Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2013, Barbara takes out a $14,000 loan, at an annual effective interest rate of 8.5%. Interest is being paid annually beginning on

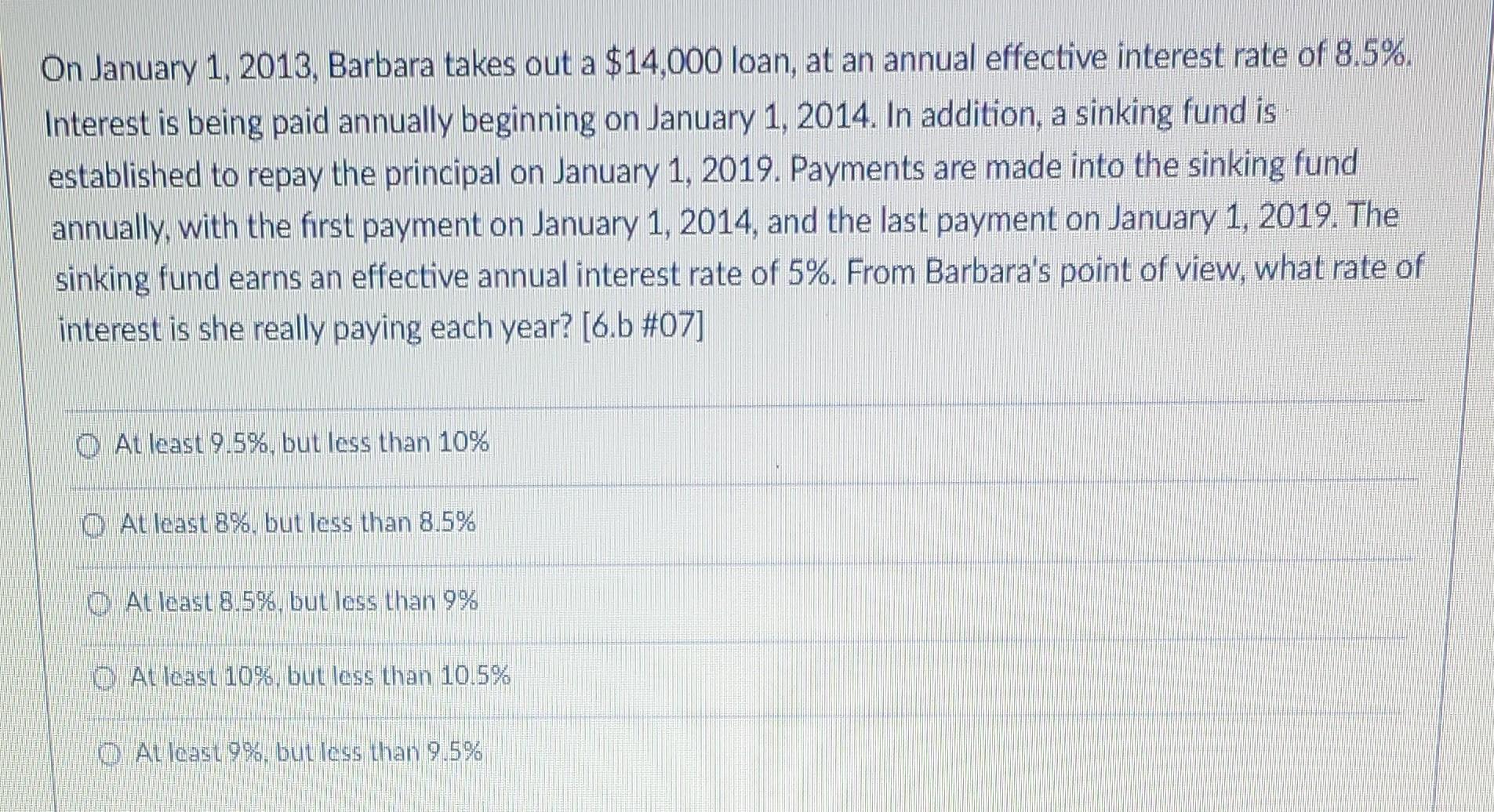

On January 1, 2013, Barbara takes out a $14,000 loan, at an annual effective interest rate of 8.5%. Interest is being paid annually beginning on January 1, 2014. In addition, a sinking fund is established to repay the principal on January 1, 2019. Payments are made into the sinking fund annually, with the first payment on January 1, 2014, and the last payment on January 1, 2019. The sinking fund earns an effective annual interest rate of 5%. From Barbara's point of view, what rate of interest is she really paying each year? [6.b #07] At least 9.5%, but less than 10% O At least 8%, but less than 8.5% At least 8.5%, but less than 9% O At least 10%, but less than 10.5% O At least 9%, but less than 9.5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started