Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2015, An equipment which cosi 5550,000 is acquired. Its estimated residual value is zero and its expected life is 10 years. The

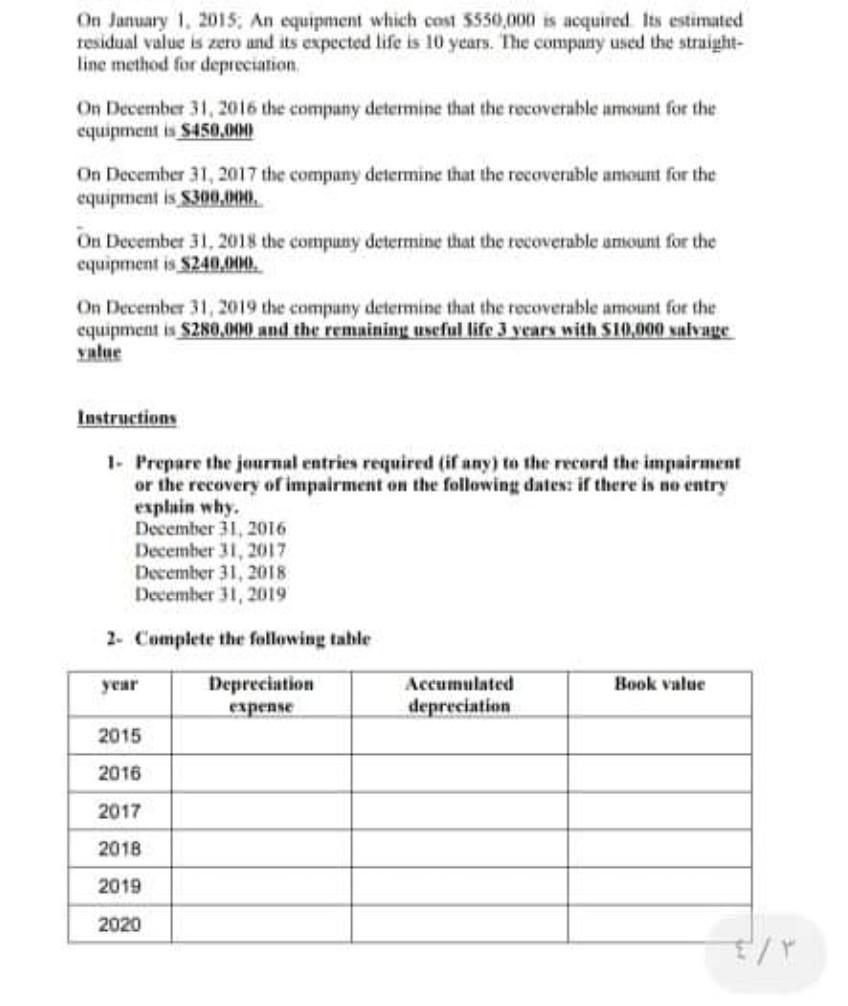

On January 1, 2015, An equipment which cosi 5550,000 is acquired. Its estimated residual value is zero and its expected life is 10 years. The company used the straight- line method for depreciation On December 31, 2016 the company determine that the recoverable amount for the equipment is 450.00 On December 31, 2017 the company determine that the recoverable amount for the equipment is $300,000 On December 31, 2018 the company determine that the recoverable ansount for the equipment is $240,000 On December 31, 2019 the company determine that the recoverable amount for the equipment is $280,000 and the remaining useful life 3 years with $10,000 salvage Instructions 1- Prepare the journal entries required (if any) to the record the impairment or the recovery of impairment on the following dates if there is no entry esphin why. December 31, 2016 December 31, 2017 December 31, 2018 December 31, 2019 2. Complete the following table year Book value Depreciation expense Accumulated depreciation 2015 2016 2017 2018 2019 2020 /

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started