Question

On January 1, 2015, Jose Company purchased a building for $200,000 and a delivery truck for $20,000. The following expenditures have been incurred during 2017:

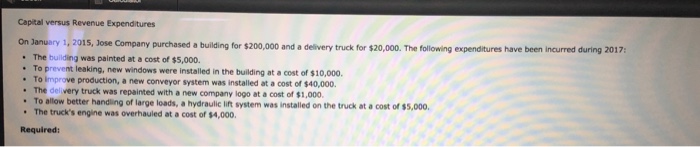

On January 1, 2015, Jose Company purchased a building for $200,000 and a delivery truck for $20,000. The following expenditures have been incurred during 2017:

The building was painted at a cost of $5,000. To prevent leaking, new windows were installed in the building at a cost of $10,000. To improve production, a new conveyor system was installed at a cost of $40,000. The delivery truck was repainted with a new company logo at a cost of $1,000. To allow better handling of large loads, a hydraulic lift system was installed on the truck at a cost of $5,000. The truck's engine was overhauled at a cost of $4,000.

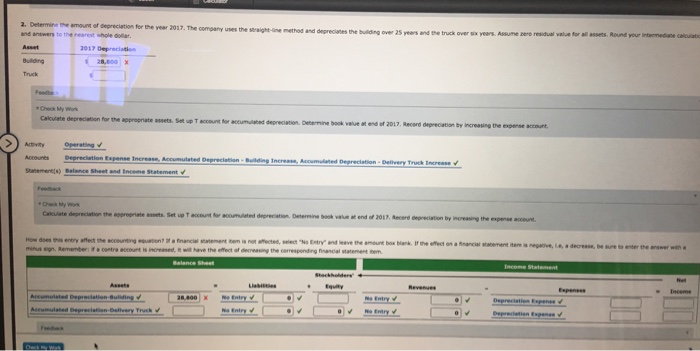

2. Determine the amount of depreciation for the year 2017. The company uses the straight-line method and depreciates the building over 25 years and the truck over six years. Assume zero residual value for all assets. Round your intermediate calculations and answers to the nearest whole dollar.

Asset

2017 Depreciation

Building

$

Truck

$

Prepare a partial Balance Sheet to show how would the assets appear December 31, 2017.

Jose Company

Balance Sheet (Partial)

December 31, 2017

Building

$

Accumulated depreciation

$

Delivery truck

$

Accumulated depreciation

Total property, plant, and equipment

$

Capital versus Revenue Expenditures On lanuany 1,2015, Jose Company purchased a building for $200,000 and a delivery truck for $20,000. The following expenditures have been incurred during 2017 The building was painted at a cost of $5,000. To prevent leaking, new windows were installed in the building at a cost of $10,000 To Iimprove production, a new conveyor system was installed at a cost of $40,000 The delivery truck was repainted with a new company logo at a cost of $1,000. allow better handiling of large loads, a hydraulic lift system was installed on the truck at a cost of $5,000 The truck's engine was overhauled at a cost of $4,000. RequiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started