Question

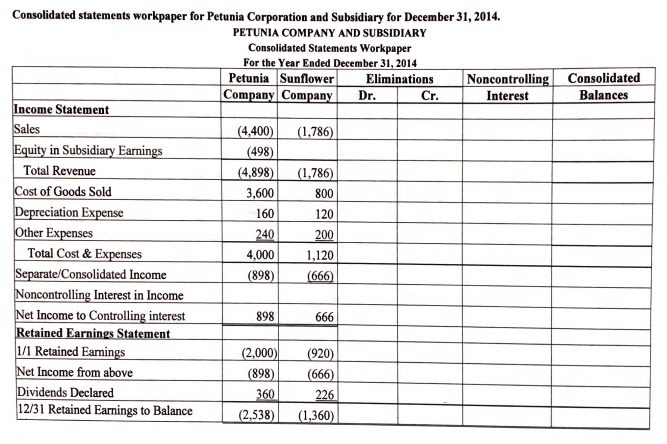

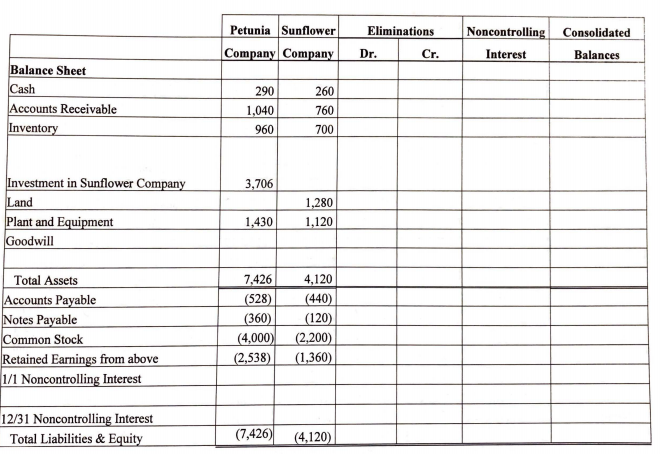

On January 1, 2014, Petunia Company bought an 85% interest in the capital stock of Sunflower Company for $3,400 (Cash + Shares of Petunia Company).

On January 1, 2014, Petunia Company bought an 85% interest in the capital stock of Sunflower Company for $3,400 (Cash + Shares of Petunia Company). Petunia Company uses the equity method to record its investment in Sunflower Company.

The plant is undervalued by $700 (7 year remaining life) and the equipment is overvalued by 200 (10 year remaining life) on January 1, 2014.

Balance sheet for the Petunia and Sunflower at acquisition are included on the December 31, Consolidation worksheets below.

Required: Answer all the questions below.

1. What is the total fair value of Sunflower at acquisition?

2. What is the goodwill of Sunflower at acquisition?

3. What is the amount of non-controlling interest reported at acquisition on the January 1, 2014 balance sheet?

4. Prepare the entries to eliminate any income earned from Sunflower Corporation during 2014.

5. Prepare the entry to eliminate Petunia's investment in Sunflower at December 31, 2014.

6. What is the common stock of the consolidated company at December 31, 2014?

7. What is the retained earnings of the consolidated company at December 31, 2014?

8. What is the dividend declared of the consolidated company for the year ended December 31, 2014?

9. What is the net income attributable to the controlling interest for the year ended December 31, 2014?

10. What is the net income attributable to the non-controlling interest for the year ended December 31, 2014?

11. What is the amount of non-controlling interest for the year ended December 31, 2014?

12. Consolidated statements worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started