Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 , 2 0 2 4 , Tennessee Harvester Corporation issued debenture bonds that pay interest semiannually on June 3 0 and December

On January Tennessee Harvester Corporation issued debenture bonds that pay interest semiannually on June and December Portions of the bond amortization schedule appear below:Determining InterestEffective Interest Method

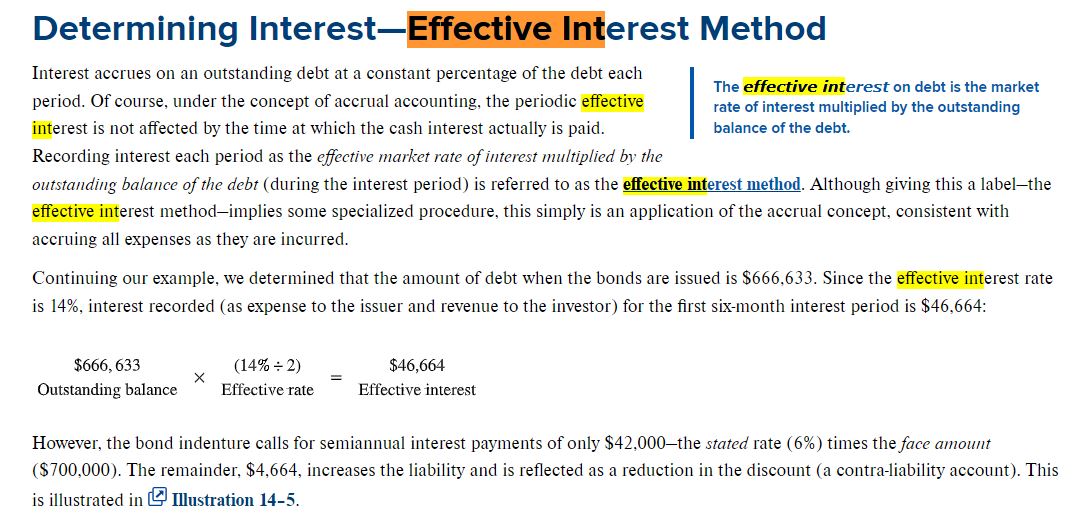

Interest accrues on an outstanding debt at a constant percentage of the debt each

period. Of course, under the concept of accrual accounting, the periodic effective

interest is not affected by the time at which the cash interest actually is paid.

Recording interest each period as the effective market rate of interest multiplied by the

outstanding balance of the debt during the interest period is referred to as the effective interest method. Although giving this a labelthe

effective interest methodimplies some specialized procedure, this simply is an application of the accrual concept, consistent with

accruing all expenses as they are incurred.

Continuing our example, we determined that the amount of debt when the bonds are issued is $ Since the effective interest rate

is interest recorded as expense to the issuer and revenue to the investor for the first sixmonth interest period is $ :

$$

However, the bond indenture calls for semiannual interest payments of only $the stated rate times the face amount

$ The remainder, $ increases the liability and is reflected as a reduction in the discount a contraliability account This

is illustrated in Illustration

Payment Cash Payment Effective Interest Increase in Balance Outstanding Balance

~ ~ ~ ~ ~

~ ~ ~ ~ ~

~ ~ ~ ~ ~

Required:

What is the face amount of the bonds?

What is the initial selling price of the bonds?

What is the term to maturity in years?

Interest is determined by what approach?

What is the stated annual interest rate?

What is the effective annual interest rate?

What is the total cash interest paid over the term to maturity?

What is the total effective interest expense recorded over the term to maturity? On January Tennessee Harvester Corporation Issued debenture bonds that pay interest semlannually on June and

December Portions of the bond amortization schedule appear below.

Required:

What is the face amount of the bonds?

What is the initial selling price of the bonds?

What is the term to maturity in years?

Interest is determined by what approach?

What is the stated annual Interest rate?

What is the effective annual Interest rate?

What is the total cash Interest pald over the term to maturity?

What is the total effective Interest expense recorded over the term to maturity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started