Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 , 2 0 2 3 , James Corp. paid $ 3 0 0 , 0 0 0 for 2 5 % of

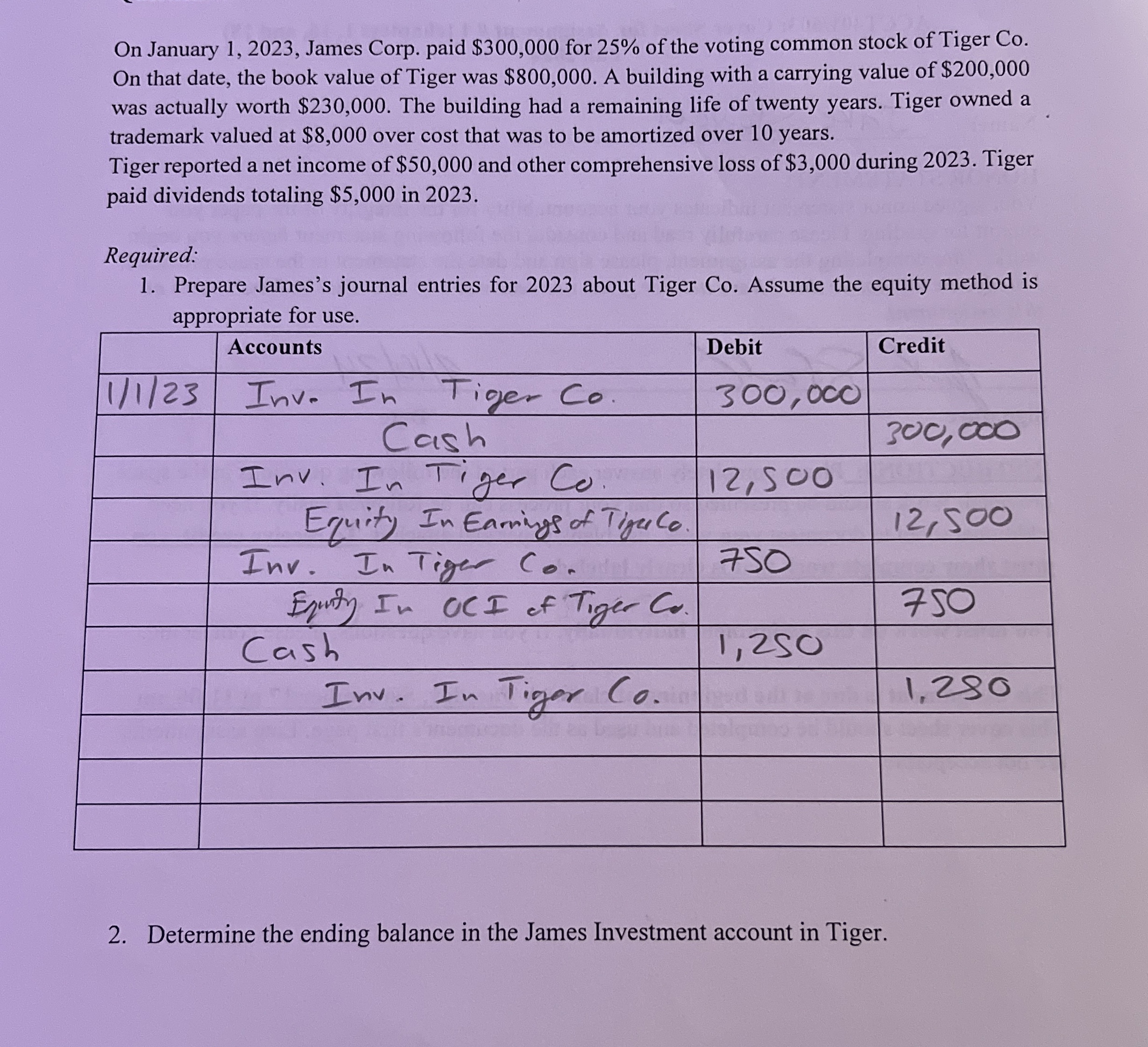

On January James Corp. paid $ for of the voting common stock of Tiger Co On that date, the book value of Tiger was $ A building with a carrying value of $ was actually worth $ The building had a remaining life of twenty years. Tiger owned a trademark valued at $ over cost that was to be amortized over years.

Tiger reported a net income of $ and other comprehensive loss of $ during Tiger paid dividends totaling $ in

Required:

Prepare James's journal entries for about Tiger Co Assume the equity method is appropriate for use.

tableAccounts,Debit,CreditInv. In Tiger CoCash,,Inv. In Tiger CoEquity In Earnings of TigaCo.,,Inv. In Tiger CoEqnity In OCI of Tiger CoCash,Inv. In Tiger Co

Determine the ending balance in the James Investment account in Tiger.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started