Answered step by step

Verified Expert Solution

Question

1 Approved Answer

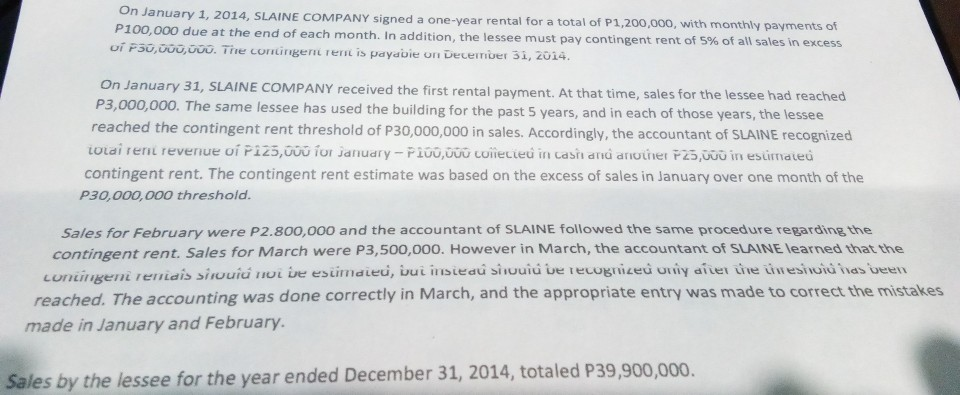

On January 1, 2014, SLAINE COMPANY P100, signed a one-year rental for a total of P1,200,000, with monthly payments of end of each month. In

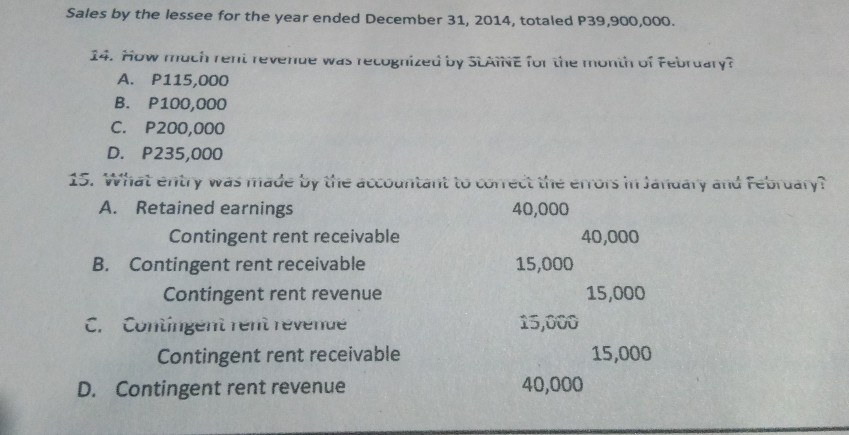

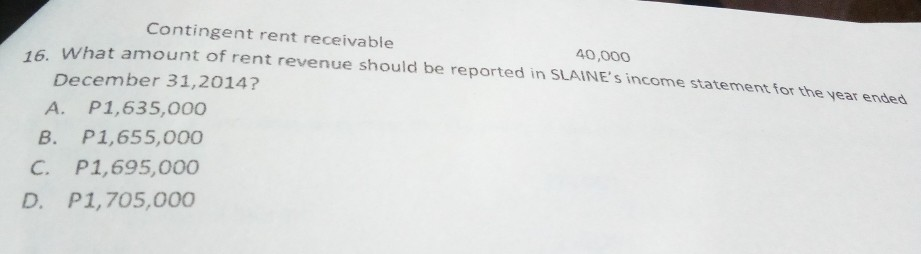

On January 1, 2014, SLAINE COMPANY P100, signed a one-year rental for a total of P1,200,000, with monthly payments of end of each month. In addition, the lessee must pay contingent rent of 5% of all sales in excess 000 due at the o.The coinger rerit is payabie on Decermber 3i, 20i4. January 31, SLAINE COMPANY received the first rental payment. At that time, sales for the lessee had reached P3,000,000. The same lessee has used the building for the past 5 years, and in each of those years, the lessee reached the contingent rent threshold of P30,000,000 in sales. Accordingly, the accountant of SLAINE recognized contingent rent. The contingent rent estimate was based on the excess of sales in January over one month of the P30,000,000 threshold Sales for February were P2.80o,000 and the accountant of SLAINE followed the same procedure regarding the contingent rent. Sales for March were P3,500,000. However in March, the accountant of SLAINE learned that the reached. The accounting was done correctly in March, and the appropriate entry was made to correct the mistakes made in January and February. Sales by the lessee for the year ended Dece mber 31, 2014, totaled P39,900,000. Sales by the lessee for the year ended December 31, 2014, totaled P39,900,000 A. P115,000 B. P100,000 C. P200,000 D. P235,000 15. wihat entry was made by uie aucountant to conet ure errors ini jauaiy a Februaiy? A. Retained earnings B. Contingent rent receivable C. Conineni rei revenue 40,000 Contingent rent receivable Contingent rent revenue Contingent rent receivable 40,000 15,000 15,000 15,000 D. Contingent rent revenue 40,000 Contingent rent receivable 40,000 16. What amount of rent revenue should be reported in SLAINE' s income statement for the yea December 31,2014? A. P1,635,000 B. P1,655,000 C. P1,695,000 D. P1,705,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started