Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 , 2 0 2 2 Patrick Corporation acquired 7 5 % of the voting stock of Spencer, Inc. The total acquisition cost

On January Patrick Corporation acquired of the voting stock of Spencer, Inc. The total

acquisition cost was $ and the fair value of the noncontrolling interest on that date was

$ At the date of acquisition, Spencer's net book value was $ and the fair value

of all reported net assets approximated their book value. Spencer had unreported intangible assets

that qualified for capitalization under ASC Topic valued at $ The assets had an

estimated five year remaining useful life as of the acquisition date, and any remaining purchase

price premium was assigned to goodwill. You are preparing the consolidated financial statements

as of December and for the year then ended. Note the following:

On March Patrick loaned $ to Spencer on a ten year note. Interest at is

payable annually every March The loan was still outstanding at December and all

interest payments have been made on time. Interest receivable and interest payable are included in

"Other current assets" and "Other current liabilities", respectively.

During Patrick sold land to Spencer for $ The land had an original cost on Patrick's

books of $ During Spencer sold the land to an unrelated party for $

Spencer routinely sells inventory to Patrick at a markup of on cost Patrick's inventory

account balance included $ and $ of inventory purchased from Spencer at December

and December respectively. Spencer's revenues balance includes $

of sales to Patrick.

Goodwill was evaluated and determined to be impaired by $ in and another

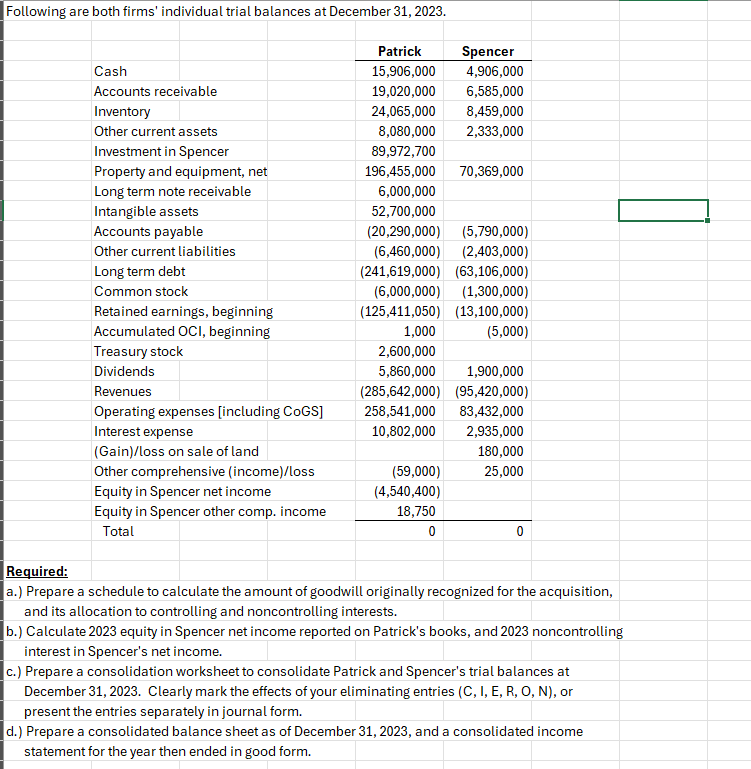

$ in Following are both firms' individual trial balances at December

a Prepare a schedule to calculate the amount of goodwill originally recognized for the acquisition,

and its allocation to controlling and noncontrolling interests.

b Calculate equity in Spencer net income reported on Patrick's books, and noncontrolling

interest in Spencer's net income.

c Prepare a consolidation worksheet to consolidate Patrick and Spencer's trial balances at

December Clearly mark the effects of your eliminating entries C I, E R O N or

present the entries separately in journal form.

d Prepare a consolidated balance sheet as of December and a consolidated income

statement for the year then ended in good form.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started