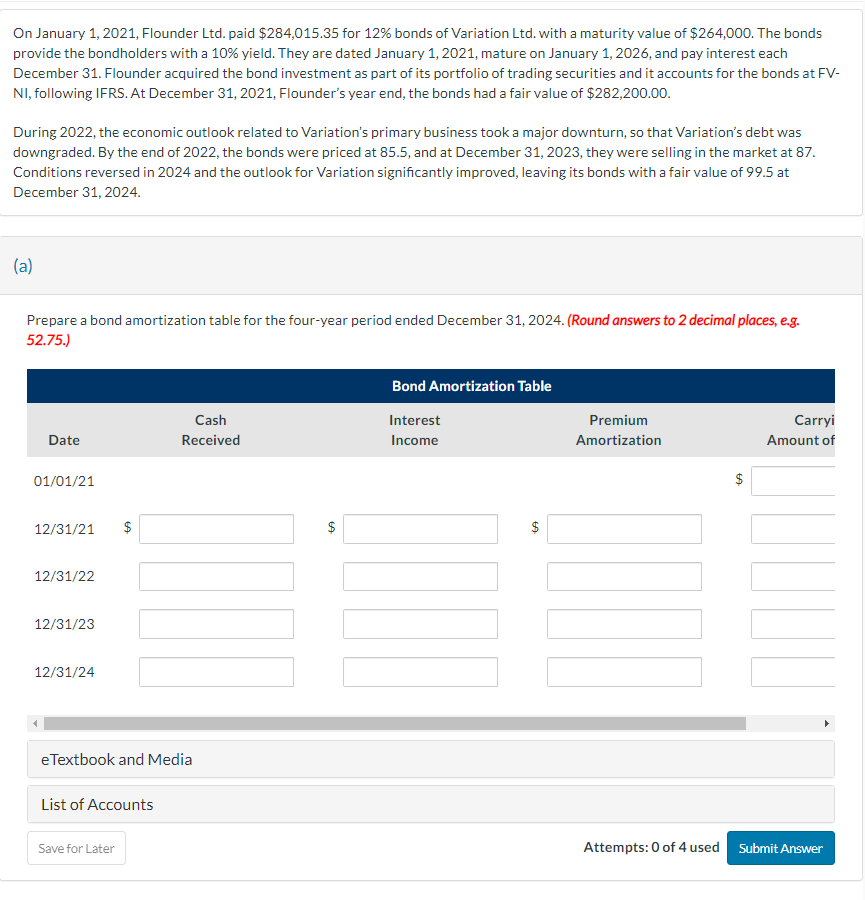

On January 1 , 2 0 2 1 , Flounder Ltd . paid $ 2 8 4 , 0 1 5 . 3 5 for

On January Flounder Ltd paid $ for bonds of Variation Ltd with a maturity value of $ The bonds

provide the bondholders with a yield. They are dated January mature on January and pay interest each

December Flounder acquired the bond investment as part of its portfolio of trading securities and it accounts for the bonds at FV

NI following IFRS. At December Flounder's year end, the bonds had a fair value of $

During the economic outlook related to Variation's primary business took a major downturn, so that Variation's debt was

downgraded. By the end of the bonds were priced at and at December they were selling in the market at

Conditions reversed in and the outlook for Variation significantly improved, leaving its bonds with a fair value of at

December

a

Prepare a bond amortization table for the fouryear period ended December Round answers to decimal places, eg

List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started